Why Peloton isn’t running anymore

From a golden stock during the pandemic to a bubble that deflates with the end of the lockdown. Peloton, an American indoor sports equipment company, slips on the stock market, cuts 400 jobs and is dumped by its CEO. Facts, numbers and comments

Summer is upon us and yet fitness already seems to have gone on holiday. At least for those who, with the pandemic, had started practicing it at home. In fact, while gym memberships began to grow again after the end of the restrictions, Peloton sales plummeted.

The high-end New York sports equipment company, a favorite stay-at-home stock during Covid-19 , is not faring well and, in addition to losing value, is now forced to lay off 400 people and look for a new CEO.

PELOTON CUSTOMERS NO LONGER RIDING

Record sales during the pandemic now seem like a distant memory. “Peloton's total revenue in the three months to March fell 4% from a year ago to $717.7 million, while sales of its connected fitness products, such as bikes and treadmills, fell fell by 14%,” writes the Financial Times .

“Subscription revenues, which now represent 61% of total revenues – continues the FT -, increased by 3% in the fiscal third quarter compared to a year ago, but the results showed signs of a decline in customer engagement. The number of paid app subscriptions fell 21% compared to the same period last year.”

While Peloton's net loss narrowed to $167 million in the third quarter, it still missed analysts' expectation of $130 million.

CUTS ON CUTS

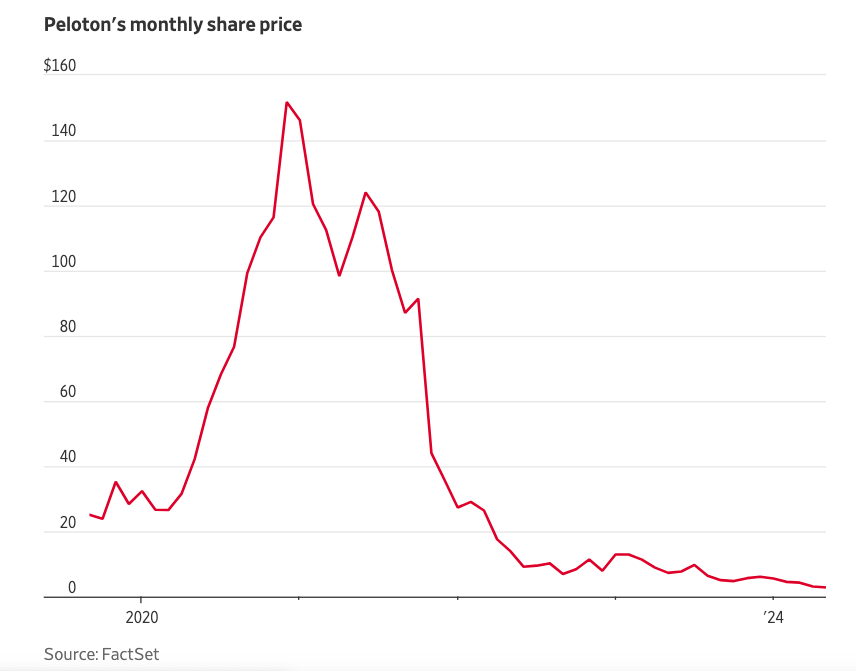

Cost and staff cuts in recent years haven't been enough — Peloton had more than 8,000 employees in 2021, compared to 3,500 in June 2023 — and the company's market capitalization has fallen to about $1.2 billion from a peak. of almost 50 billion at the beginning of 2021. “The group – says the FT – was valued at 8.1 billion dollars at the time of its initial public offering in September 2019″.

To straighten out its balance sheets, Peloton has announced the layoff of 400 people, equal to 15% of its workforce, which will allow annual savings of over 200 million by fiscal year 2025. The company also intends to continue to reduce the number of showrooms and spending on marketing and software in an attempt to reduce costs.

“Peloton shares – reports the FT – jumped as much as 18% shortly after Wall Street opened on Thursday [2 May, ed. ], but ended the day down 2.5%.”

AAA WANTED NEW CEO

Finally, the farewell of Barry McCarthy, CEO of the company for just two years, fits into this beautiful picture. Brought back from retirement with a pay package initially valued at $168 million, the former Netflix and Spotify executive was tasked with reviving Peloton, but the stock price never regained its pandemic-era highs.

Currently, group president Karen Boone will work with Chris Bruzzo as interim co-CEO until the company finds a permanent replacement for McCarthy, who will become a strategic advisor until the end of the year. Jay Hoag, another director, founder of the venture capital firm Tcv and one of Peloton's largest investors, was named the next chairman of the board.

DEADLINES AND ANALYST COMMENT

“Someone has to acquire it, because at this rate I don't even know if this company will still be a standalone company in the future,” said Paul Cerro, chief investment officer at Cedar Grove Capital Management.

Peloton, meanwhile, wrote in a letter to shareholders that it is "aware of the timing of the maturities of its debt", which consists of $1 billion in convertible bonds and a $700 million term loan, to be addressed in the near term .

The company said it is working with its banks, including JPMorgan and Goldman Sachs, on a refinancing strategy.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-peloton-non-corre-piu/ on Fri, 03 May 2024 08:27:43 +0000.