What will happen to the economy of Japan

After the tragic death of former Prime Minister Shinzo Abe, and the subsequent electoral victory of the ruling coalition, can Japan stimulate its politics and economic reforms? comment by Dina Ting, Head of Index Portfolio Management

For the observers of this country, it is a moment in which Japan is somewhat suspended, as well as for us, as we try to assess what the near future will be for the third world economy. Almost ten years after the Bank of Japan (BoJ) set its inflation target of 2%, the country finally met it towards the end of May. Although the impetus came from rising energy prices rather than domestic demand, inflation could still be a psychological aid to persuade consumers to abandon a long-persistent deflationary mindset.

Could the tragic death of former Prime Minister Shinzo Abe, and the subsequent electoral victory for his ruling coalition, also mark a turning point for Japan's politics? Even in this sadly increasingly submerged society, there is no shortage of positive turns for the country's economy and for investors who at this moment want to strengthen exposure to Japan.

Dynamics in Asia

Global markets have been mostly in the red recently, but we have seen some positive momentum in Asia. The Chinese market showed signs of improvement in June, although the near-term outlook for its stocks is one of cautious optimism. Meanwhile, Japanese equities have fared significantly better this year than most of their developed counterparts.

In the short term, it appears that Japanese export prices may continue to be adversely affected by persistent restrictions in supply chains and by rising prices for materials needed for processing. We are convinced, however, that further easing of pandemic-related restrictions in China, the largest trading partner, should contribute positively, helping the trend towards a significant rise in demand. US Treasury Secretary Janet Yellen and Japanese Finance Minister Shunichi Suzuki agreed this month on a partnership aimed at strengthening financial stability and managing volatility in currency markets. In January, when Japan and the United States had publicly reconfirmed their bilateral relations, they had come to define them "the strongest and most profound of any historical moment."

Currently 82% of the Japanese population is vaccinated, marking one of the most successful vaccination campaigns against COVID-19 among G7 member countries. With the yen currently hitting a new low for the past 24 years against the US dollar, the export-driven market could be poised for momentum generated not only by the manufacturing sector but also by the rebound in tourism. The attractive exchange rate should help draw visitors from mainland China, the single largest group of travelers, to Japan until the pandemic broke out.

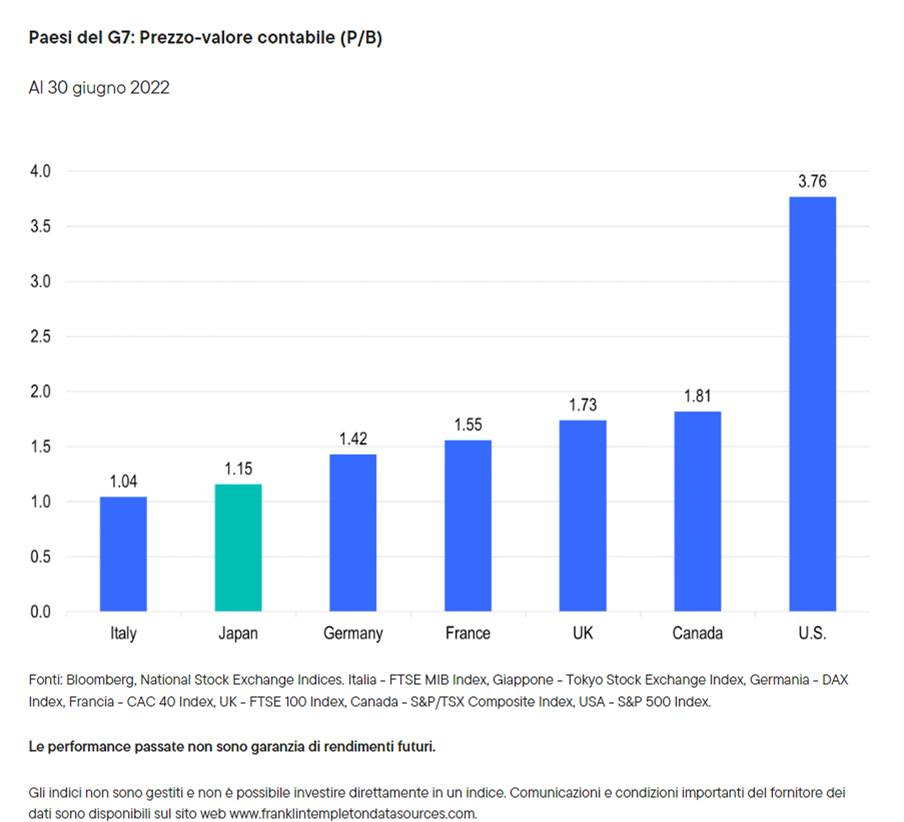

In our analysis, current valuations of Japanese equities are attractive relative to those of other developed markets. Based on a price-to-book ratio, the Tokyo Stock Exchange Index is trading at just under 1.2x book value, so it can be assumed that the valuations of the stocks represented are better than other G7 member countries.

