Will the era of the super dollar really end?

The strength of the dollar allows the US government and the Fed to take robust fiscal and political measures without unduly affecting the value of the currency. Facts and analyzes by Roberto Rossignoli, Moneyfarm Portfolio Manager

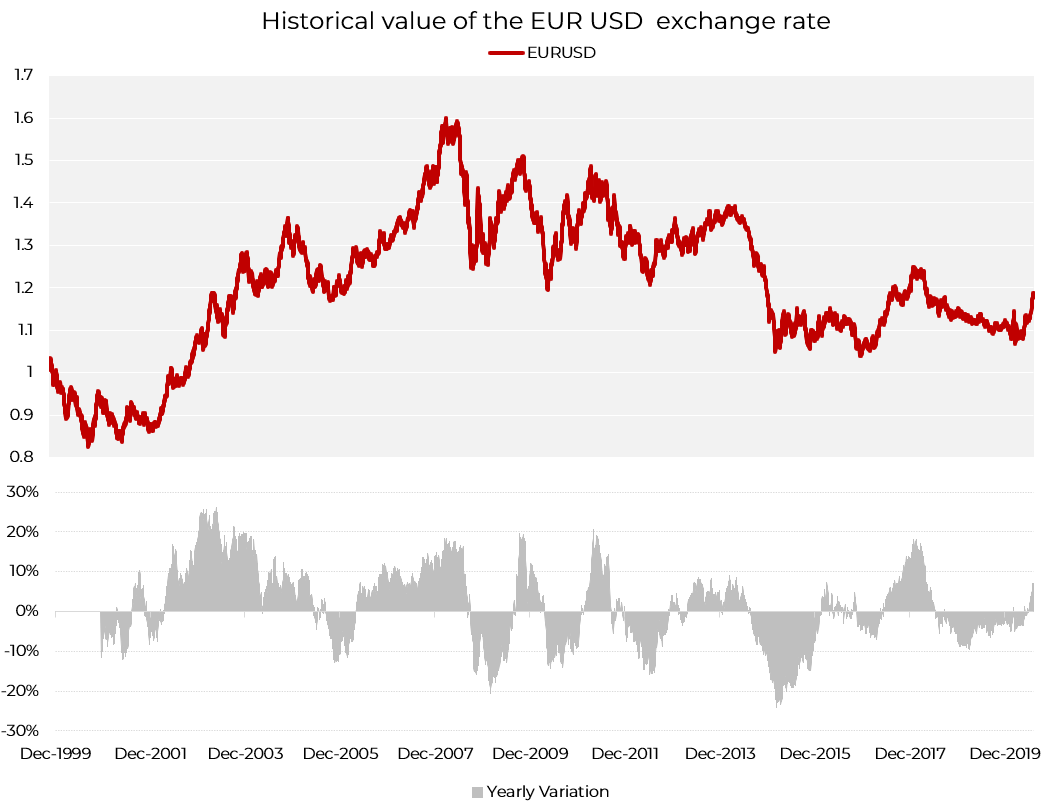

The dollar index, which tracks the dollar's performance against the top 10 other major currencies, fell 10% from its peak in March. Given the mammoth size of the American financial market, and the enormous weight of US stocks and bonds in global indices, when the dollar moves it is essential for investors to analyze the causes and consequences of the trend.

Those with dollar investments may see some of their value decline and a change in the currency ratio could have direct or indirect consequences on a large number of asset classes.

A RESERVE CURRENCY

The dollar is the world's reserve currency and as such also the most traded currency on the markets. Oil is priced in dollars (although the recent volatility of the dollar oil market has favored the rise of the yuan market) and many countries around the world either accept the dollar as their currency or have linked their currency to the dollar. The value of the dollar is certainly influenced by the same factors that affect other currencies: level of trade, quantity of currency in circulation, extension of the monetary base.

All of these factors are ultimately attributable to the global confidence of US hegemony, which make the greenback the currency considered the safest to retain value, both by individuals and by institutions such as central banks. The strength of the dollar allows the US government and the Fed to take extremely significant political and fiscal measures without unduly affecting the value of the currency. However, there are limits.

REASONS FOR CORRECTION

The retracement of the US currency is in some way linked to the US economy, burdened more than other geographies by the expansion of the pandemic, but above all to the monetary policy moves announced by the central bank. The Federal Reserve met the Federal Open Market Committee (FOMC) last week, leaving rates unchanged at a level close to zero. Powell has left no doubt that the Fed will continue to expand the monetary base if this is necessary to resolve the crisis caused by the pandemic.

