US real estate: current bubble dwarfs 2007-08

2022 has already seen a correction in US house prices, but it's still not enough. The real problem for house prices will come in 2023, when the stalemate between supply and demand will be felt much more.

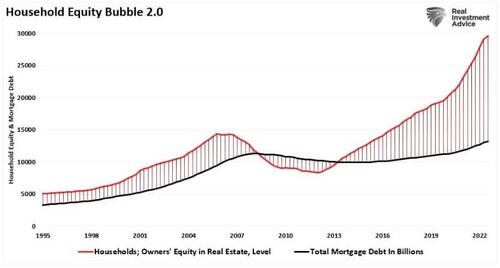

Two real estate bubbles have occurred since the turn of the century, with home prices reaching previously unaffordable levels in the United States. This was, of course, thanks to lax lending policies and artificially low interest rates that drove financially unstable individuals to buy homes they could not afford. This is easily seen in the chart below, which shows home equity versus mortgage debt. (Equity is the difference between the price of the house and the underlying debt).

The current surge in home prices dwarfs the previous bubble of 2008.

At its previous peak in 2007, home equity was about $15 trillion, while mortgage debt was $9 trillion. When the bubble burst, home prices plummeted, causing homeowners' equity to go from positive to negative. Home equity is around $30 trillion, while mortgage debt has risen to around $12 trillion. This is an incredible gap, never seen before.

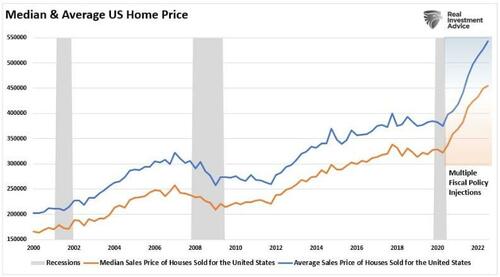

This time, however, the surge in house prices was not due to a surge in lax underwriting by mortgage companies, but rather the infusion of capital directly into households following the shutdown caused by the COVID-19 pandemic .

Naturally, many young Millennials have taken that money and jumped into the real estate investing frenzy. In many cases, buying sight unseen or paying much more than the first asking price, accentuating the bubble effect .

“More and more millennials are investing large sums of money in homes they've never set foot in. Although the sharp increase in sight buying in 2020 was certainly driven by the pandemic of restrictions, the phenomenon looks set to remain, thanks to the technological nature of millennials and the competitive nature of the real estate market.

Naturally, the rush to buy a house, and overpay for it, led to regrets. The number one reason for buyer's remorse: 30% of respondents said they overspent. The second most common regret was rushing into the home buying process, with 30% saying they made a hasty decision and 26% indicating they bought too quickly.

Unfortunately, demand will decline as the massive influx of money into the housing market thanks to government stimulus is reversed. Right now there are all the grounds, demographic and monetary in particular, to expect a sharp fall in real estate values which will have devastating effects, given its size.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article US real estate: the current bubble dwarfs that of 2007-08 comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/immobiliare-usa-la-bolla-attuale-fa-impallidire-quella-del-2007-08/ on Fri, 13 Jan 2023 18:20:04 +0000.