Why I am trialing the ECB. Bagnai’s post

The analysis of the ECB's moves in recent years by the economist and Lega deputy, Alberto Bagnai, on his blog Goofynomics

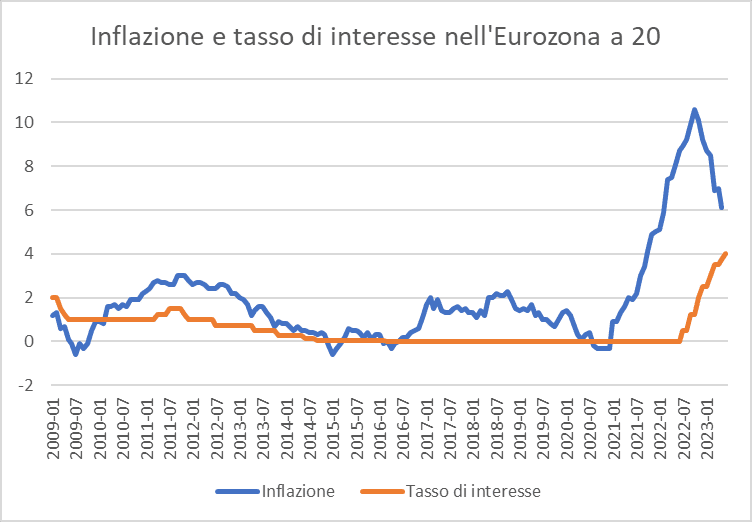

At the beginning of June 2022, the interest rate on refinancing operations to the banking system, the one charged by the ECB to banks that ask for liquidity, was still 0%. A year later, effective tomorrow, following an unprecedented flurry of hikes, that same rate will hit 4% (inflation data here , interest rate data here ).

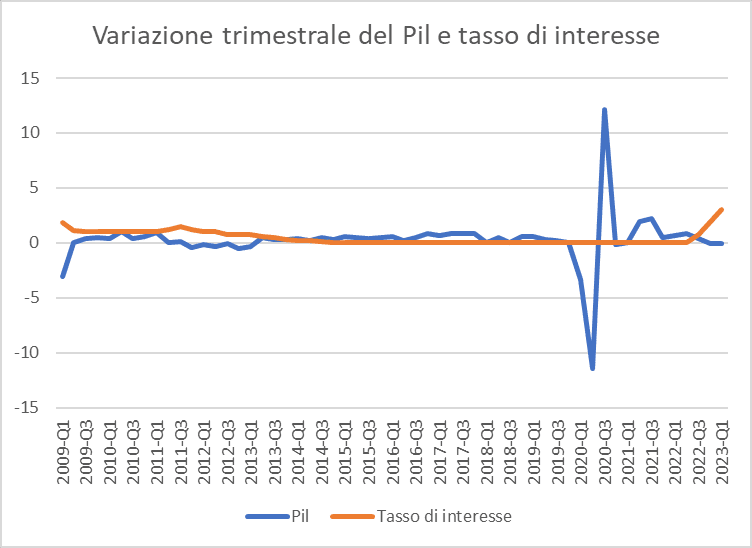

The results were not long in coming:

(GDP data comes from here and interest rates are expressed as a quarterly average).

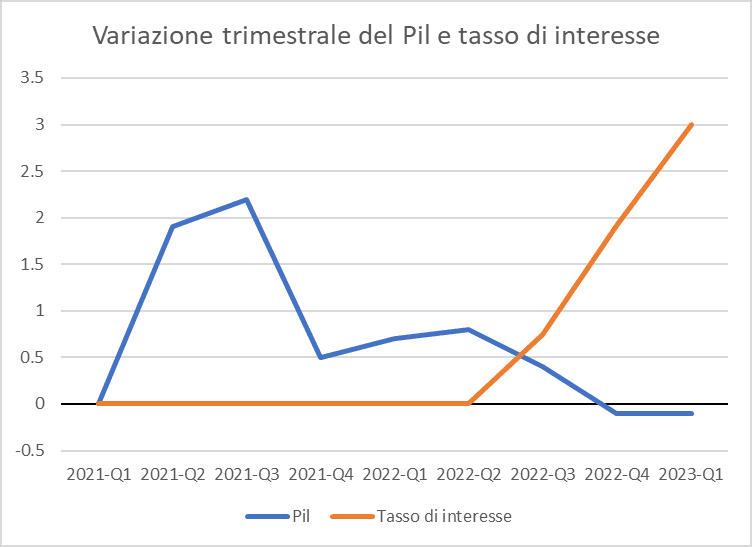

The Eurozone first saw its growth halve from 0.8% in spring 2022 to 0.4% in the summer, then in the autumn it entered a recession (the recession that the media modestly describe as "technical", almost diminish its importance), in contrast with the non-European OECD countries, where growth continues at quarterly rates of around 0.6%.

