What will happen to the job market in the world

Of all the recent economic trends, slow employment growth is perhaps the most important to watch. Here because. The analysis by Sonal Desai, CIO, Franklin Templeton Fixed Income

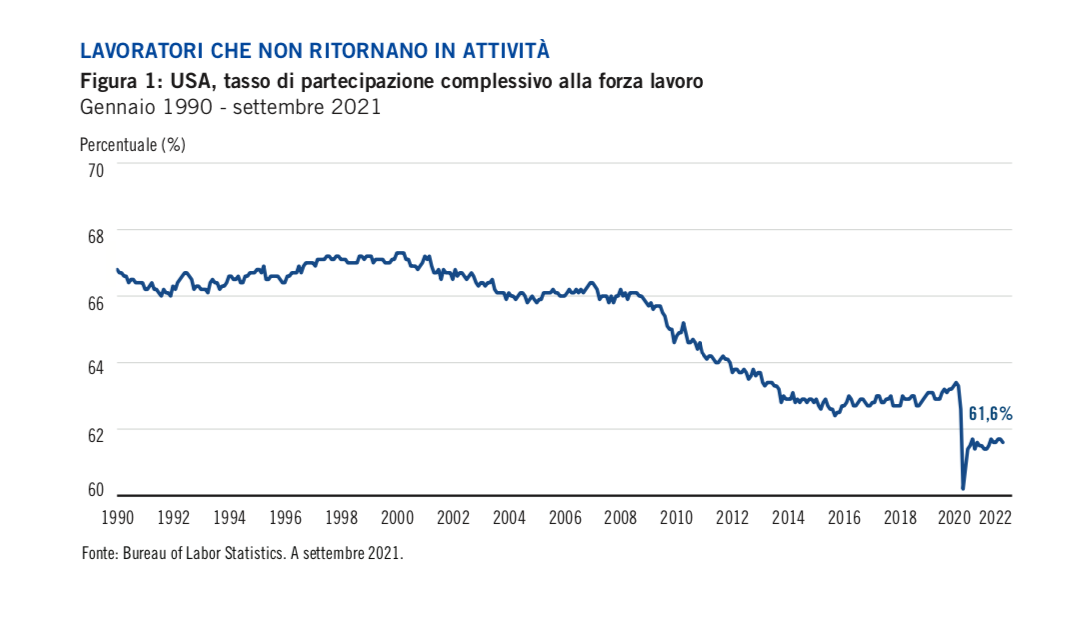

Lower participation in the workforce

While the demand for labor has picked up steadily, many workers do not seem to want to get back into business. Labor force participation suffered a sustained decline between 2000 and 2015, stagnated for a few years and finally began a timid recovery in 2018-19, but pandemic-induced lockdowns have knocked it out again and now it seems. unable to get up.

This is partly due to older workers, who have decided to retire earlier (the workforce over the age of 65 has around 1 million fewer workers than the 2007-2019 trend), but also to older workers. young people who remain on the bench; the participation rate of people in the prime of working age (25 to 54 years old) is 1.5 percentage points below the pre-Covid peak.

Increase in job changes

Just like in the real estate sector, in the job market the price is made by sellers. Vacancies in the United States are around 11 million and, given the many job opportunities and limited competition, more workers are resigning to find new jobs: except for the financial and information services sectors, dropout rates are significantly higher than the 2017-2019 average, and are positively correlated to the abundance of places available (also higher than the 2017-2019 average).

Churn rates are particularly high in the leisure and hospitality sectors, but well above pre-pandemic levels in manufacturing, retail and wholesale as well. Resigning pays: the salary increases obtained by those who changed jobs are greater than those obtained by those who remained in the position they had.

