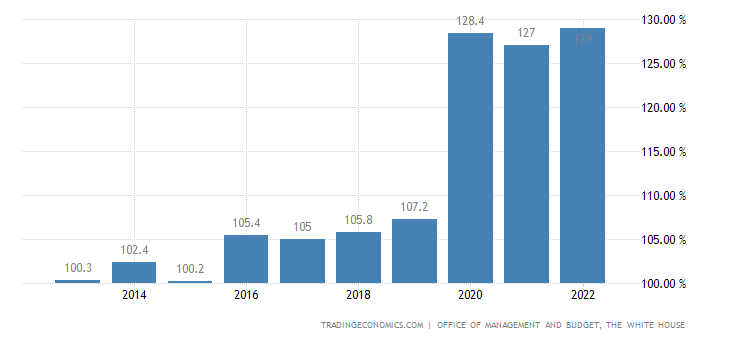

Fitch downgrades US debt which is currently close to 130% of GDP. Biden and Yellen will not celebrate

Today is going to be a bad day for the US Treasury secretary; Janet Yellen. Fitch Ratings downgraded the US long-term foreign currency issuer's default rating from AAA to AA+, citing factors such as "the expected fiscal deterioration over the next three years, the high and growing public debt burden and the erosion of governance” compared to other countries. And to think we only talked about it yesterday .

The rating agency underlined "repeated political deadlocks on the debt limit and last-minute resolutions" which have eroded market confidence in the country's fiscal management.

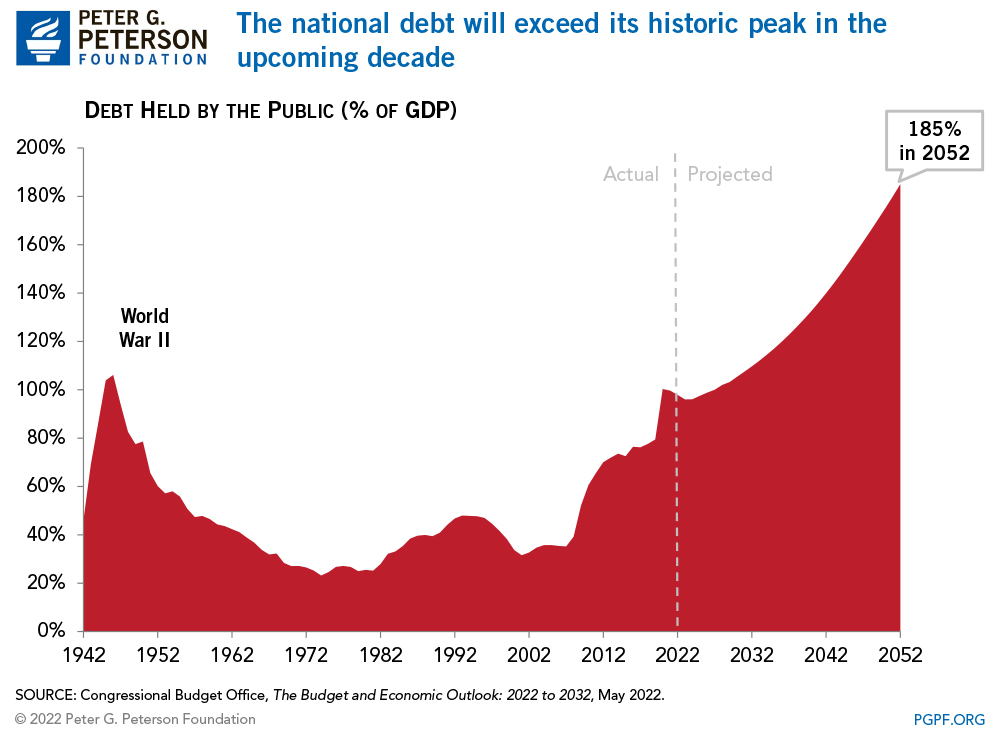

In May, at the height of the debt ceiling impasse, Fitch placed the US AAA rating on negative watch. The agency also highlighted the increase in the public deficit, which according to its forecasts will reach 6.3% of GDP in 2023 , as well as a combination of tighter credit conditions, weakening business investment and a slowdown in consumption that could lead to a mild recession. A decline in GDP would automatically lead to an increase in the debt-to-GDP ratio. Debt now appears effectively out of control

