Why Coop and Carrefour are struggling. Report

Negative results for Carrefour which accumulated losses of 604 million, and for Coop with losses of 460 million. What emerges from the 2022 edition of the Observatory on Italian and international large-scale distribution created by the Mediobanca Research Area

2022 will be the year of the discounters . The cheapest supermarkets will be the protagonists of Italian spending thanks to good pricing policies and the quality of the goods sold, which are constantly increasing. To say this are the data of the 2022 edition of the Observatory on Italian and international large-scale distribution created by the Mediobanca Research Area, aggregating the data of 116 national companies and 30 major world players.

The success of the discounters

Between 2007 and 2021 , the discount market share in our country grew from 9.5% to 21.7% , and is expected to rise to 24.7% in 2023. In addition, the cheaper supermarkets have seen sales rise. per square meter, approaching those of supermarkets, while hypermarkets see their share drop to 26.5% from 32.6% in 2007. Discounters also recorded a Roi of 17.5% in 2020, about three times higher than the other formats. Supermarkets navigate in calm waters and remain the leading sales channel with a penetration of 43.1%.

The role of inflation

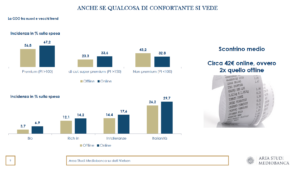

Inflation is also blowing in the sails of large-scale distribution in general, and discounters in particular, which has led to greater use of promotional pressure which in the first half of 2021 returns to 27.9% from 26.5% in 2020. L 'inflation, the Mediobanca researchers write, has sharpened the vertical competition between retailers and suppliers of consumer goods with different margins.

Online shopping: the boom of 2020 continues into 2022

2020 was the year of e-commerce, a habit that consumers retained even after the restrictions on circulation imposed by lockdowns ceased. In Italy the share of turnover achieved on the online channel does not exceed 3% , globally it increased by 50% reaching 8% of revenues. Those who buy online spend an average of around 42 euros, double the number of customers in physical stores.

The market shares of large-scale distribution groups in Italy

In 2021, the top five GDO companies (Conad, Selex, Coop, Esselunga, VéGé) control 57.6% of the market. The first player by market share with 15% is Conad , which took over the Auchan stores in July 2019, followed by Selex (14.5%), while Coop is at 12.3%. Esselunga reaches 8.3% and VéGé 7.5%. Ten years ago Coop was the market leader (15.3%) followed by Conad (10.6%) and Selex at 8.1%.

The results of the Italian GDO groups

The best result in the last five years was achieved by MD, champion of sales growth between 2016 and 2020: + 10.7% on average per year. Followed by Crai (+ 9.2%) and Lidl Italia (+ 8.4%) closely followed by the discount Eurospin (+ 7.8%), Agorà (+ 7.6%), further behind Conad (+6, 5%). In 2021, however, Crai achieved the best performance (+ 15.9%) , ahead of MD (+ 14.5%), Conad (+ 12.4%) and D.lt (+ 12.2%). If we look at the return on invested capital (Roi) in first place is MD (22.7%), followed by Eurospin (20.2%), Crai at 13.7%, Lidl Italia at 13.4% and Agorà at 12.3%. Esselunga is the queen of cumulative profits between 2016 and 2020 : 1,212 million, close to Eurospin at 1,137 million, VéGé at 995 million, Selex at 962 million and Conad at 945 million. The only two chains in red are Coop and Carrefour Italia.

The difficulties of the Coop and Carrefour

Negative results for Carrefour which accumulated losses of 604 million, and for Coop with losses of 460 million. Coop Alleanza 3.0 is the largest Italian cooperative with sales in 2020 of 4,046 million, followed by PAC 2000 A (Conad Group) at 3,654 million and Conad Nord Ovest at 2,605 million . The Coop system shareholder loan is in constant decline from 10.7 billion in 2015 to 8 billion in 2020 (stable compared to 2019). The Coops have come from a difficult five-year period: in the last 5 years they have achieved net financial income of 854 million and undergone financial write-downs of 791 million.

GDO at an international level

In 2020, the major international groups recorded a turnover that fluctuated between 453 billion Euros WalMart and 17 billion Euros of the Russian PJSC Magnit. Large chains in 2021 saw a 3.6% increase in sales with double-digit growth in industrial margins (+ 13.1%) and net income (+ 16.3%). The world ranking of industrial profitability is led by the American group Publix with 22.9% , in second place is the Italian Md with 22.7%, in third the US Target (21.9%), in fourth the Italian group Eurospin with 20.2% and finally the US Dollar General (17.6%). Lidl Italia scores a Roi (13.4%) higher than that of the German parent company Lidl Stiftung (11%). The first group in the world for sales per square meter is Esselunga : with 15,343 euros it precedes the big British J Sainsbury with 14 thousand euros and Wm Morrison with 11,300 euros. The two Australian Woolworths and Coles close the top five.

Large-scale distribution and sustainability

Attention to environmental sustainability has grown among the Italian GDO groups but is not yet at the level of international groups. The environmental impact of Italian companies decreased with a drop in 2020 of 5.5% in energy intensity and 6.6% in carbon intensity . Foreign companies did better, reducing energy intensity by 12.9% and carbon intensity by 12.1%. The share of differentiated waste is 67.7% in Italy and 72% abroad.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/grande-distribuzione-il-2022-sara-lanno-dei-discount/ on Mon, 02 May 2022 05:30:54 +0000.