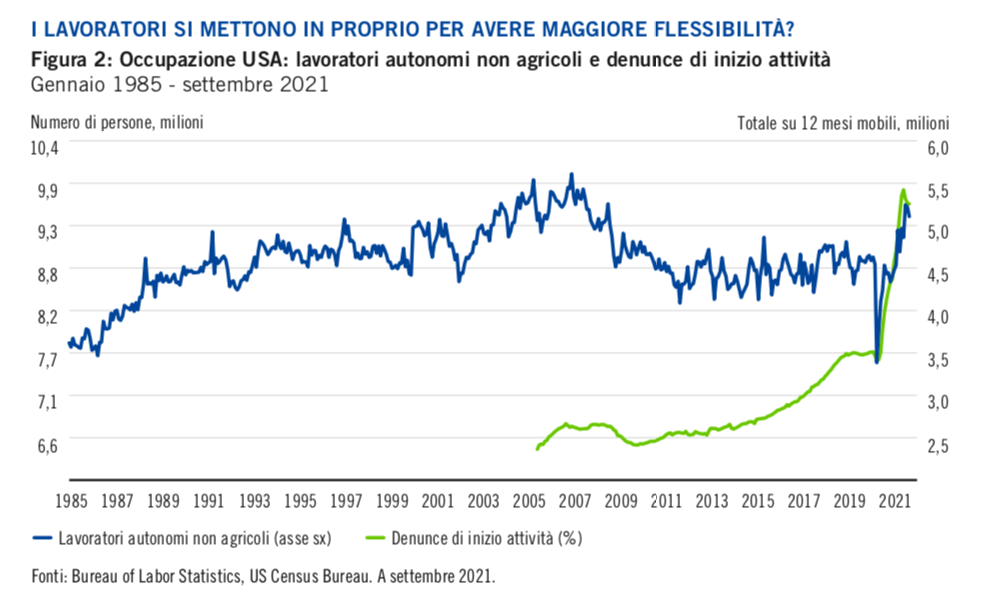

Increase in self-employment

To make matters worse (for companies), self-employment has increased dramatically. The US Bureau of Labor Statistics reports an increase of one million self-employed between November 2020 and September 2021. Business start-up complaints have risen sharply. As a result, even at a time when companies allow flexibility in working hours and places, many prefer to set up their own business. This entrepreneurial boom reduces even further the pool of potential workers that companies can draw on.

What skills shortage?

Some analysts and pundits have blamed the slow recovery in employment on a skills shortage, arguing that the pandemic has changed the sectoral composition of the economy such that some skills that are in high demand by businesses two years ago are now no longer so. . This reasoning does not make much sense, as vacancies are particularly numerous in the leisure and hospitality sectors, where most jobs do not require specialized skills. For their part, companies are so desperate to find workers who are willing to offer training to new hires.

