Why Wall Street fears a divided US Congress

What is said about the markets after Biden's victory. The analysis by Richard Flax, Moneyfarm's Chief Investment Officer

After an exciting and full of twists marathon, the official announcement arrived at the weekend. Joe Biden won the election , but the Democrats failed to win Congress. This scenario, which was clearly outlined for the markets as early as the second half of last week, was greeted by the stock exchanges with a rally, which could somehow surprise given the erratic path that characterized the counting of votes.

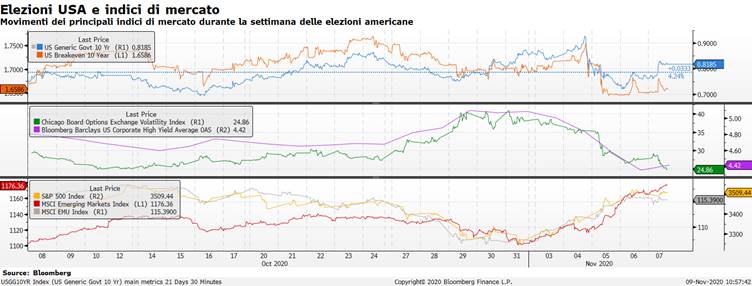

US equities (red and blue lines in the graph below) rose 7.36% last week, mainly favored by growth stocks, i.e. those with high multiples, which belong to most of those tech companies that led the market throughout 2020. The rally also extended to Europe (+ 7.52%) and Emerging Countries (+ 6.62% in USD). Even in the most dramatic phases, in which it might have seemed that the elections would not have delivered any winner, the reaction of the markets was positive and focused on the medium-term prospects, proving that operators did not take the rhetoric too seriously and the complaints of Trump, who feared the alleged risk of fraud for weeks. The Vix (green line in the graph below), the most famous risk index, fell by 13 points (35%), falling below pre-election levels and not even Trump's accusation of fraud, judged unfounded, has managed to reverse the trend.

We must not forget that the US elections have been a major risk factor for the past few weeks and the reabsorption of the risk premium has certainly helped. The movement of the rate curve was perhaps the most unexpected, with a drop of more than 20 bps on long maturities (yellow and white lines in the graph below), catalyzed by a downsizing of inflationary expectations. We recall how an interest rate regime contained in a context of a growing economy is a determining factor for corporate valuations.

THE “RISK” BLUE WAVE REMOVES

The Republicans, despite the defeat, obtained a better result at the polls than predicted by the polls not only in the presidential race – where a defeat of Trump was predicted – but above all in the votes for the Senate. The total victory of the Democrats, which would have sparked the fear of a fiscal tightening on companies, did not happen. Now that the uncertainty surrounding the election campaign is behind us, the markets will soon focus on the issue of economic recovery. While we don't rule out the risk that the debate around Biden's tax reform proposal could reignite volatility, the fact that Democrats don't have a majority in the Senate is seen as a guarantee of a better balance between investment and taxes and this could take some of the away. 'pressure from equities.

NOW TAX STIMULUS

On the other hand, a divided Congress could hinder the political process towards a new stimulus package (hence the underperformance of cyclical sectors and mid-cap companies, which are more in need of state support). However, it does not seem likely that party diatribes will significantly limit the scope and scale of political action. There is historically no evidence that a divided Congress negatively affects market performance. Having said that, we cannot ignore the fact that rapid progress is needed in the fiscal stimulus talks and economic maneuver negotiations to justify the current equity valuations, which will have to start again in reverse and must therefore be followed closely.

BONDS SECTOR

Turning to bonds, as mentioned, the reaction of the yield curve has been that of a flattening, probably because the clear victory by the Democrats, which would have weighed up the inflation prospects, does not seem in sight. This does not exclude that in the medium term, when the terms of the democratic plan are clearer, the fear of an increase in prices could rekindle and the curve could soar in the part relating to long rates. Emerging markets and European equities are likely to benefit from improved trade sentiment.

ONE LESS RISK FACTOR FOR 2021

In short, it seems that what the markets feared most was uncertainty itself. All in all, as we move closer to 2021, we believe that macroeconomic factors will take over the political issue. This could be good for risky assets, as long as Covid-19 doesn't spiral out of control again and growth starts picking up momentum in the first quarter. Of course, there is the unknown factor of the appeals, with the lawyers already in action even before the result was confirmed, to highlight any irregularities. Trump contested the regularity of the votes, arousing for now more bewilder than actual fear for the democratic seal. A long tail of controversy (in the style of the one following Bush's victory in 2000) would certainly create uncertainty on the markets. If anyone wants to continue paying the lawyers' fees, the appeals will continue. But at the moment there seems to be no basis for mounting a credible legal case against an electoral process which, while proceeding slowly, has progressed in an orderly fashion.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/mondo/perche-wall-street-teme-un-congresso-usa-diviso/ on Sun, 15 Nov 2020 15:14:25 +0000.