Will China really be scary on bonds and beyond? Pictet’s analysis

What will happen in China and beyond in the light of the latest macroeconomic and real estate news. Analysis by Sabrina Jacobs, Senior Client Portfolio Manager and Echo Chen, Investment Analyst at Pictet Asset Management

China is not only the world's second largest economy, but also the second largest bond market. So it's no wonder that as soon as it hiccups, investors in emerging market (EM) bonds get nervous. However, we believe there is no need to panic, for three key reasons.

First, China's economic outlook is not as bleak as it might appear at first glance.

While the real estate sector remains weak, there are some positives elsewhere. Domestic tourism is now higher than pre-Covid and outbound tourism is back to over 50% of 2019 levels (also benefiting the rest of Asia's emerging markets, such as Macau, Hong Kong and Thailand). The service sector in general is holding up well and public investment is strong.

Chinese authorities have also been proactive in supporting growth. They cut interest rates and buoyed the real estate sector. Mortgage rates have been cut by 150 basis points since their peak and, as the positive effects on borrowers tend to be seen with a lag, the benefits are still largely to materialise. At the recent Politburo meeting, the authorities pledged to step up counter-cyclical measures, which could include plans to help young job seekers and easing purchasing restrictions to support the real estate sector. In the Politburo meeting, the phrase “the house is meant to live in, not to be speculated on” was omitted – an important signal.

Economists recently revised their 2023 growth projections downwards, with consensus expectations converging towards the official forecast of 5%. While it's lower than initial expectations (about 6% after the strong rebound in Q1), it's still a marked improvement over last year.

This, in turn, should help emerging markets more broadly maintain an attractive growth differential relative to their developed counterparts, to the benefit of EM corporate and sovereign bonds.

