Why US Treasuries Indicate Slow Global Growth

The solid 20-year US Treasury auction of recent days demonstrates that real money continues to bet on weaker global growth. The analysis by Althea Spinozzi, senior fixed income for BG SAXO

The 20-year pre-Christmas US Treasuries auction was the latest long-term bond sale. It had all the elements to trigger a sell-off on the long end of the yield curve, but it didn't. Long-term bonds were "saved" in the middle of a day of intense bear market recovery.

Prior to the bond sale, the US yield curve turned steep following the lead of its European counterparts. Long-term yields have risen rapidly as expectations for UK interest rates rise, with the OIS curve currently forecasting a 21 basis point rate hike as early as February. A second rate hike in the UK will allow the Bank of England to start liquidating its balance sheet. This move implies higher returns along the entire yield curve. Hence, the steepness increases.

Yields on US Treasuries each year increased seven basis points before the auction. All pointed to a weak bond sale as this mood is usually unloved and the market is illiquid around Christmas time. However, stronger-than-expected investor demand canceled out losses on the long end of the yield curve. Bid-to-cover rose to 2.59x, the highest since June 2020, while primary dealers remained with an all-time low of 14.3%. The auction stopped through the WI of 2.3 basis points, with a high yield of 1.942%.

It's another confirmation that the market is betting on weaker global growth and inflation expectations that could have a significant risk-off event in the equity market. Within this scenario, long-term bonds act as "accident insurance" on the economy and real money is not afraid to increase its position in this part of the curve.

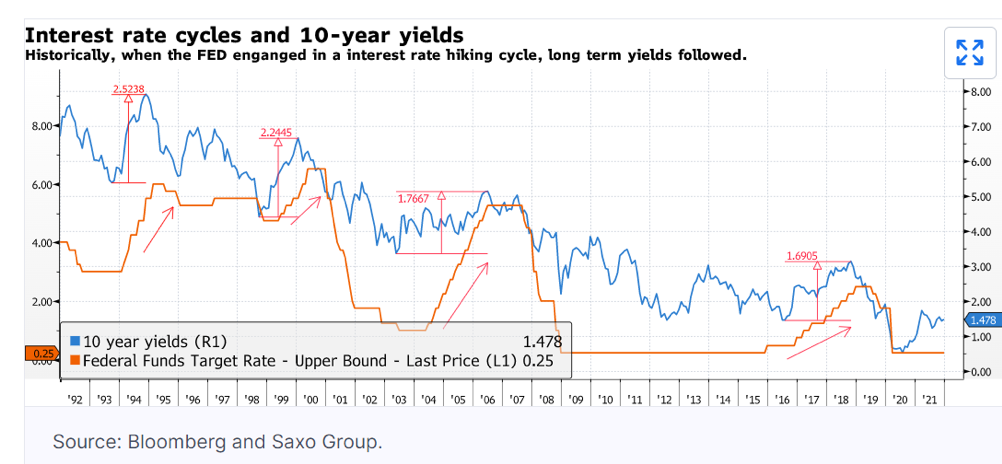

However, the long part of the yield curve rally may not last beyond the first quarter of 2022. As the Federal Reserve finishes reducing purchases under its QE program, the onset of a tightening cycle begins. will approach and an increase in yields across the curve will be inevitable. As the graph below shows, 10-year yields have always increased during previous interest rate rising cycles. It is prudent to predict that the same thing will happen this time.

There is one more thing to consider: inflation remains an underestimated threat. If the central bank reverts to its dovish stance due to a market sell-off after it has embarked on a tightening path, there is a chance that inflation could rise further. If so, the Fed will have no alternative but to keep raising interest rates.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-i-titoli-del-tesoro-usa-indicano-una-crescita-globale-lenta/ on Sun, 02 Jan 2022 07:03:42 +0000.