From a fiscal standpoint, Congress is discussing a new stimulus package that is likely to be $ 1.5 trillion in size. When rates are cut and the monetary base (the amount of money in circulation) is increased so much relative to that of other currencies, it is evident that both the dollar demands and the relative value of the currency are bound to fall.

Furthermore, the Fed's message, although reassuring, had the effect of signaling that the US economy is far from resolving the crisis. In some ways, this has created distrust of Treasuries and the dollar. The granite perception that investors had of the greenback has cracked a bit.

CONSEQUENCES OF A WEAK DOLLAR

The implications are quite broad. Emerging market currencies tend to increase in value with a weaker dollar (taper tantrum 2013). However, this time around, the dollar appears to have weakened mostly at the expense of other strong currencies such as the euro, yen and Swiss franc. It should be remembered that many emerging countries are struggling with very hard recessive dynamics due to the pandemic and it is not obvious that in the medium term they will be able to take advantage of the weak dollar.

WHERE WILL THE DOLLAR PRICE GO?

The direction is difficult to predict, much will depend on how the pandemic spreads in the United States and the resilience of American politics. When we consider the factors that determine the value of the dollar we realize that they are to some extent affected by a set of events. It must be remembered that:

The US economy has shown a lot of resilience and is likely to be heading for a faster recovery in 2021; this trend – if it occurs – would gradually compensate for the weakening of the greenback in the medium term.

The Fed does not act in isolation. Although monetary – and fiscal – expansion was clearly more pronounced than in other geographies, history teaches us that the world's major central banks tend to bridge the policy gap with the Federal Reserve over time.

That said, and also considering the starting point that sees a dollar in any case at an all-time high, in the coming months we could probably see a gradual repositioning of the dollar against the euro and a partial return of volatility from a currency point of view.

What we are witnessing therefore seems to be a normal dynamic due to contingent factors. The dollar remains the reserve currency, because there is no alternative and we do not see a significant positioning of the greenback against the euro at the gates. However, it must be remembered that the dollar has historically been highly valued in recent years and that a repositioning towards a more favorable exchange rate to the euro would not be unnatural and could in a certain sense also be hoped for by the US administration which, in the past, has expressly he said he was in favor of a devaluation of the dollar to favor the competitiveness of his companies and rebalance the trade balance.

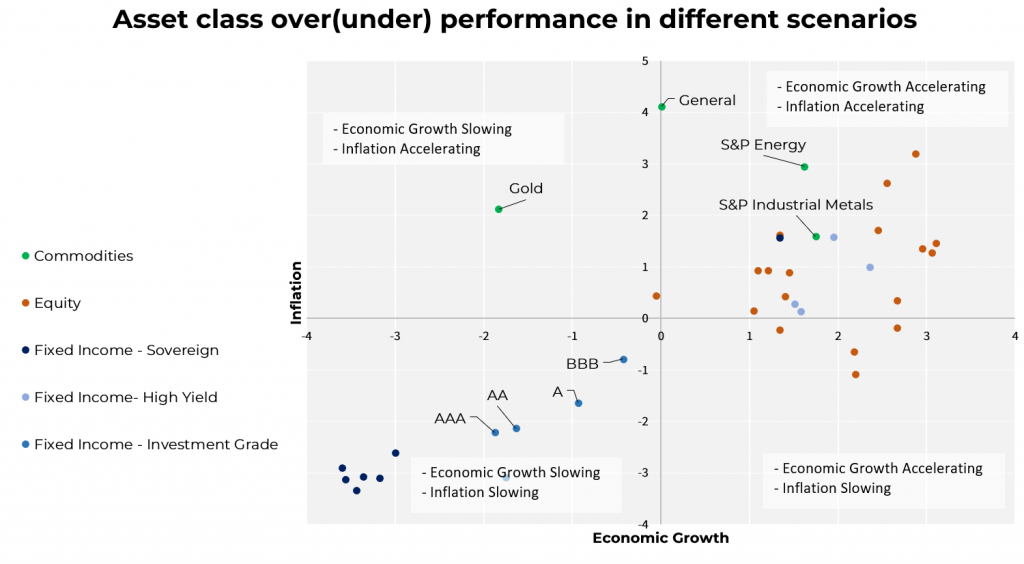

GOLD: GROWTH AND INFLATION THE KEY FACTORS

Each asset class is ranked based on its over (under) performance across regimes. On the X axis the difference between periods of growth and periods of GDP slowdown, on the Y axis the average in yield between periods of more or less strong inflation. As for gold, the average yield is higher in periods of slowing economic growth and in periods of accelerating inflation, peculiar characteristics of the current phase. Other matters behave differently but are positively related to inflation.

