Why the financial markets aren’t anxious about the runoff in Türkiye

However, Turkey has relatively little influence on international economic growth and therefore the outcome of these elections will not realistically move broad market indices, including those of emerging markets. The analysis by Giorgio Broggi, Quantitative Analyst of Moneyfarm

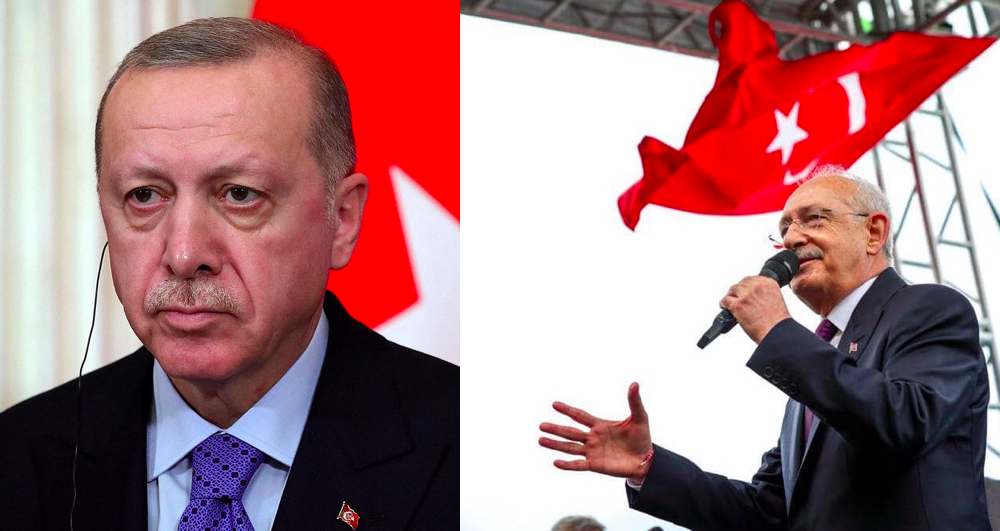

On Sunday 28 May there will be a runoff between Turkish President Recep Tayyip Erdogan , leader of the Justice and Development Party (AKP), and the challenger to the presidency Kemal Kılıçdaroğlu, of the Republican People's Party (Chp). Erdogan, who has led Turkey uninterruptedly for 20 years, did not pass the 50% threshold in the May 14 elections, necessary to proclaim himself the absolute winner, stopping at 49.9% against 45.28% for his challenger. A situation which therefore made it necessary for a second round of voting to be held this very Sunday. As Erdogan's undisputed power begins to waver for the first time in 20 years, what financial repercussions should we expect?

Financial markets are not afraid of elections in Türkiye

After the first round of voting, Erdogan obtained the support of Sinan Ogan, a challenger who finished in third place on May 14, obtaining 5% of the votes. Support that for the markets is equivalent to the victory of the outgoing prime minister: the base case. In reality, whatever the outcome of the elections, no major impact is expected on the financial markets. The country does not represent a fundamental driver for global growth (it is the 19th economy in the world) and therefore the power to move even the sentiment of the markets remains very limited. The first round of voting disappointed investors, who expected a sudden change in national politics following the recent challenges Turkey has faced in terms of economic growth, inflation and earthquakes. It wasn't like that. The uncertainty linked to the first round of elections, and to the fact that Erdogan is now considered the favorite to win, has resulted in a depreciation of the Turkish lira. While the local currency is suffering, the impact on broader market indices, including those relating to emerging markets, remains small, in part because Turkey has been viewed as a struggling economy for years now. Downside surprises are somewhat limited.

What if Kiliçdaroğlu wins

An opposition victory could lead to positive effects on the Lira in the medium and long term, even if some elements of uncertainty remain. First, in fact, if Kemal Kiliçdaroğlu were to win, he would immediately establish a more austere monetary policy than Erdogan's, which could be positive for the currency but probably not immediately, as we would see the end of interventionism of the central bank, which for years has been selling reserves and putting pressure on national banks to support the Turkish currency. Secondly, in view of the local elections of 2024, essential for political stability, the new leader could be less rigid than expected, maintaining the focus on economic growth and, clearly, reducing that on the fight against inflation. This would be detrimental to the value of the currency. Finally, there is the risk of political instability linked to the fact that after 20 years of government, Erdogan has brought allies and friends to fill the main institutional roles.

What if Erdogan wins

If Erdogan were to win, however, the push for his own unorthodox monetary policies would increase, among them cutting interest rates despite inflation that remains extremely high.

Conclusions

While the lira remains at risk, the economy is weak and inflation is out of control, markets are not worried about the impact of the Turkish elections on global growth and the wider emerging market area, aware that Turkey has little weight on international markets.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/primo-piano/turchia-ballottaggio-ansia-mercati/ on Sat, 27 May 2023 05:28:32 +0000.