Will the US enter a recession?

Will a recession be needed to bring wage inflation under control in the US? The analysis by Steven Bell, Chief Economist EMEA of Columbia Threadneedle Investments

Before talking about the United States, it is worth highlighting the exceptionally positive news from Europe in recent times.

Last year, soaring natural gas prices led to high inflation, recession fears and power blackouts in Europe. However, an extraordinarily mild January and a strong response in terms of reduced demand and increased supply transformed the situation. Gas prices have plummeted . Coupled with much lower inflation, last week saw the biggest drop in German bund yields since unification over 30 years ago. Europe's problems are not over yet, but the prospects have definitely improved.

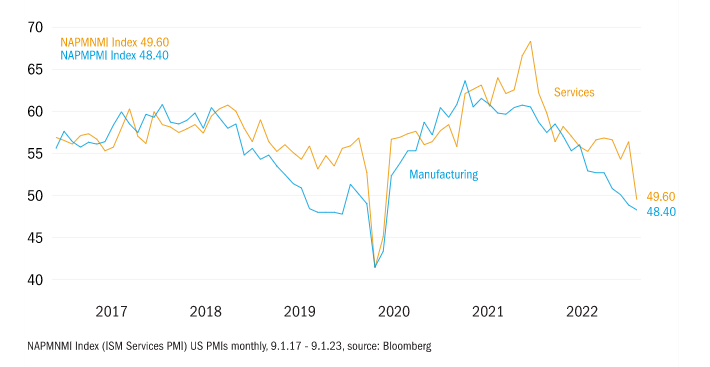

Turning to the US, Friday's jobs data showed another sharp increase in jobs and a drop in unemployment to its lowest level in modern times. Why are we talking about a recession? The reason is the Purchasing Managers index of services. Indeed, the latter collapsed from a healthy 56.5 to 49.6, below the threshold of 50 which signals a contraction. We've been waiting for this index to fall that low because it has a heavy weight on the real estate sector, which is clearly in a recession.

US Purchasing Managers Indices enter recession territory

Of course, one figure doesn't prove anything, but we think the general trend is changing. One of the main boosters to the US economy over the past year has been consumer spending, which has remained strong despite the squeeze on real incomes. Families have drawn on the huge fiscal support – the “covid piggy banks” – provided during the pandemic to defray expenses. Their confidence has been boosted by the low level of unemployment and, in recent months, also by the decline in petrol prices. But piggy banks are starting to run out and inflation has eroded the real value of existing savings.

WHAT WILL THE FED DO ABOUT INFLATION?

Even if the economy slows, as we expect, and labor demand weakens, there is still a long way to go before the Federal Reserve feels confident that inflation is under control. This week should see a further decline in both headline and core inflation as measured by the consumer price index.

The problem is that wage inflation is still too high. Don't be fooled by the decline in average hourly earnings data released last week, because they are biased by compounding effects. The average increase decreased because more low-paid workers were employed. The Atlanta wage tracker's reading is much better, showing that wage inflation remains too high to be consistent with the Fed's 2% inflation target.

Even more concerning for the US central bank is the fact that wage increases for job changers are accelerating, forcing companies to raise the wages of their existing workforce to avoid losing it to competitors.

The Fed's preferred measure of wage inflation is the labor cost index. It is only published quarterly, but at the end of January. This will be more important than this week's CPI numbers.

THE CONSEQUENCES ON THE MARKETS

What does all this mean for the markets? First, weak economic data took the pressure off bond markets and led to a rally in equities. But if, as we expect, we need a recession to bring wage and price inflation under control, equities will struggle as margins come under pressure. Second, the improvement in inflation is welcome, but the Fed won't feel reassured until it sees a sustained drop in wage increases. And to achieve this, unemployment must rise well beyond the current level of 3.5%.

THE FORECASTS ON THE FED'S LINE

There is much talk of a Federal Reserve turnaround and the markets expect only a further modest hike in the Fed Funds rate with cuts later this year. Instead, we expect the Fed to raise rates more than the markets expect and to keep them at this level for an extended period. A pause, not a breakthrough.

This week we hear from Jerome Powell, the Fed chairman, at a major conference in Sweden. I think Powell will counter market optimism about US interest rates, which will be bad news for bonds and stocks.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/stati-uniti-recessione/ on Sun, 15 Jan 2023 06:22:25 +0000.