Will the US economy continue to surprise?

Surprising data on US growth. In the second quarter, the US economy grew by 2.4% annualized, well beyond the 1.8% expected. In the United States, fears of a recession in 2023 have significantly diminished. The analysis of Richard Flax, Chief Investment Officer of Moneyfarm

Recession , inflation and fears related to the banking crisis seem to have been set aside for the moment: driven by the rally in stocks linked to the trend of artificial intelligence, risky assets surprised most investors positively in the last quarter, with the S&P 500 which is up nearly 18% year-to-date. The risks certainly remain and there are many signs of an economic slowdown. However, consumption and the labor market, especially in the US, remain extraordinarily strong and inflation, which is still the main source of concern, continues to fall, albeit not as fast as hoped. Rate hikes and the hawkish tone of central bankers have not affected the performance of stocks, which do not seem to be affected much by monetary policy moves. On the other hand, the risks on the credit and liquidity front remain strong, while the innovations related to artificial intelligence, ChatGpt above all, seem to hearten investors with new investment opportunities. On the portfolio front, the last quarter was excellent, even if caution and quality remain the watchwords in a market context that is not yet completely serene.

The fight against inflation

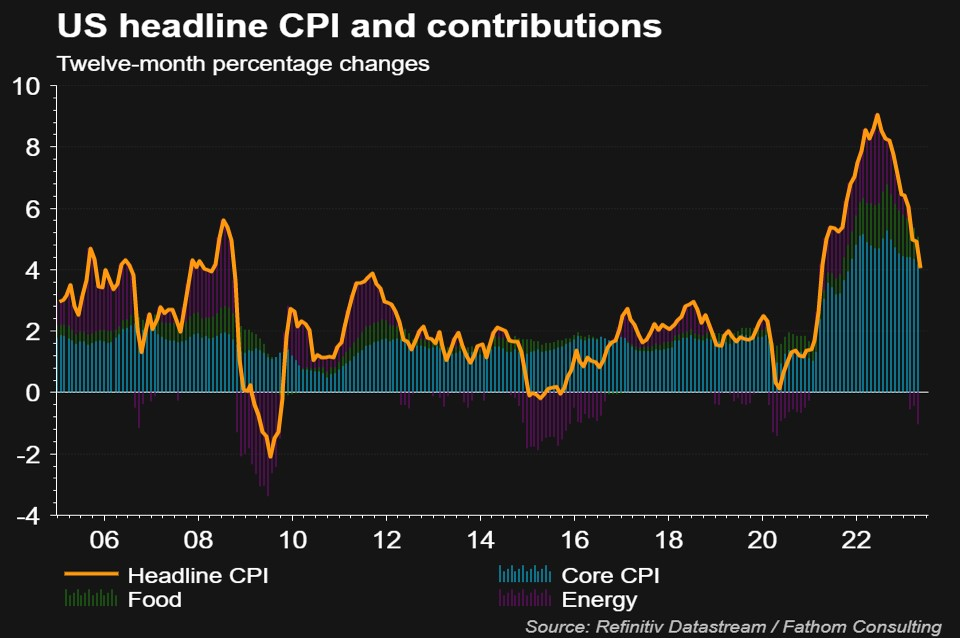

In the United States, price dynamics gave strong signs of normalisation. In June, headline inflation fell to 3% from 4% in May, the lowest level since 2021. The core index, which excludes food and energy from the basket, slowed to 4.8% annually compared to to 5.3% in the previous month, and also in this case it is the lowest value since October 2021. Although absolute values remain high, especially for the core component, and far from the Federal Reserve's 2% target , there are two reasons to look at the coming months with greater optimism:

- The component linked to housing services, the main driver of overall inflation, has given the first signs of normalisation. There are good reasons to expect further significant downward adjustments

- The more stringent inflation measures, which consider only the most resilient components, have shown signs of slowing down, fading fears that the price race is linked to more persistent factors. The PCE supercore index, which measures the performance of services excluding expenses related to housing, fell to 4.1% on an annual basis against 4.7% in May.

In short, US inflation is less scary, even if it remains high. However, after the break in June, in July the Fed raised rates by 25 basis points, bringing them in the 5.25-5.50% range, to a 22-year high. However, the door remains open to all solutions: Governor Jerome Powell has not in fact ruled out further tightening between now and the end of the year, showing himself to be flexible in evaluating incoming data, especially those on inflation and the labor market.