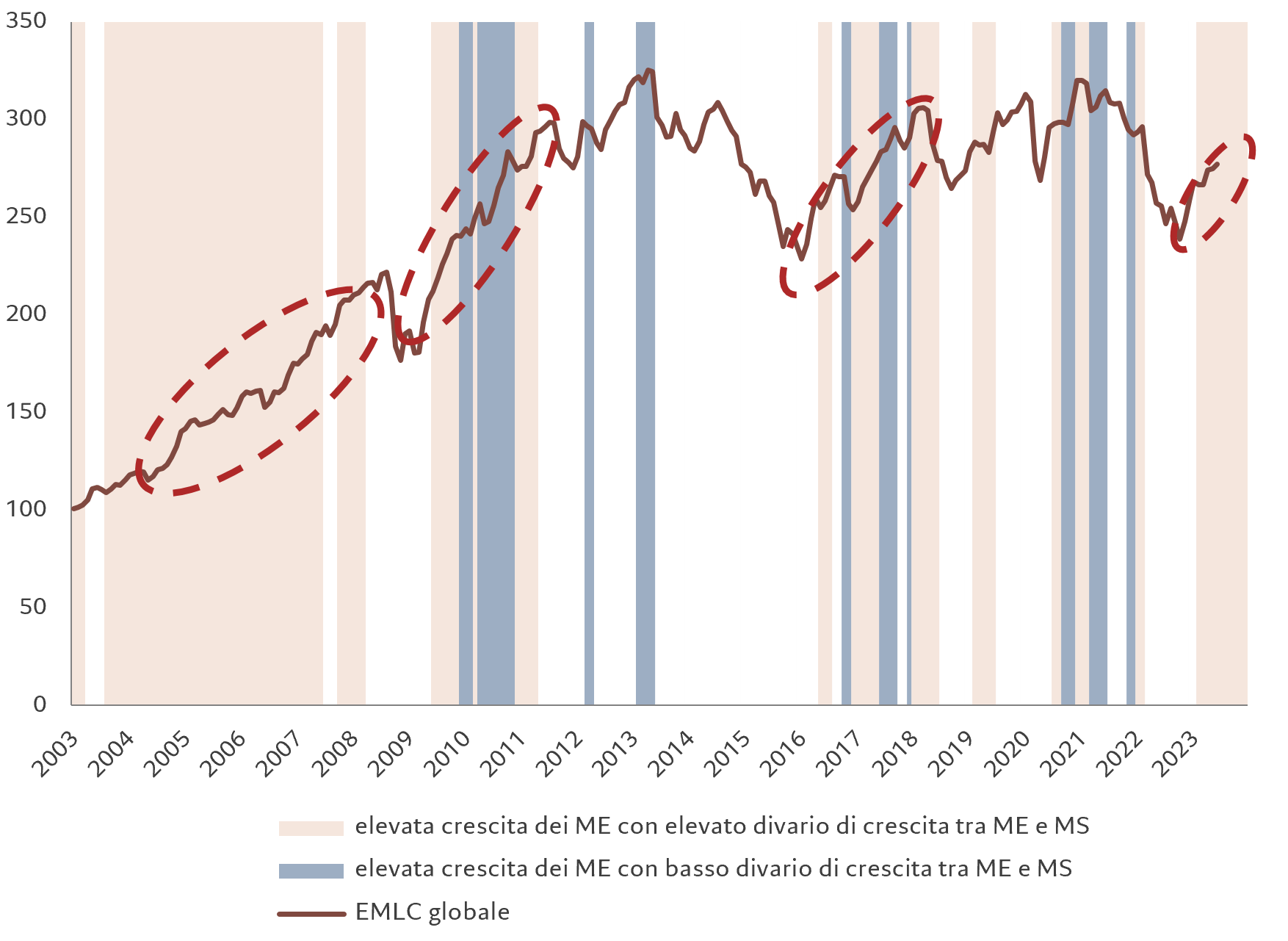

Fig. 1 – Increased growth

GDP growth, % annualized quarterly and local currency performance of emerging markets

We see a growth gap of about 4 percentage points for this year and next. This is a sizeable gap and, therefore, even if China's growth were to be lower than current expectations, the growth gap between EM and MS would still be significant.

Our analysis shows that historically this gap has been accompanied by an appreciation of emerging market currencies against the US dollar and a general outperformance of emerging market assets (see Fig. 1).

A DOMAIN IN DECADENCE

Second, while China is clearly central to the emerging markets universe, its dominance is not as strong as it used to be. In recent years, the fate of other emerging markets has emancipated itself from China in terms of macroeconomic and asset class performance.

The different approaches to the lockdowns due to Covid-19 and the consequent political reactions have led to divergent growth paths, rates and inflation. The lockdown implemented in China was significantly more severe than in many other countries. The country is, therefore, only now recovering from an economic point of view, and has not recorded the sharp increase in inflation which is witnessed, to varying degrees, in almost the rest of the world.

While other central banks in emerging countries, especially in Latin America, have proactively raised interest rates over the past two years, the People's Bank of China (PBOC) has maintained an easing path to support growth. Now other emerging central banks are preparing to ease monetary policy, which would potentially provide a huge boost to their local currency debt markets. Chinese assets will not receive such a marginal boost as the PBOC is already in easing mode, although its current monetary policy should prove to be a mildly positive and not a hindrance to the overall theme of EM monetary easing.

The divergence also underscores the lesser dependence of other EM economies on China through the link to commodity prices. Chinese demand for commodities was a major boost for developing countries in the 2000s given the dominance of commodity exporters in the EM universe at the time. However, today EMs are a much more diverse group and have a much more balanced ratio of commodity exporters and importers. Therefore, China's current lack of demand for raw materials is much less of a problem for the rest of EMs than it was 10 or 20 years ago.