THE PROFIT SEASON: WHERE IS THE RECOVERY

Now that Q2 earnings have been widely released, we can get an idea of how companies in Europe and the US performed in a very difficult quarter. Combining data from the business world with the macro updates that come to us regularly gives us a good idea of where we are positioned right now.

The short answer is that companies have generally reported better-than-expected results in the second quarter, but that macro data suggests that the recovery is not gaining the momentum we would like.

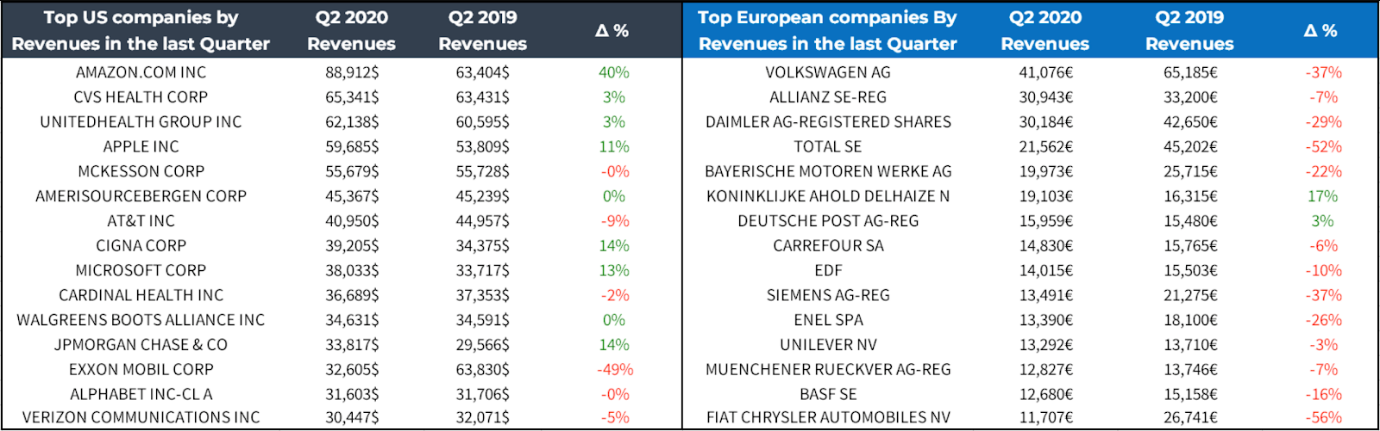

First, good news on earnings: the table below summarizes Q2 earnings for most of the companies listed on the S&P 500 (453 out of 498). In the face of a drop in both sales -11.6% and profits – 9.4%, the "surprise" (ie how much better / worse these companies did compared to consensus expectations) was positive by 1, 3% and 21.8% in terms of earnings, extremely robust data also considered with respect to history.

These are solid results, particularly in this macro environment. The better than expected earnings performance, in our view, reflects the ability of companies to manage their costs, at least in the short term. Even in Europe, the surprise on earnings (+ 31%) is very positive, even if the absolute decline in earnings on an annual basis (-28.5%) is much greater than in the US.

This difference is mainly due to the difference in the sector split of US equities compared to the European one, as shown in the following table which shows the performance of the main American and European companies by turnover.

These data indicate a difficult environment. Earnings releases tell a story of good business performance in a challenging environment. The macro environment still looks challenging, while valuations – for both US bonds and equities – are high relative to their historical standards. Our long-term return forecasts still suggest that equities will perform better than other asset classes, with near-zero bond yields in most developed markets, although those yields are likely to be lower than in the past. Within the equity space, an important question is to what extent US equities can continue to outperform the rest of the world as they have done in recent years. Betting against large-cap US stocks has been a steady underdog, and Q2 results explain why. The combination of a favorable sector composition, stronger growth and higher profitability largely offset the higher initial valuation. This mix is hard to beat. And in a slow recovery world, the winners are likely to continue to win, unless politics intervenes.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/forza-dollaro/ on Sun, 23 Aug 2020 05:52:48 +0000.