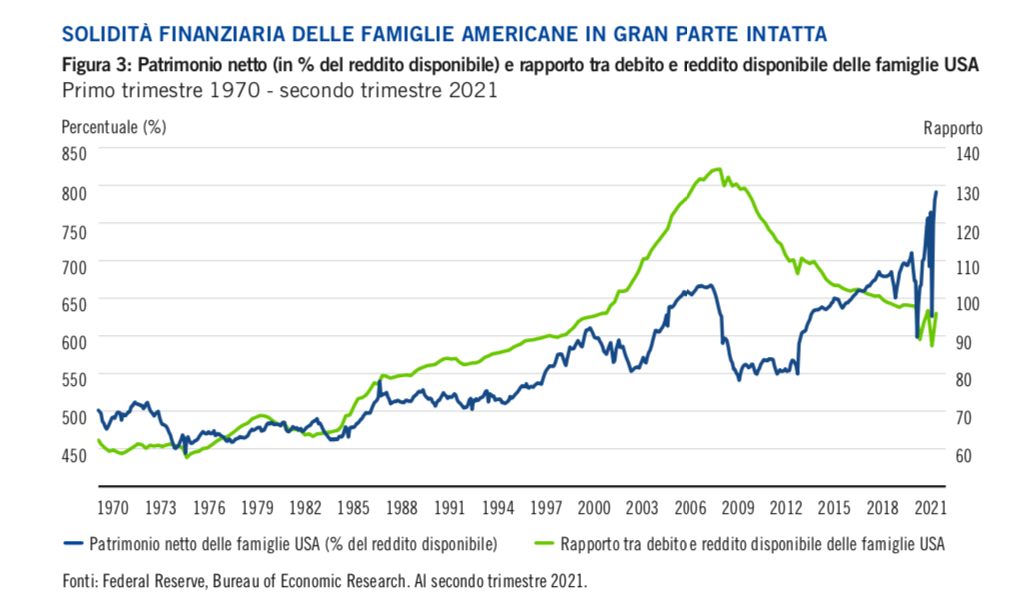

Increase in public subsidies

Other factors that negatively affect the job offer could be linked to Covid: people who are afraid of getting infected at work or unwilling to get vaccinated or unable to look after their children. Perhaps the most important factor, however, is the solid financial position in which households found themselves at the end of the pandemic, with high levels of financial assets and savings; many households still benefit from generous public subsidies.

Although federal unemployment benefits of $ 300 per week expired on September 5, the state unemployment benefits will remain in effect for between 16 and 26 weeks. These allowances are on average $ 319, or 26% of the average weekly wage. Additionally, 39 million US households qualify for the 2021 Child Supplement Tax Credit; as a result, families with two children, for example, could receive an extra $ 500-600 ($ 250-300 per child) per month between July and December. This brings the wage coverage rate to around 36%, and the government plans to raise and extend it.

Congress has also earmarked approximately $ 46 billion for housing assistance for low-income families, and the Biden administration's “Build Back Better” plan includes additional assistance, such as funding a two-year community college, l 'expanded Medicare and Medicaid coverage, twelve weeks of paid family leave and public housing funding.

Rising inflation triggered a significant adjustment of pension benefits to the cost of living, with a 5.9% adjustment starting in January 2022 (the highest since the 7.4% increase in 1982), a measure that affects almost 50 million pensioners2 and their dependents. Pensions should be protected from inflation, but this also means that rising prices will not induce older people to rejoin the workforce. Meanwhile, the Build Back Better plan promises additional subsidies to families, some of which will discourage returning to business because they would be terminated upon accepting a job.

In short, generous government support makes it easier – and more rational – for many people to decide not to work. Several people stay out of the workforce because they can afford it.

Investment implications

All these factors suggest that labor market dynamics will remain subdued for some time to come. Over the past twenty years, the labor factor has lost bargaining power and its share of income has fallen in favor of profits. Now the situation is changing, also due to the backwardness of globalization and the friendly attitude of the government towards the trade unions.

This is not necessarily bad, but in the short run it has unequivocally inflationary effects. It is true that we are not in the 70s, when wages were often indexed to past inflation; however, employers today need to raise wages to attract workers, and they have enough pricing power to pass the higher costs onto prices.

The US authorities are tacitly abandoning the topic of "transitional inflation", and the likelihood that prices and interest rates will continue to rise is higher than in recent years. This corroborates the investment implications our Franklin Templeton Fixed Income team has long pushed: limiting duration exposure and focusing on solid fundamentals to select opportunities in high yield corporate bonds, bank loans, municipal bonds and emerging markets.

Over the medium term, the implications are more complex. If weak labor market dynamics consolidate, potential growth will tend to decline; technological innovation and automation, for their part, will push in the opposite direction, boosting productivity.

The net effect is both uncertain and important: as economic growth slows, high levels of debt and rising pension liabilities would jeopardize financial stability, leading to significant volatility in asset prices. More sustained economic growth would have a stabilizing effect, but rapid technological innovation, coupled with lower labor force participation and higher government subsidies, could consolidate and possibly aggravate income inequality.

An acceleration of the labor supply would be the best guarantee of stronger and healthier economic growth.

For now, however, investors need to prepare for a stagnant job offer, persistent inflation and mounting financial volatility.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-succedera-al-mercato-del-lavoro-nel-mondo/ on Sat, 01 Jan 2022 06:53:34 +0000.