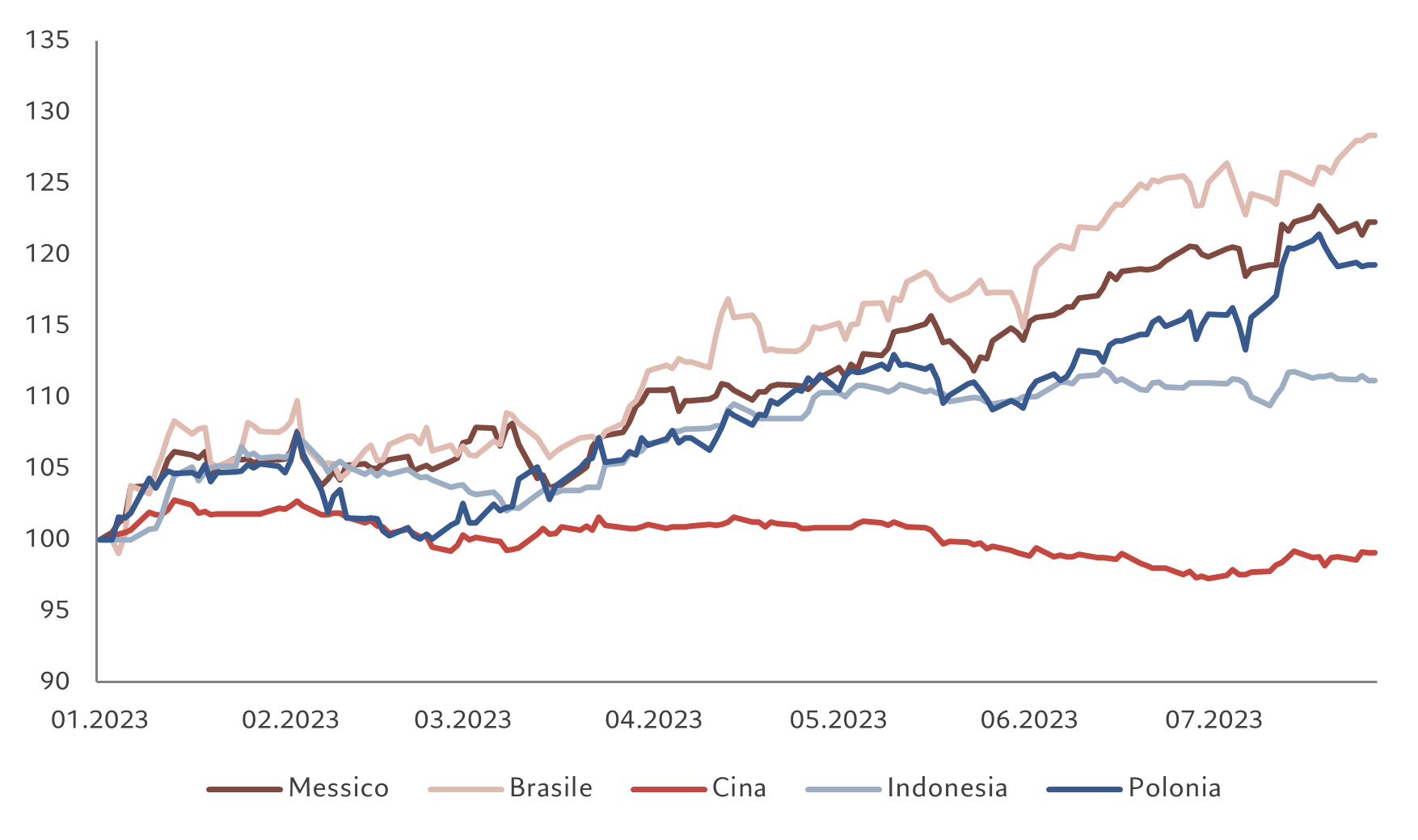

Fig. 2 – Diversified returns

Performance of some national GBI total return indices

Unsurprisingly, markets are also differentiating Chinese assets from other EM assets (see Fig. 2).

JP Morgan's local sovereign index, the GBI-EM, is up 10.5% in USD terms since last year, while its Chinese sub-index fell 0.7% over the same period. This reflects the development of currencies: while, for example, the currencies of Latin American countries have risen this year, led by the Brazilian real, the Chinese renminbi has lost 3.3% against the US dollar.

OPPORTUNITIES BEYOND CHINA

Third, we see very positive news across the developing world, creating potentially lucrative investment opportunities.

Mexico is benefiting from the trend of companies to bring production closer to the US market. Property vacancy rates have dropped significantly in major Mexican cities, while rents are on the rise. Collectively, we expect near-shoring to boost Mexican exports by nearly 3% of GDP through near- to medium-term opportunities. Similar trends are also taking place in other Latin American countries. Some of these investments are being diverted from China due to geopolitical tensions between Washington and Beijing. What China loses, therefore, will be the gains of other EM economies.

India and Indonesia, on the other hand, both report improving economic growth, which is largely domestically driven. This bodes well not only for sovereign debt, but also for credit in some sectors. Our emerging markets credit teams are particularly fond of green energy companies in this region, as well as infrastructure and transportation in India and consumer goods companies in Indonesia. Financial stocks should perform well as strong economic growth translates into more lending.

We are also seeing positive developments in some frontier markets. Nigerian authorities recently harmonized the country's myriad exchange rates, signaling a shift to a more focused and predictable monetary policy and non-interventionist currency regime. They also cut costly fuel subsidies, raising the possibility of an improvement in Nigeria's budget balances, which in turn should boost investor confidence and capital inflow into the country.

Zambia, meanwhile, has reached a major debt refinancing deal and Ghana is expected to follow suit.

For now, we think some of these opportunities are more attractive than those offered by China itself, where some of our portfolios are more neutrally positioned. However, we remain convinced that, over the medium term, China will remain key in a diversified EM portfolio; its large domestic economy allows it to craft tailor-made policies unrelated to developments in the rest of the world.

We currently look favorably on China's technology sector. Recently, after three years of regulatory tightening, there have been political signals of greater openness. Conversely, we remain cautious on the real estate sector.

Overall, we think China's slowdown is manageable (especially since it has already triggered further support from the authorities) and that it has already bottomed out in the second quarter. The outlook for emerging market debt remains strong, with some attractive opportunities within China and many more beyond.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/la-cina-fara-davvero-paura-su-bond-e-non-solo-analisi-di-pictet/ on Sun, 03 Sep 2023 05:22:36 +0000.