And the forecasts of the House of Representatives are also worrying

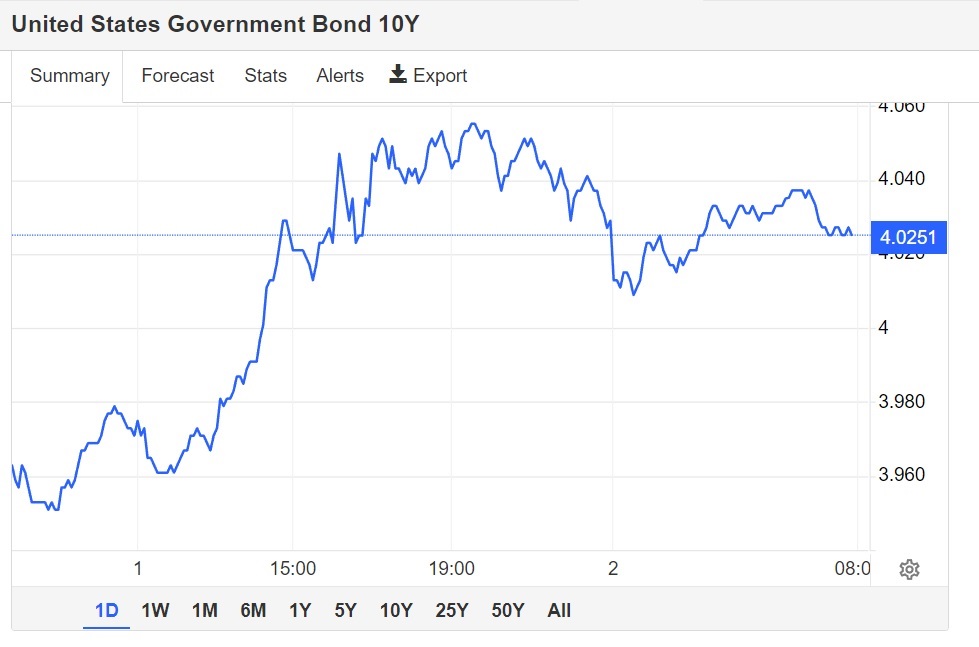

US authorities did not agree with Fitch's decision, described as "arbitrary and based on outdated data" by Treasury Secretary Janet Yellen. In general, the rating is used by sovereign wealth funds, pension funds and other investors to assess the creditworthiness of the United States, which has a major impact on the country's borrowing costs, and therefore there could be an effect on US bond yields which indeed, it can be seen, albeit on a smaller scale.

Krugman also spoke on the subject, and with some reason: in the end, what happened today that we didn't know yesterday or a month ago? Nothing, it was already known that Biden could not have applied a restrictive policy in the year before the elections!

OK, some more on that bizarre Fitch downgrade. The US has a long run fiscal problem, because we have effective blocking coalitions against both spending cuts and tax increases. But what would make that problem seem worse this year than a year ago? 1/ https://t.co/1ZC9YhlOLn

— Paul Krugman (@paulkrugman) August 1, 2023

There are two problems with US debt:

- a political one, because Bidenomics, the economy according to Biden, is based on low-growth public spending (as in the EU, after all);

- a cheap one; because the FED's rate hike sends interest payments on US debt skyrocketing.

The cure for the first point is to change president, for the second it is either to reverse the restrictive policy as a whole, or to "Japanise" the FED and forcefully apply interest rate controls on US debt, buying it on the market, exactly as says the BoJ on ten-year bonds. However, this would have strong repercussions on world finance, it would undermine the residual credibility of the dollar and the convenience of its possession and it would be a very evident policy change for the FED.

The government could also apply a "Supply side" policy, eliminating many of the constraints on growth for the private sector, but this is not consistent with the policy of the federal government Dem. We would need a new Raegan, at least in part, who would fight the inflation and would stimulate growth at the same time. For now, however, nothing like this is seen.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The Fitch article downgrades US debt which is currently close to 130% of GDP. Biden and Yellen won't celebrate comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/fitch-degrada-il-debito-usa-che-attualmente-sfiora-il-130-del-pil-biden-e-la-yellen-non-festeggeranno/ on Wed, 02 Aug 2023 06:18:12 +0000.