Inflation continues to fall in Europe too, albeit slightly behind the United States. In July, the ECB raised rates for the ninth consecutive time, with an increase of 25 basis points which took the reference rate to 4.25% and that on deposits to 3.75%, the highest level ever recorded in introduction of the euro. Although the Eurozone economy is experiencing a more marked slowdown than the US one, a further upturn by the end of the year seems certain. While admitting that the sharp decline continues, the ECB believes that inflation – especially core inflation, which stood at 5.5% in June – will remain too high for too long.

The US economy continues to surprise

In the United States, fears of a recession coming in 2023 have significantly diminished. In the second quarter, the American economy grew by an annualized 2.4%, well over the expected 1.8% and the Fed itself, while forecasting a significant slowdown in growth starting from the end of the year, rules out the possibility witness a recession. The labor market is also showing surprising signs of stability, with 209,000 jobs created in June, while the unemployment rate remains at an all-time low (3.6%).

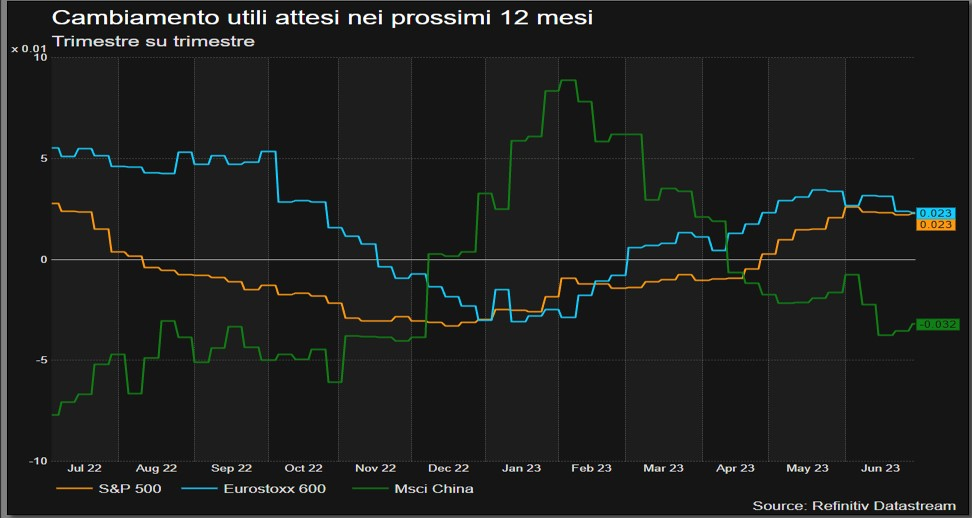

The picture for Europe and China is not as good. While aggregate PMIs (source: HCOB) for the Eurozone hold above 50 in June, signs of a slowdown are growing. After ending up in a technical recession between the end of 2022 and the beginning of 2023, with two quarters of negative growth, in the second quarter of this year Germany recorded a zero change in GDP, which translates into a contraction by 0.2% on an annual basis. As for China, the post-Covid reopenings have fallen short of expectations. Although the disappointing Chinese growth has had negative repercussions on the European economy, for the moment it has not significantly affected global growth expectations, led by the USA. However, geopolitical tensions with Beijing weigh on future prospects with the possible escalation of tensions over Taiwan.

In short, we find ourselves in an uncertain but less negative market context than expected, in which the economies continue to hold up. However, the unknown remains as to when the rate hike and the reduction of central bank balance sheets will make their effects fully felt. On the credit front, the markets appear to be underestimating the consequences of the March banking crisis on the economy. We believe that the credit crunch will have an impact on economic activity over the next 6-12 months. However, credit spreads aren't pricing in even a moderate impact. At this rate level, we believe it makes no sense to take on too much credit risk, as a result, we trimmed exposure to low quality credit in the latest rebalancing.

Looking ahead, the most likely scenario is one of an orderly slowdown, without a significant contraction for developed economies. Corporate earnings, which have so far proved stronger than expected, may be revised downwards as economies slow down. Inflation will continue to decline, but it may be difficult to return to the 2% target anytime soon. Against this backdrop, we expect rates to stay “higher for longer.” In our view, uncertainty remains high and the keyword is, more than ever, quality, especially in the bond sector. Indeed, if the economy were to start slowing more strongly, HY and Emerging Market debt would be the first to be hit. At the same time, on the equity side, despite the notable readjustment of 2022, we believe it is more important than ever to maintain the focus on diversification and pay attention to valuations.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/economia-stati-uniti-crescita-sorprendente/ on Sun, 06 Aug 2023 05:47:31 +0000.