Will US inflation threaten consumption?

"US inflation rising, threatening for consumption: falling l / t rates and flattening curve". The analysis by Antonio Cesarano, Intermonte's chief global strategist

US inflation in May higher than expected, disappointing the market consensus which partially assumed the return of the May peak to around 5%.

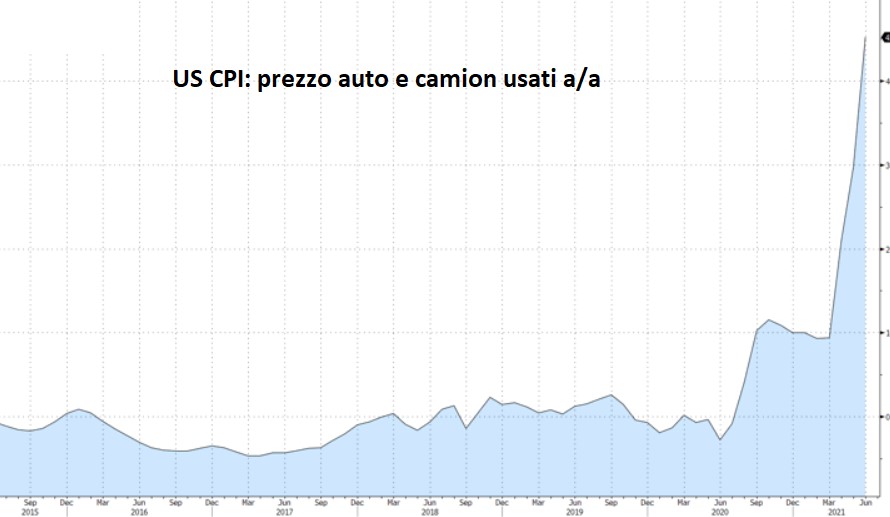

- The two components that had led to the strong increase in May (the price of cars and trucks used together with transport, especially air fares) continued to have a strong impact on the strong increase in inflation in June.

The novelty is represented above all by the more pronounced increase in rents which, with a few months of delay, are starting to feel the effects of the sharp increase in house prices in recent months.

Therefore, the causes of the sharp rise in consumer prices can be easily understood:

- the bottlenecks delay the deliveries of components, also delaying the production and delivery times of some goods (this explains the growing interest in the used car sector, in the absence of certain delivery times for new cars)

- the reopening effect (see, for example, the sharp increase in air fares)

- the pandemic effect has led to strong de-urbanization with a consequent marked increase in house prices

- We therefore understand the reasoning in the world of bonds at the basis of the curve movement and the directional trend of rates:

- interest rate hikes in the face of data such as today's focus only on the short-term sector, while on the long / very long-term part, paradoxically, everything translates into a gradual return to the downward trend with a flattening curve.

Basically:

- the short-term part looks at the possible tapering of the Fed (less purchases, for example, of securities having mortgages, the so-called MBS as underlying) and, in perspective, at a possible rate hike in 2022.

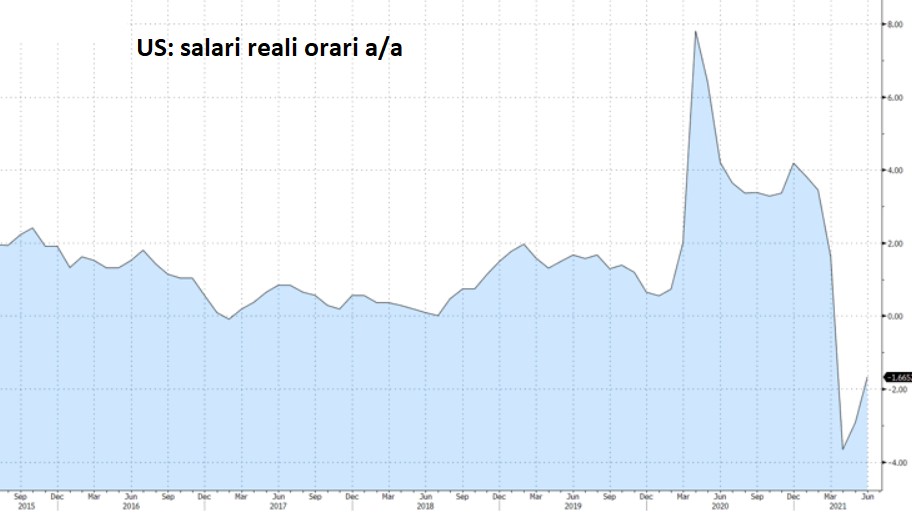

- The long-term part looks at the fact that, with persistent inflation and penalization of real wages, a slowdown in nominal consumption and, therefore, in GDP will also tend. As a result, long-term rates start falling again.

OPERATIONAL

- The divergence in monetary policy confirms the assumption of reaching 1.16 in terms of EUR / USD during the summer.

- In this direction also the possible fligth to quality (i.e. more USD purchases) in view of the worsening of the US / China frictions that have emerged in recent weeks, in view of the resumption of the confrontation on the Trump-era tariff theme.

- For the bond sector, the recovery of the primary trend of declining long-term rates with a flattening curve was confirmed for the half year, more markedly in the USA.

- For the equity market, the prospect of a reported slowdown in flattening sounds like some kind of reassurance that rates will begin to decline again on the long-term segment. Consequently, the climate is always positive on average but with two important differences compared to the first half:

- no longer double-digit performance

- higher volatility.

- In this case, the month of August could already provide a first taste of greater volatility, in view of the usual drop in liquidity, greater attention to risk during the summer holidays after substantial gains from the beginning of the year.

In this context, the possible greater diffusion of the variant at the moment sounds more like a macroeconomic risk rather than a health one in the Western world, characterized by a high vaccination rate.

- This is due to the possible macro transmission from the Asian world (almost not vaccinated at all and where, however, important supply lines from the Western world are still present) through delays in deliveries at increasing costs (see freight rates).

- Preparing production lines on site for part of the components that now arrive from Asia (especially the chips) will take a few years. In fact, if the process of fine-tuning the production of easy-to-work goods such as, for example, bezels is faster, the situation is completely different for other types of components with a higher technological content, starting precisely from the chips.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/inflazione-usa-consumi-minaccia/ on Wed, 14 Jul 2021 07:09:35 +0000.