Structural reforms

There has recently been an extensive review of the business program which has taken the name of “Abenomics,” from its creator, and which has obtained mixed results. The Prime Minister with the longest term in the country's history was credited with bringing Japan's corporate governance practices closer to global standards. Eight years ago, his administration put in place key measures to attract more investment from abroad, which required improvements such as more risk management disclosures and independent external directors. His successors continued to push ahead with these reforms, and the Japanese Corporate Governance Code, which was revised twice: first in 2018 and again last summer to take into account better promotion of diversity, particularly with regard to presence of women in managerial roles.

In our opinion, however, change in Japan can be quite slow, and a lot of shifts are required. The code has no specific goals, and the share of Japanese women in executive roles (12 &) continues to be below the global average (27%), according to the International Labor Organization. Prior to the pandemic, however, the government successfully enacted legislation that included expanding childcare, a tax code reform that was beneficial to double incomes, and better work permit policies for children. parents. We find Japan's recent efforts to broaden immigration policies in favor of foreign workers, to solve workforce problems and to progressive reforms that encourage the advancement of women into important careers, encouraging.

Abe's legacy has also left its mark on the ways certain large corporations interact with investors and the market at large. The returns offered to shareholders, in terms of both dividends and share repurchases, are indicative of these positive developments. According to the Nikkei Asia, Japanese companies plan to double their share buybacks to $ 32 billion, the highest level in 16 years, and which could help boost market confidence.

Japan has long struggled with demographic dynamics that can be a drag on growth. However, as the International Monetary Fund (IMF) states, Japan is a "laboratory from which other countries are starting to learn lessons." These include Japan's key contributions to artificial intelligence (AI) and automation as the world's largest manufacturer of industrial robotics. Despite the obstacles to overcome in global supplies, the pandemic has spurred demand for integrated robotics in the past two years.

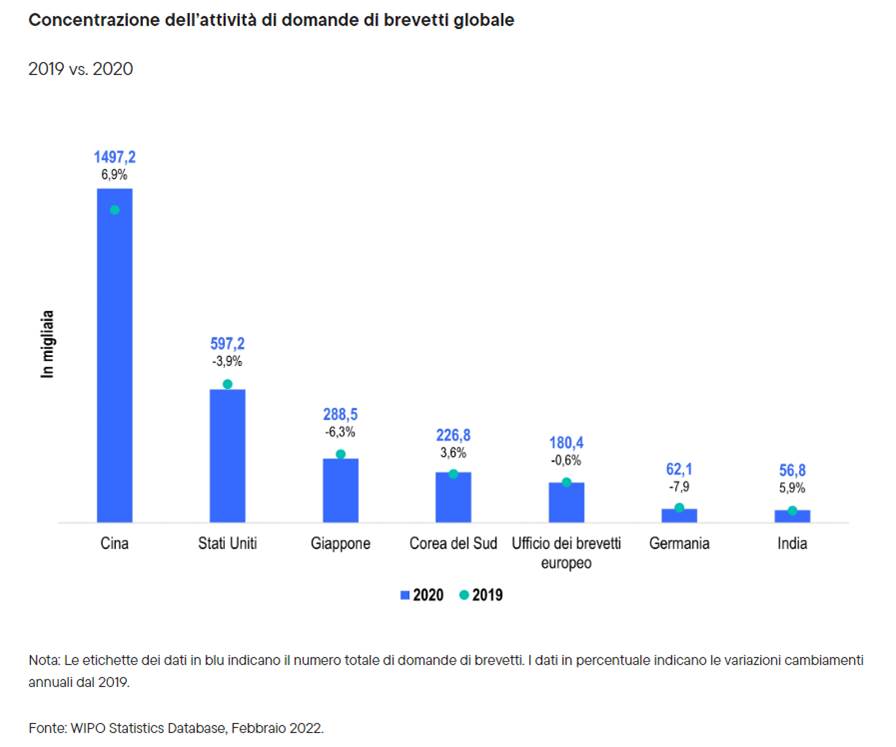

Japan also consistently ranked high among more than 100 economies rated by the World Economic Forum (WEF) Global Competitiveness Index and continued to be a major competitor in global patent business. While the Japanese venture capital (VC) area may still be in pursuit not only of Silicon Valley but also of Europe, the VC landscape gained momentum last year during the Chinese tech crisis. There is currently growing support for strengthening Tokyo's startup ecosystem, with increased subsidies to entrepreneurship and embarking on a paradigm shift in policies designed to promote a general revitalization of the economy.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/cosa-succedera-alleconomia-del-giappone/ on Sun, 07 Aug 2022 06:19:48 +0000.