Why Unicredit enjoys selling Webuild (which is tumbling on the stock exchange)

Capital gain of over 35 million euros for Unicredit which sold its stake in Webuild. Facts, numbers and insights, with the stock market tumble of the group led by Pietro Salini

Unicredit enjoys the capital gain, Webuild mourns the fall on the stock market. This, in short, is the double effect of Unicredit's move to sell its share in Webuild. Here are all the details.

WHAT HAPPENS ON THE STOCK STOCK AT WEBUILD

Webuild thud on Piazza Affari, after Unicredit decided to sell the stake it held in the construction company. At 10 am the stock lost 7.7% (FTSE MIB at -0.02%), trading at 2.23 euros per share, after having reached a minimum of 2.196.

UNICREDIT'S MOVE ON WEBUILD

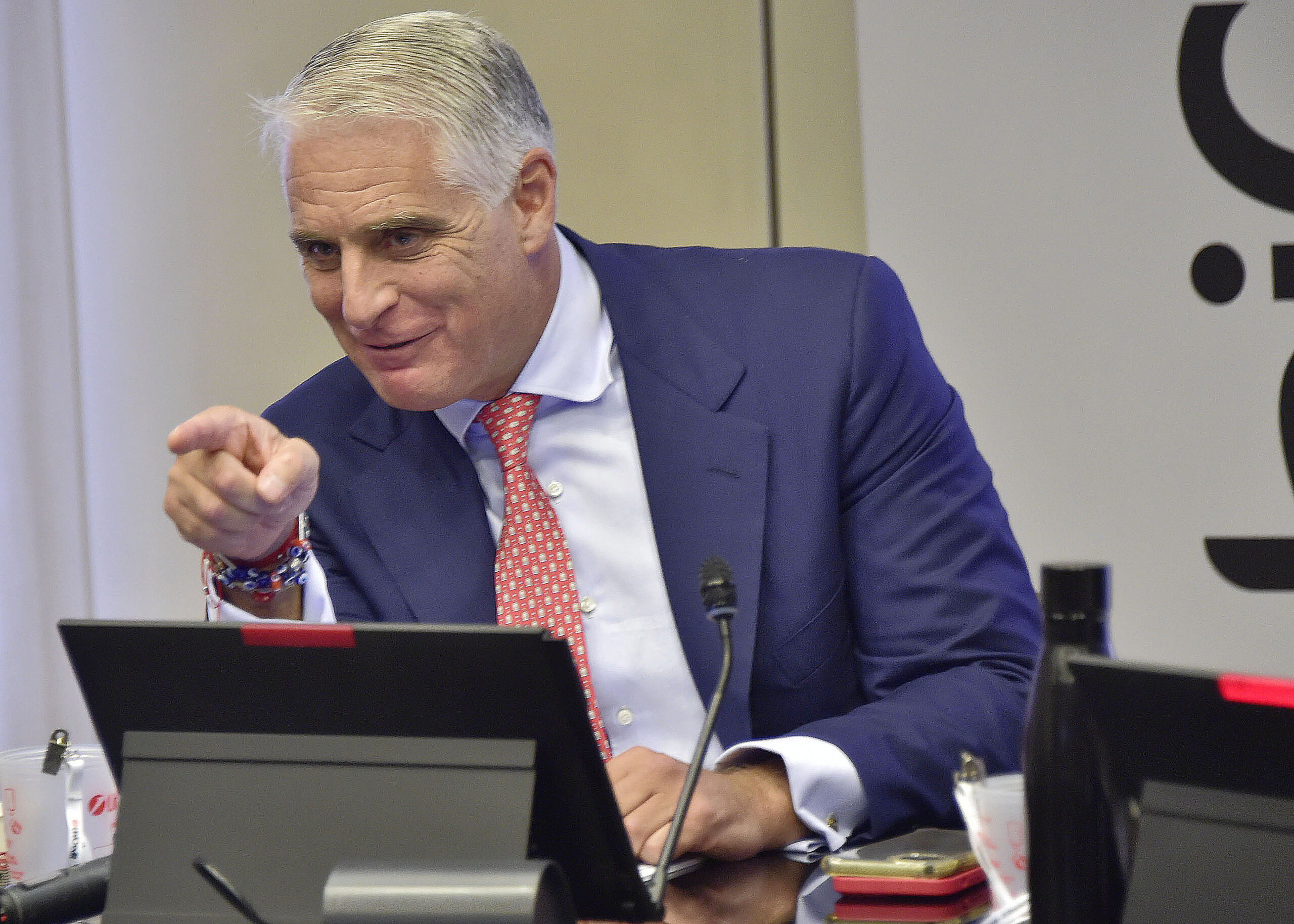

The bank led by Andrea Orcel sold its stake in Webuild, equal to 4.99% of the capital, through an accelerated book building. The bank – according to market sources, we read on Radiocor – would have sold 50.9 million shares of the group it joined in 2019, sold at 2.2 euros per share, at a discount of 8.9% compared to the closing yesterday at 2.416 euros. The total amounts to 112 million euros.

Unicredit's move attests and confirms the brand direction of a group that is getting rid of shareholdings not considered core and legacies of systemic public-private operations such as the de facto rescue of the Salini group.

HOW MUCH DOES UNICREDIT EARN BY SELLING WEBUILD

Considering that Unicredit became a shareholder of Webuild in November 2019 – when there was a capital increase as part of a systemic public-private operation in which Intesa Sanpaolo also became shareholders of the group active in public works – with the new shares paid to 1 .5 euros, the bill is soon done for the coffers of the banking group led by Orcel: with the sale of the shares at 2.2 euros, Unicredit has forfeited a capital gain of 35.63 million euros.

Furthermore, in 2023 Unicredit budgeted dividends of 3 million euros for the Webuild share.

WHAT THE ANALYSTS SAY

Unicredit therefore took advantage of the good stock market moment of the shares of the former works and construction giant Salini Impregilo. In fact, the stock has grown in the last three months by 31.5% and despite the news of Unicredit's exit, Equita analysts maintain the "Buy" rating, with a target price of 3 euros per share, while Intermonte reiterates the target price at 3.30 per share. Webuild's current shareholding structure sees Salini (39.7%) and Cdp Equity (16.5%) bound by a recently renewed shareholders' agreement until February 2027. Among the relevant shareholders also Intesa Sanpaolo (47 million shares, equal to 4.6% of Webuild).

THE SHAREHOLDER STRUCTURE OF WEBUILD

Webuild 's shareholding structure includes Salini (39.7%) and Cdp Equity (16.5%) bound by a recently renewed shareholders' agreement until February 2027. Among the relevant shareholders also Intesa Sanpaolo (47 million shares, equal to 4 .6% of Webuild ). The shares held by Unicredit and Intesa Sanpaolo in Webuild – recalls Mf/Milano Finanza – derive from previous credits towards Astaldi which was subsequently integrated by Webuild.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-unicredit-gode-vendendo-webuild-che-ruzzola-in-borsa/ on Fri, 22 Mar 2024 09:46:30 +0000.