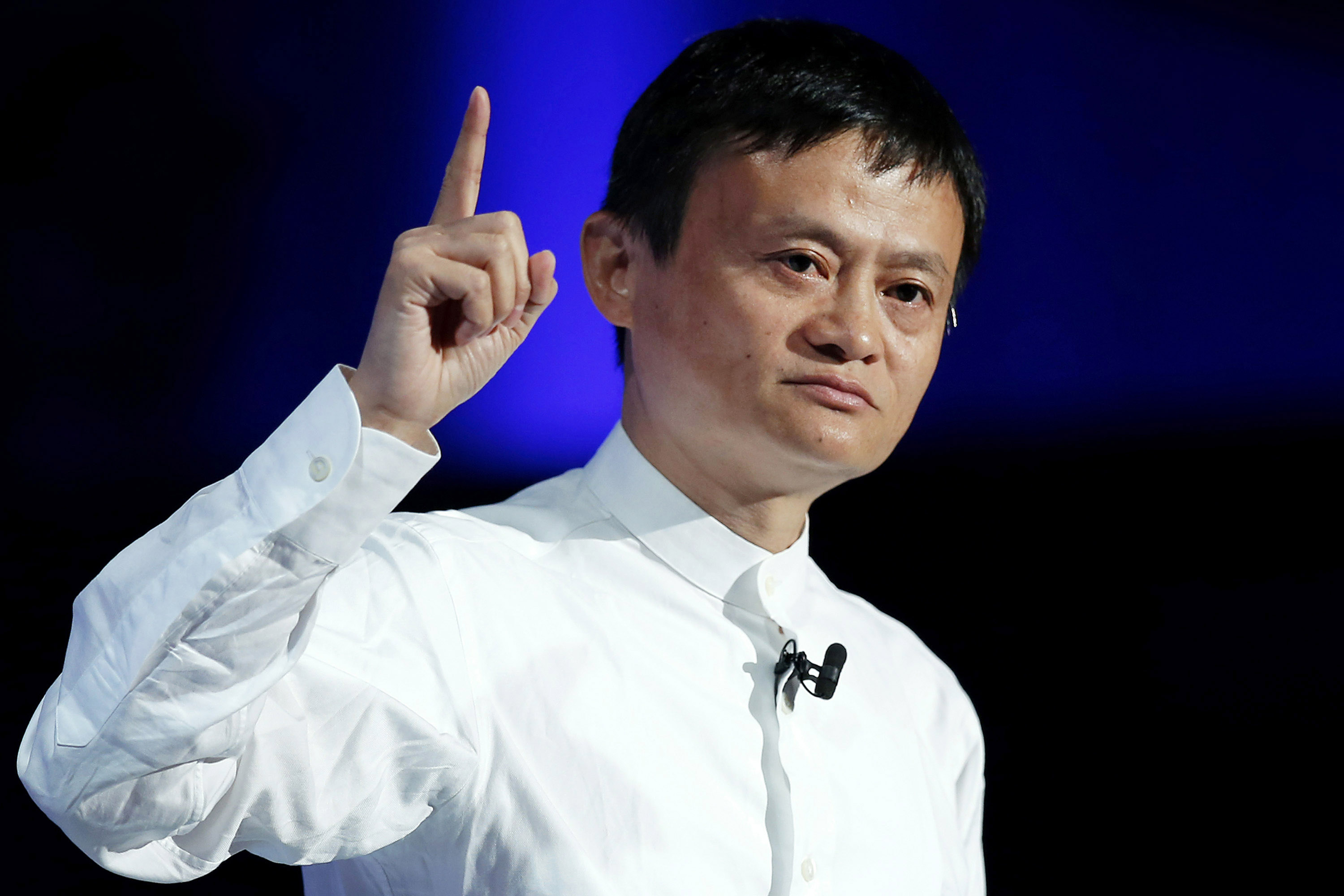

Will Jack Ma leave Ant Group?

Alibaba's fintech arm, Ant Group, is exploring options for the possible exit of founder Jack Ma, according to Reuters. But the Chinese giant denies it

Ma-exit in sight for the Chinese Ant Group?

Ant Group – the fintech arm of e-commerce giant Alibaba – is exploring options for the exit of founder Jack Ma, according to Reuters news agency.

Options are being explored to sell its stake in the financial technology giant and give up control. Meetings with Chinese regulators have signaled the company that the move could help ease pressure from the country's regulators, according to Reuters sources.

THE RELEASE OF JACK MA ACCORDING TO REUTERS

The company hoped that Jack Ma's stake, worth billions of dollars, could be sold to existing investors in Ant or its e-commerce subsidiary Alibaba Group Holding without involving any outside entities, one of the sources told Reuters .

But another source reported that during talks with Chinese regulators, regulators would not allow Ma to sell his stake to any entity or individual close to him. The Chinese billionaire should rather quit completely. Another option would be to transfer its stake to a state-affiliated Chinese investor, the source said.

THE CHINESE CLOSE ON THE EMPIRE OF MA

Since late last year, the Beijing government has squeezed Ma's Internet empire. As part of an effort to indelibly imprint its authority on the country's tech industry.

JACK BUT DISAPPEARED FROM THE RADARS

After the blows inflicted on Jack Ma's empire, the tycoon has severely thinned out his public appearances in recent months – the most recent in January – following heavy criticism of Beijing's financial authorities in a speech in Shanghai in October. 2020.

THE FINE RECORD IN ALIBABA

In mid-April, the Chinese authorities fined the e-commerce giant Alibaba with a maxi-fine of 18.2 billion yuan (equal to 2.78 billion dollars) for abuse of dominant position.

This is the highest fine ever imposed by the Chinese antitrust.

THE “MANDATORY” RENOVATION FOR ANT GROUP

In addition to the maxi-fine to Alibaba, the Chinese Central Bank (PBOC) has ordered that Ant Group, Alibaba's fintech arm, become a financial holding.

The restructuring provides for the separation of activities related to online payments and the possible sharing of their data with competitors.

THE CONSEQUENCES

Ant will effectively be supervised more like a bank, a move with far-reaching implications for its growth.

The new regulation requires fintech platforms to own 30% of all loans they grant in partnership with banks.

Brokerage Jefferies estimated in a report last week that Ant will need 13.4 billion to 20.1 billion yuan ($ 2 billion to $ 3 billion) of capital to meet the minimum capital adequacy ratio for companies. consumer credit. According to Jefferies' estimates, one-third or half of Ant's 1.7 trillion consumer loans are in the co-loan model. It will be difficult for Ant to inject more capital into its consumer credit company of which it only owns 50%, brokerage firm Macquarie said.

According to Bloomberg Intelligence senior analyst Francis Chan, Ant's valuation could drop below 700 billion yuan ($ 107 billion) from 2.1 trillion yuan in the previous attempt to go public in November 2020.

WHAT WILL HAPPEN TO ALIPAY

Finally, Ant Group will cut “improper” ties with Alipay, Alibaba's payment app, and other digital payment operators, such as Jiebei or Huabei.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/jack-ma-uscira-da-ant-group/ on Mon, 19 Apr 2021 12:38:29 +0000.