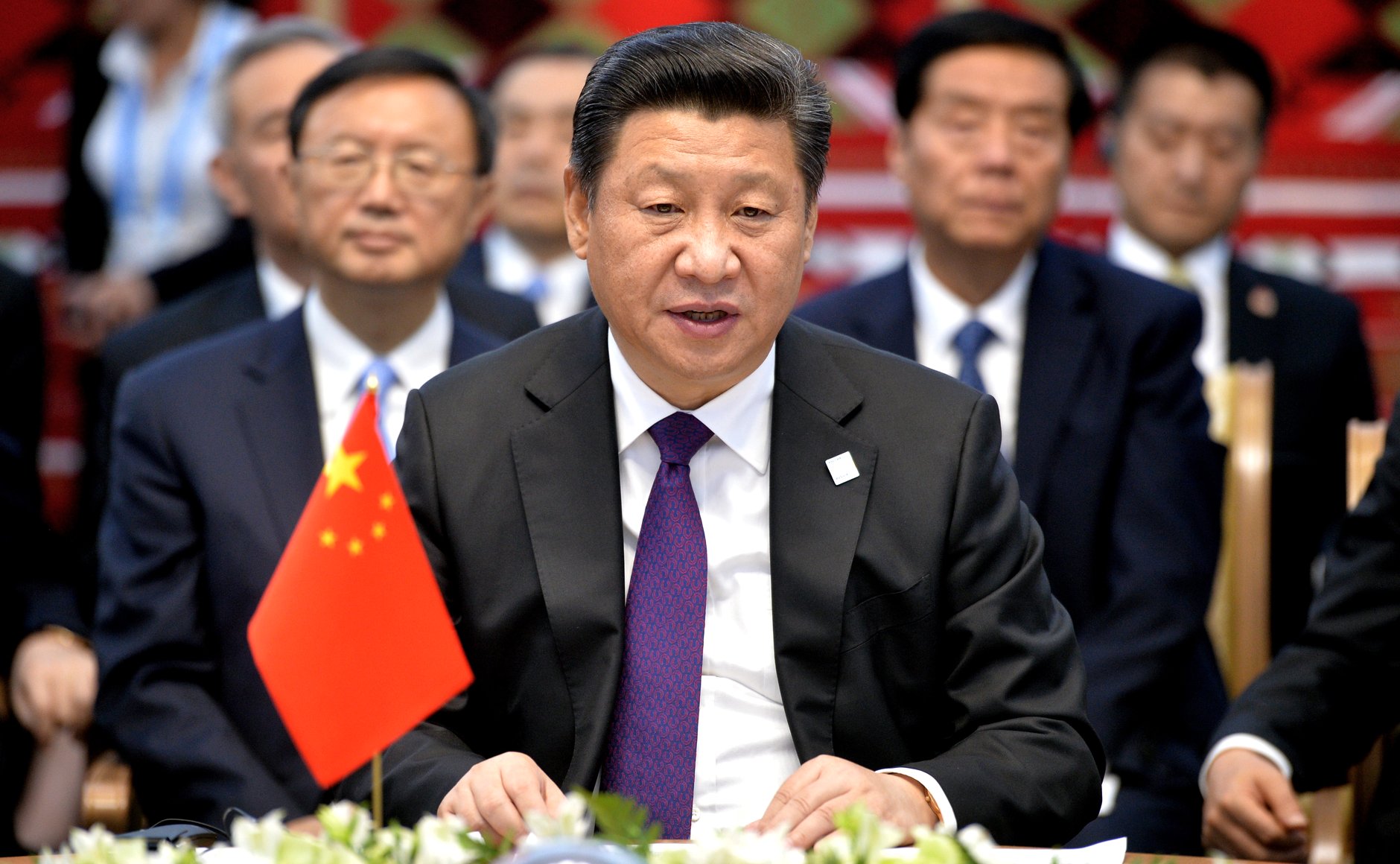

Will Xi Jinping be able to revive the Chinese economy?

China, if the battle against the virus slows the economy. The analysis by Giovanni Buffa, Senior Fund Manager of AcomeA SGR

After three very positive years for international stock exchanges, 2022 is proving to be a difficult year not only for emerging equity markets, but also for developed ones.

The reasons are common and mainly attributable to these causes:

- Extremely high inflation which is pushing central banks, in particular the Fed, to be very aggressive in their monetary policy, creating risks of a slowdown or even recession;

- The war in Ukraine with consequent rise in the prices of raw materials, in particular energy and food, which, in the wake of what happened in 2021, continues to generate inflation and marginalization problems for many companies;

- The slowdown in the Chinese economy induced by the domestic strategy to contain the pandemic (the so-called "zero covid strategy" or ZCS) which provides for very severe and long lockdowns, which are paralyzing the supply chains of many sectors and causing a collapse in consumption and internal demand;

- A very strong dollar which represents a fundamental variable for emerging markets and is negatively correlated to their performance.

