Why the ECB shouldn’t raise rates again

In Europe, hints of recovery and a potentially significant demand for durable goods are emerging, but overall the signals are still mixed. What should the ECB do? Analysis by Paul Doyle, head of large-cap equity Europe at Columbia Threadneedle Investments

It is said that "necessity is the mother of invention," so Europe acted swiftly to ease its dependence on Russian gas. The high cost of living has led households to reduce energy consumption by turning down thermostats, and companies have also reduced gas consumption, while preserving production. Furthermore, the mild winter helped to reduce consumption. To address supply issues, Germany has built its first five floating liquefied natural gas (LNG) terminals, while Norwegian gas is arriving in Poland for the first time.

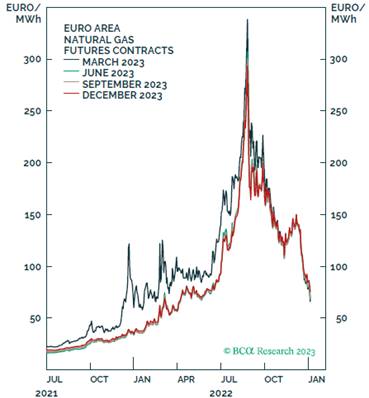

The easing of the energy crisis has sent gas prices plummeting (Figure 1), driving down inflation and boosting business confidence – all positive factors for equities. European inflation triggered by pandemic-related supply chain problems has tightened amid the effects of the war in Ukraine. We expect consumer price inflation to fall to 3%-4% by the end of the year, benefiting the European economy.

Over the longer term, we believe inflation will not return to the 2% levels we have been used to for 20 years, but will remain closer to 4%. The reasons behind this data are many, including the shortage of raw materials after years of low capital expenditure, the reopening of the Chinese economy thanks to the reduction of infections from Covid, the aging of the European population, the European subsidies for the green transition, deglobalization and military tensions in Europe. All of this will lead to higher bond yields and higher market volatility, resulting in lower P/E (price/earnings) multiples than in the recent past.

Mixed signals on the strength of the economy

In Europe there are hints of recovery, but the signs are mixed. The best leading indicator is the money supply, which appears to be declining further. If inflation comes down as we expect, demand will increase. In Europe there is ample room for an increase in the demand for durable goods, unlike in the United States, where demand has already exceeded pre-pandemic levels.

Another positive factor concerns the end of the zero Covid policy in China. The country absorbs 8% of European sales, making Europe its second largest trading partner after Southeast Asia. As the number of coronavirus infections in China decreases and consumers start traveling again, consumer spending will increase. Supply chain issues will ease and strengthening Chinese demand will ease pressure on the renminbi. These developments also speak in favor of Europe. The European sectors most exposed to China are semiconductors, luxury goods, energy and automobiles. In fact, China accounts for a quarter of the demand for semiconductors and 16% of that for luxury goods.

Biggest valuation discount ever

Turning to equities, valuations (including Europe) look reasonable after the 2022 downturns. The valuation discount between European and US equities has never been greater. IP/E based on next 12 months earnings is 10x in Europe and 17x in the US. US companies may be more profitable than others, but a stronger China and weaker US dollar will push valuations outside the US higher. In the unlikely event that European equities lose traction this year, the cause will have to be attributed to the squeeze on earnings.

The situation in the United States is different

The neutral interest rate is the interest rate equivalent to the amount of investment a country makes with its savings. Anything that reduces savings or increases investment raises the neutral interest rate. The highest level is recorded in the United States, which implies that the US economy can tolerate higher interest rates than other countries.

In the United States, the neutral rate is at its lowest since the global financial crisis: while households and businesses were intent on repaying their debts, this situation led to excess savings which lowered the cost of money. Globalization and extra savings in other parts of the world have accentuated this phenomenon. These dynamics are now reversing which is why the neutral interest rate is going up. Demographic aging leads to an increase in the dependency ratio, ie the percentage of the population of inactive age, compared to the active population. Thus, output will decrease relative to spending, with an inflationary impact. US government interest spending will increase, as in other countries, perhaps reaching the levels of the early 1990s. Over the long term, the rising cost of capital will reduce systemic risk in economies and capital markets, as leverage and inefficient capital allocation will be penalised. Meanwhile, the war in Ukraine should accelerate investment in renewable energy, boosting productivity in Europe.

In the near term, risks to US asset prices (stocks and bonds) persist, as slowing inflation typically leads to higher real wages. Nominal wage growth will manifest itself lagging behind inflation given the tightness of the US labor market. Rising real wages will encourage consumer spending, so the economy could overheat, creating a dangerous scenario as the US Federal Reserve is forced to raise rates again and equities do not react well.

Inflationary risks are declining

We expect the European Central Bank not to raise rates as much as the market expects. The neutral European interest rate is low, much lower than in the United States. The European economy is too fragile to resist the Fed's rate hikes. The real neutral rate in Germany is around zero, while in Italy it is negative. Germany could survive with rates of 2.5%; Italy doesn't. In summary, inflation in Europe was caused by a supply shock, but a price/wage spiral was averted. In Europe, rates do not need to go much higher, which means that stock prices still have some upside left.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/bce-tassi-no-aumento/ on Wed, 15 Mar 2023 06:32:34 +0000.