A tsunami of debt: the US must place 1 trillion of government bonds this quarter

The known ones come home to roost. As we already wrote a few days ago, the USA is supporting its growth only through an increase in its public deficit , with 1,000 billion more public spending in the last quarter:

This public spending boom cannot be financed by tax revenues alone, despite the fall in tax refunds this fiscal year. We need public debt, and not a little.

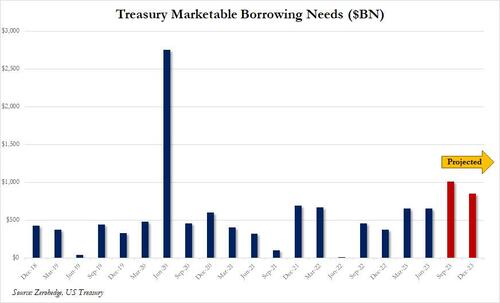

So in the current quarter the greatest value was reached in the sale of US government bonds, a good trillion of funds to be raised on the private market. This is the second-largest number in American history, second only to what happened in the third quarter

So what does the placement of this huge amount of debt mean? A pair of things:

- those who keep an eye on the Treasury's cash balance will need to expand their attention to broader dynamics of the debt market, including the amount of total debt being issued. Where will the money needed to pay off this enormous debt come from?

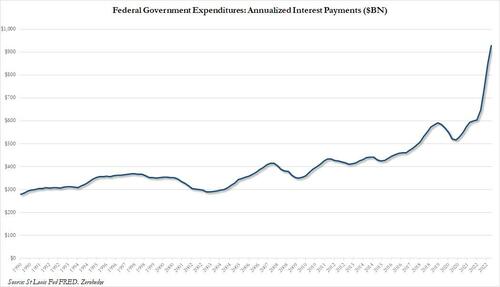

- Now that we know that the reason behind US economic stability is none other than the $1 trillion fiscal stimulus that is supporting Bidenomics, this debt-fueled artificial economic levitation is set to extend for at least two quarters. Of course, it will also mean that we hit the $1 trillion Treasury interest payment even faster than we expected, but that is the price to pay for sustaining a policy that is popular in the short term, but one that appears to have no way out. . And interest is growing at a very high speed

The impending debt deluge will kick off as early as this week when, for the first time since early 2021, the Treasury raises its quarterly repayment of long-term Treasury securities to $102 billion from $96 billion, the government suggests. consensus between operators and today's sources and The table of uses confirms. While below the record levels achieved during the Covid-19 crisis, it is well above pre-pandemic levels, but – again – this is the price to pay for “Bidenomics”.

Bloomberg writes that the need for public loans is increasing thanks in part to hikes in Federal Reserve rates which have brought its benchmark to 22-year highs and which have led to an increase in public debt.

Meanwhile, the QT continues – for now – as the Fed reduces its holdings of Treasuries, forcing the government to sell them to other buyers. All of this increases the risk of larger volatility swings when the government auctions its bonds.

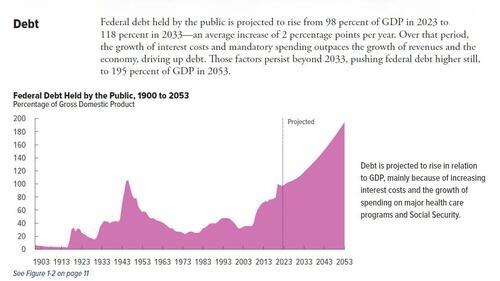

Meanwhile, the level of US government debt is taking off to levels never seen before, and the projections for the next few years are even more ominous:

At this point it is clear that the FED's high interest rate policy cannot be maintained for long, if not with the risk of a cut in non-financial spending, i.e. in investments and current spending by the federal government. Something that Biden cannot afford, unless he is already certain of defeat and therefore wants to burn resources for the next Trump government.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article A tsunami of debt: the US must place 1 trillion of government bonds this quarter comes from Scenari Economics .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/uno-tsunami-di-debito-gli-usa-devono-piazzare-1000-miliardi-di-titoli-di-stato-questo-trimestre/ on Tue, 01 Aug 2023 13:12:54 +0000.