The ECB's masterpiece stands out better by zooming in on the last few quarters:

This result will fatally damage a country like Italy, which, thanks to the resilience of its production system, has so far positively surprised all international forecasters. But it is above all a result of which neither the timing nor the logic are understood. Eurozone inflation increased by 9 points from the end of 2020 to June 2022. Why didn't the ECB intervene earlier, gradually, rather than applying shock therapy at the last moment, moreover while the was inflation coming back? Maybe because he didn't understand the nature of the ongoing inflationary process. Prices are driven by the forces of supply and demand, and at the moment the most authoritative commentators see the origin of the inflationary process in supply constraints, in the lack of investment in areas such as energy sources and infrastructure. But the ECB, instead of creating an environment conducive to investment by keeping interest rates at a sustainable level for businesses and households, has decided that the only remedy against supply-side inflation is to throttle demand, with the risk of creating insolvency for households, businesses, financial institutions. The result will be that supply and demand will cross at a lower level: that is, it will be a structural recession.

It is they who say it, followed by a flock of commentary parrots: we need to cool down demand (a senseless intention, when clearly the problem is not excess spending but the shortage of some goods: first the energy sources, now the materials raw materials necessary for the ecological transition). It means, in practice, that the only solution that the ECB has to offer us to fight inflation is to let the mortgage payments of families grow, forcing them to spend less, so that the shopkeeper does not sell and, in order to free up the shelves, lower prices. In summary: starve the family and make the shopkeeper go bankrupt. The same reasoning applies to businesses and their demand for goods (which in macroeconomics is called "gross fixed investment", i.e. expenditure for the formation of fixed capital: machinery, industrial sheds, means of transport, etc.).

In summary: the deliberate induction of a recession is the only tool available to the ECB.

Decades of highly refined theoretical elaborations, inspired by a haughty contempt for Keynesian theories, seen as simplistic and out of step with the times, give us back as the only result the popular wisdom of the 1950s Keynesians, those who said that you cannot push an object with a rope (meaning that with the monetary policy rope you can't push growth, but only pull it back, i.e. hang the economy). A lot of studies, a lot of arrogance, a lot of brilliant academic careers built by stringing together banalities with the latinorum of functional analysis , only to then find oneself in the moment of need at the starting point of post-war macroeconomic elaboration!

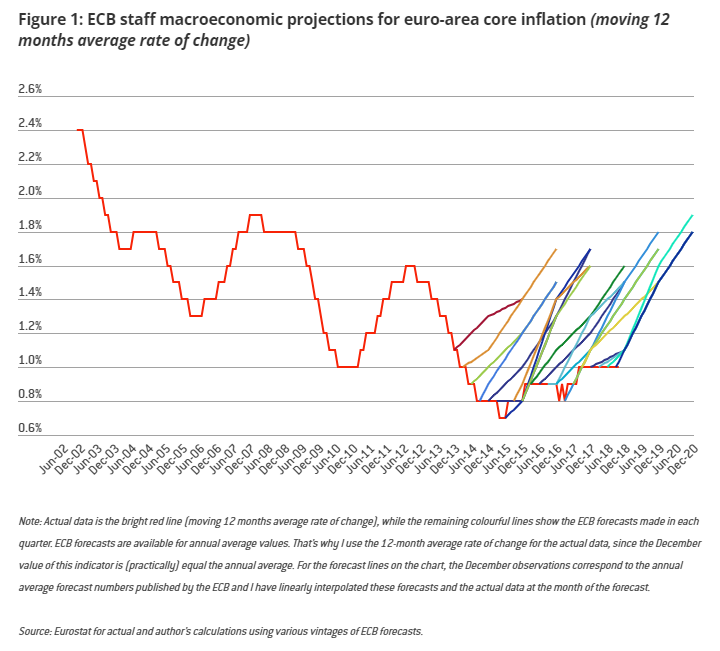

Inflation is often compared to fever. If a patient has a fever, killing him is an effective way to bring his temperature under control, and hanging is one possible avenue. Anyone using this method, however, would not want to be considered a doctor, but a murderer (regardless of his degree). If the ECB is unable to propose other antipyretics, it will necessarily be necessary to open a debate on its role. An institution that bases its policies on predictions whose comic fragility and fallacy have earned a disgraceful mention in the annals of statistics :

an institution systematically incapable of reaching and maintaining that 2% inflation target which it set itself, not the Treaties, (thus demonstrating a spectacular and disturbing lack of prudence and far-sightedness), will be called, if not by the citizens and by their representatives, by history, to take a step back. For what little correlations are worth, and always having regard to their merely descriptive nature, it is interesting to note that the correlation between the inflation rate and the interest rate in the first graph is positive and significant (at 0.46), while that between the of inflation and growth rate in the second graph is negative (at -0.10), but rises to a symmetrical -0.46 if we eliminate the conspicuous anomalous event caused by the pandemic (which obviously pollutes the estimate of the coefficient).

Paperoga ECB therefore works only half as the textbooks say it should: while on the one hand its interest rate hikes send the economy into a recession (in full accord with standard economic theory), on the other they do not curb , but accompany, inflation (in total disagreement with standard economic theory). We are dealing with a cultural problem (the fallacy of the tautological theory that inflation "is a monetary phenomenon") which becomes a major political problem.

To err is human, to persevere is Lagarde: independence cannot mean irresponsibility, a modern democracy simply cannot afford such a gigantic lack of accountability . What today only we are saying here unheard will soon become a choral request: an institution that places itself above all laws, except Murphy's, is a serious and current threat to the economic and social stability of our strip of land .

(The article was published by Goofynomics )

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-processo-la-bce-il-post-di-bagnai/ on Sat, 24 Jun 2023 06:05:22 +0000.