Will we run out of copper for the energy transition?

The move away from fossil fuels has fueled the demand for "transition metals" such as copper, and demand is outstripping supply: new mines are needed. The analysis of Harry Ashman, Vice President, Responsible Investment of Columbia Threadneedle Investments

Reconciling the mining industry with a responsible investment approach can be extremely difficult due to the serious environmental and social impacts associated with this sector: its very business model is based on the extraction and use of the planet's finite resources. If poorly planned, projects can also run into land law problems, i.e. undermine sites of cultural or natural significance. It has been found that, if mismanaged, mining waste products can pollute local water resources or lead to disasters such as the collapse of the Brumadinho tailings dam in Brazil, which in 2019 caused the deaths of 270 people. In addition, the metal and mining industry contributes about 8% of global greenhouse gas emissions.

Nonetheless, the company is increasingly relying on industry products as it drives to accelerate the energy transition, which is already fueling demand for so-called “transition metals” such as copper, nickel, cobalt and lithium.

We examined the role of transition metals in the decarbonization process, assessing whether they can be considered a responsible investment. We focused on copper, as it is one of the most commonly used metals, for which we have more accurate data on demand growth and end use.

The energy transition favors the growth in the demand for copper

Mitigating the climate crisis and shifting to a low-carbon economy requires a massive expansion of low-emissions technologies, such as renewable energy and electric vehicles, resulting in increased demand for the metals needed for these technologies.

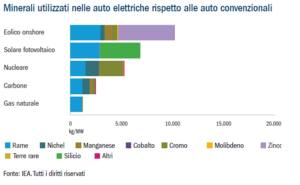

As illustrated below, solar PV, onshore wind and offshore wind require approximately 2.8, 2.9 and 8 tonnes of copper respectively per MW of new capacity, versus the 1.15 tonnes/MW needed for conventional generation of electricity from coal. Depending on the technology, other transition metals are also experiencing a sharp increase in demand.

For transportation, full battery electric vehicles require approximately 2.5 times more copper per vehicle than a conventional internal combustion engine. They also need new large-scale recharging networks, possibly powered by electricity from renewable sources.

Copper for "ecological uses" represents just 6% of current consumption, while the largest shares are attributable to construction (29%), "traditional" electricity networks (27%) and consumer products (22%). However, copper demand for electromobility and renewables is expected to account for almost 40% of total growth over the next 20 years; Wood Mackenzie estimates, in fact, that in 2040 the global demand for copper will exceed the current level by 50%. If the world opts for a more aggressive decarbonisation path to align with a 1.5°C scenario, these numbers will only increase.

Copper supply won't keep pace

New mining capacities are needed, but due to some of the socio-environmental factors mentioned above, public and political support for new projects needed to meet demand is declining, especially in developed markets.

It is also necessary to focus on the higher grade deposits, as the extraction of metals from the lower grade ones is more expensive, polluting and energy consuming. Estimates vary, but there is a consensus that underinvestment in supply, coupled with growing demand, will lead to a shortage of around 10% of annual copper demand by 2030.

Fortunately, copper can be recycled indefinitely without deteriorating its chemical or physical properties. With rising prices and technological improvements, we will likely see the recycling rate increase from the current 15-20%. This could go some way to offsetting the need for new mines and the problems that accompany them. Resource efficiency will also play an important role, as we have seen over the past decade when reducing the silver and silicon content in solar cells has enabled greater use of solar energy.

Overall, we expect green copper demand to nearly quadruple this decade to more than 17 percent of total demand. While not representing the majority share of overall demand, it is undeniable that the energy transition depends on the ability to meet this demand. We therefore believe that copper deserves to be classified as a transition metal.

Accurate due diligence is undoubtedly necessary to ensure that the issuers in which one invests are responsible operators and comply with virtuous standards of environmental and social management.

The trends observed for copper are amplified in the case of other transition metals with fewer alternative uses. Electric vehicles and storage batteries are already the largest consumers of lithium, and the IEA's sustainable development scenario predicts that by 2040, clean energy will account for 60-70% of nickel and cobalt demand. A concerted global effort to achieve net-zero emissions globally by 2050 would require six times more minerals in 2040 than today.

Unfortunately, the socio-environmental issues associated with some of these metals are much more relevant than for copper, making their inclusion in ESG portfolios more difficult to justify in the eyes of responsible investors. For example, currently half of lithium mining takes place in water-stressed areas, where mining, processing and consumption activities impact local communities and biodiversity.

The human rights, child labour, safety, pollution and conflict issues associated with cobalt mining in the Democratic Republic of the Congo, responsible for more than 60% of global supply, are well documented. For investors who are focused on mitigating ESG risk and have direct exposure to mining companies in the region, such as Glencore, these issues are a cause for concern, as are supply chain issues in the technology and ancillary industries. original ("original equipment manufacturers", OEM).

Is it possible to be a responsible mining company?

Despite the challenges facing all mining companies, the industry has steadily improved its practices, even if in some areas, corrective actions have been triggered by disasters or disputes.

For example, in the aftermath of the Brumadinho disaster, investors promoted the development of the Global Industry Standard on Tailings Management, while Rio Tinto's unfortunate decisions behind the destruction of aboriginal sacred sites at Juukan Gorge have prompted an overhaul of community engagement practices, governance and cultural awareness across the industry. The International Council on Mining and Metals has also contributed to the improvement of ESG standards; particularly noteworthy in this regard is the commitment of all members to achieve net-zero operating emissions by 2050.

This constant improvement in standards has allowed a limited number of mining companies specializing in the extraction of transition metals to be considered responsible operators, which we believe can be a useful long-term performance driver.

Identifying the most virtuous mining companies with the highest ESG standards and encouraging the less virtuous ones to improve is one way to ease the energy transition.

Responsible mining companies may be compatible with an ESG-focused approach

Decarbonizing the global economy inevitably requires significant quantities of copper and other transition metals.

It is necessary to balance the local socio-environmental impacts of mining operations with this need. Investors can support responsible mining companies in developing the new projects needed to smooth the transition, while ensuring that the managements of these companies are aware of the need for high standards at every stage of the project lifecycle. From maintaining free, prior and informed consent to responsible waste management practices and site rehabilitation safeguards, mining companies are required to comply with several ESG standards.

As governments, investors and businesses move from setting goals to implementing their climate change strategies, more such questions and trade-offs will arise, as we have observed in our reflections on the nexus between climate and nature.

It goes without saying that while the extractive industry can facilitate the transition, the sector must find ways to decarbonise itself given its crucial role in the global path towards carbon neutrality.

We must continue to be guided by data and science to make decisions in the long-term interest of society and the planet. As investors, the combination of research and stewardship activities is essential to ensure a responsible and balanced approach.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/domanda-offerta-rame-transizione-energetica/ on Sat, 19 Nov 2022 07:02:30 +0000.