Will there be stagflation in Europe?

Facts, numbers and scenarios on the European economy. The analysis of Davide Petrella, Portfolio Manager of Moneyfarm

Among financial market operators there has been a return to talk of "stagflation", i.e. the combination of high inflation and low levels of real growth. In the current phase of the economic cycle, in fact, inflation has forcefully returned to the scene, thanks to the shocks to the supply, production and distribution chains caused first by the pandemic and then by the Russian invasion of Ukraine.

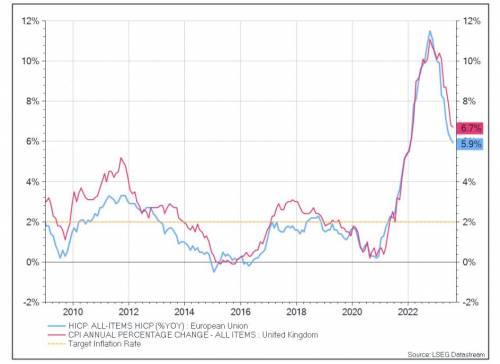

The result is that the Consumer Price Index (CPI) is now at levels well above the historical level of the last period both in the Eurozone and in the United Kingdom, while the 2% target which represents the objective of the Central Banks is still away (Figure 1).

The response of the ECB and BoE to the inflation shock was not long in coming and resulted in the most sudden rate hike in recent history, which contributed to cooling inflation in recent months, without however solving the root problem.

It should be clarified that the general increase in prices on the European continent is fundamentally the result of two causes:

Monetary inflation, i.e. the inflation resulting from the high liquidity that central banks have injected into the system to deal with the pandemic;

Supply-driven inflation, i.e. the inflation resulting from the surge in production costs that caused the energy shock due to the crisis in Ukraine and which was passed on to final consumers.

Although both these dynamics contribute to the increase in inflation, the second tends to escape the control of central bankers and risks having a negative impact on growth, already compromised by the increase in rates which in turn has led to an increase in the cost of money , complicating access to credit for businesses and consumers. If, on the one hand, the tightening of monetary policy has certainly contributed to the cooling of the inflation trend, it must be considered that inflation is made up of different components which can react differently to rate increases. The metric held in greatest consideration by central banks, to have a measure of inflation that is as close to reality as possible, is the so-called Core inflation, which is measured on the basis of the same basket with which the Headline CPIs are calculated (Figure 1 ), from which the more volatile component linked to energy and food is subtracted. This is an indicator characterized by a higher stickiness than the Headline index, which only recently began to show timid signs of slowing down.

In the last meeting in September , the ECB gave more or less encouraging signals that the peak of monetary tightening had been reached, stating that, if maintained long enough, the current level of rates will be high enough to bring Eurozone inflation back below check. However, the game is still far from being won, also because the rise in the price of oil per barrel in recent weeks and the imminent start of the winter season put energy costs back at the center of the debate which, if If the winter around the corner turns out to be cold and high consumption could hinder the slowdown in inflation in the EU. Inflation in the Eurozone is estimated to be around 5.6% by the end of 2023, before normalizing significantly in 2024, when it is expected to reach 2.9%.

On the growth front, as mentioned above, the current economic context and the stressors affecting supply chains have contributed to a downward revision of growth estimates for the EU. The Summer 2023 Economic Forecast forecasts an annual nominal growth rate for Eurozone GDP of 0.8% in 2023 and 1.3% in 2024.

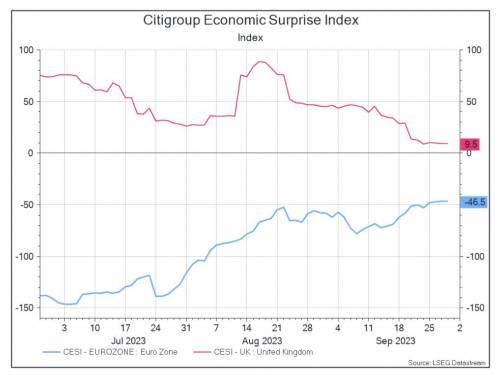

Therefore, the current macroeconomic picture shows still high inflation and growth, although positive, slowing down compared to previous estimates. Also increasing economists' pessimism is the fact that the surprise indicator linked to the publication of economic data continues to be strongly negative for the Eurozone and sharply decreasing for the United Kingdom (Figure 2). This is a very popular index among operators, which estimates how much the economic data regularly published differ from the values expected by analysts: if the value is positive, the economic data have on average exceeded expectations (and vice versa). The Eurozone, continuing to regularly report data below expectations, shows strong signs of weakness and the United Kingdom signs of deterioration.

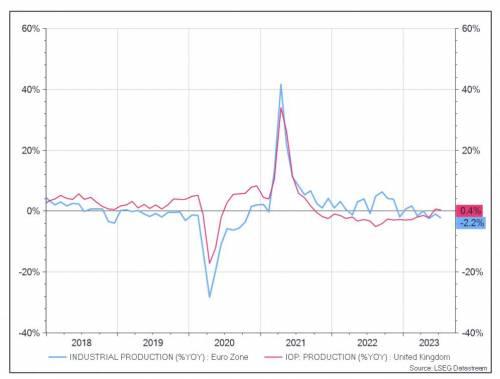

Another metric to take into consideration concerns industrial production: the growth rates compared to last year are currently equal to -2.2% for the EU and +0.4% for the UK, confirming the fact that past stresses have not yet been fully absorbed (Figure 3).

All these data help to explain why the word "stagflation" is back on the lips of experts. Inflation remains well above warning levels and the growing uncertainty in the energy sector could slow down its normalization. As regards growth, both the EU and the UK have had to revise their estimates downwards and the production context still presents various challenges that could further undermine the picture, causing high inflation and low (or even negative) growth to coexist within of the same scenario.

It is also essential to highlight that, although the EU and the UK find themselves facing a context that is similar in certain respects, the differences between the two cases are clear (just think that the Eurozone is made up of 20 different economies) and the specificities in question could lead to opposite developments. The task of analysts and managers remains to constantly monitor the evolution of the macroeconomic and geopolitical context, in order to optimize the risk/return profile of the portfolios.

We currently do not see stagflation as the most likely scenario. Our base case foresees a rather limited economic slowdown accompanied by a progressive normalization of inflation. Given the context of uncertainty in the markets, we believe that a conservative and well-diversified positioning can bring benefits to investors.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ci-sara-stagflazione-in-europa/ on Sun, 08 Oct 2023 06:17:08 +0000.