The reaction of the stock exchanges should therefore not be surprising, with the MSCI EM Asia index in $ which recorded losses from the beginning of the year of almost 14% with peaks of 15% as regards the Chinese market. With rare exceptions (such as Chile) the emerging markets of other geographic areas were also not brilliant with the overall MSCI EM TR index in euro in the red by around 7%.

In the last decade, China has been the real growth engine of the global economy and its market represents 1/3 of the entire MSCI Em. In the last two years, however, local stock exchanges have been penalized compared to the rest of the markets. . The MSCI China in 2021 in fact lost 22.4% which, added to the losses of the current year, leads to a cumulative loss of almost 40% with a drawdown from the highs of February 2021 of almost 35%.

The reasons for the sell off are clear:

- Strict regulation of the technology sector;

- Squeezed on the real estate market which still represents a very important slice of the country's economy;

- Economic transition still far from the internal consumption targets set by the government;

- Tensions with the United States and Taiwan and a general distrust of investing in companies whose budgetary transparency and related geo-political risks are higher than ever.

To these factors must be added the recent anti-Covid measures, which are causing a very significant economic slowdown, in some ways comparable, albeit to a lesser extent, to what happened in Western countries during the first wave of Covid. The most affected city is Shanghai, where millions of people have been confined to their homes for several weeks, so much so that retail sales in April plummeted by 48%.

Many businesses are closed and to keep production in strategic sectors, workers are forced to live isolated in factories. However, managing a contagious variant such as the Omicron under the illusion of being able to reset the infections seems to be a losing battle, especially if we consider the immense population of the country (over 1400 million inhabitants).

These policies, combined with the costly population screening campaign, involve significant direct and indirect economic costs. Elections for the General Secretary of the Communist Party of China will be held in the autumn and the re-election of Xi Jinping for the third term now seems likely.

However, discontent about the management of the pandemic began to spread among some members of the Communist Party, the community of entrepreneurs and the population, which is quite rare in an autarchic country like China, so much so that the Politburo itself, the top decision-making body of the CCP, had to issue a statement in which he promises to crack down on any form of dissent on the Covid control policy in the country.

Xi is the figure behind which the ZCS was born, therefore a complete turnaround by the Chinese government on this issue appears highly unlikely, at least until the autumn elections. However, reaching the latter with the economy on its knees and with a high unemployment rate, especially among young people, certainly does not help his chances of re-election.

What we expect to happen in the coming weeks / months is therefore an easing of the restrictive policies of the LPN that can give some respite to the economy, in particular to consumption.

At the same time, the Chinese government is implementing a series of measures to support the economy of a monetary and fiscal nature that should bear fruit in the near future, even if the partial ineffectiveness of transmission channels to the real economy during lockdowns will greatly limit the benefits in the 'immediate. The turning point, in our opinion, could be represented by direct support for consumption, in the wake of what happened in Western countries during the pandemic. The measures implemented to date have, in fact, mainly concerned cuts in taxes and contributions and an increase in infrastructure spending, while very little has been done to support families and their consumption. If these measures were implemented and the scenario of zero growth in 2022 were averted, the market would react very positively.

Regardless of what might happen (no one owns the crystal ball), it is clear that the Beijing government is under enormous pressure trying to revive an anemic economy with almost daily announcements of new fiscal, regulatory and monetary measures. Nonetheless, the market remains skeptical about the measures implemented to date, pricing in a very negative scenario. Indeed, the MSCI China index treats expected earnings at just 11x and around 9x those estimated for 2023. Chinese internet stocks have gone from being considered growth stocks to value stocks; Suffice it to say that Alibaba has gone from trading its profits at 60x at the beginning of 2021 to the current 12x, with almost half of its market cap represented by cash on the balance sheet.

In this difficult context we have moved in a coherent way with our approach to contrarian value management, accumulating positions in particular on the Chinese market to exploit its weakness, bearing in mind that equity investments are made for the medium / long term and that in the short, unless there are drastic changes in outlook, volatility must be exploited to one's advantage if supported by fundamental values.

We believe Covid will be just a parenthesis for the Chinese economy, as it has been for developed economies, and that today's prices do not reflect the core values of many Chinese companies. Of course, volatility will remain high for some time yet and Covid is not the country's only problem: relations with the United States and geopolitical tensions in the Pacific, relations with Russia and Taiwan, regulatory uncertainty and demographics are issues that will need to be resolved and which justify a higher risk premium, but it should be emphasized that at current valuations many of these negativities seem to be already widely discounted in prices.

Currently approximately 36% of the AcomeA Emerging Countries fund is invested in China, while the exposures to South Korea, Taiwan, Brazil, South Africa, Greece and Australia have been maintained. The fund is an all cap which can therefore take positions on the so-called large-cap blue chip stocks, but also on small and mid-cap companies, which currently account for around 50% of the portfolio.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/xi-jinping-riuscira-a-rianimare-leconomia-cinese/ on Sun, 12 Jun 2022 05:55:40 +0000.