Bad US private employment data reduces US 10-year bond rates

Mors tua vita mea, and bad news for someone becomes excellent news for someone else.

Good news from employment

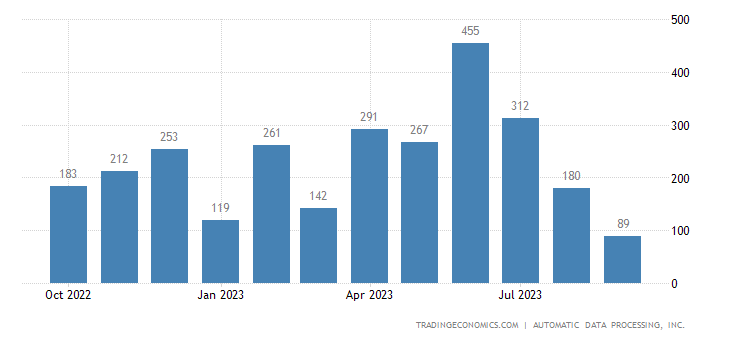

Private companies in the United States hired 89,000 workers in September 2023, the lowest number since January 2021, when private employers cut jobs, and well below market forecasts of 153,000.

This follows a revised gain of 180,000 jobs in August, up from 177,000 initially reported. The service sector added 81,000 jobs, particularly in hospitality and entertainment (92,000), financial activities (17,000), and education and health services (10,000).

The construction sector also added 16,000 jobs, while the natural resources and mining sector created 4,000 jobs. In contrast, losses occurred in professional services and business (-32,000), trade, transportation and utilities (-13,000), and manufacturing (-12,000). Large companies led this slowdown, losing 83,000 jobs and wiping out the gains made in August. On the other hand, small businesses added 95,000 jobs and medium-sized businesses 72,000. Here is the relevant graph:

Meanwhile, annual wage growth slowed to 5.9%, marking the 12th consecutive monthly decline. Wage gains for job changers also fell to 9%.

Recent news regarding employment in the United States has had a significant impact on financial market dynamics and Federal Reserve policies.

Employment, along with various other economic indicators, plays a key role in formulating Federal Reserve policies. When employment data show weakness, such as rising unemployment or modest job growth, the likelihood that the Federal Reserve will raise interest rates is reduced. This is because the Federal Reserve aims to promote economic stability and the highest level of employment, as well as keep inflation under control.

As a result, bad news about employment can be perceived as good news for financial markets, especially the securities market. If the FED is less likely to raise rates, then speculators will stop biting into US government bonds. This was seen yesterday with a decline in the 10-year yield after several continuous days of increases. The stock market also breathed.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Bad US private employment data reduces US 10-year bond rates comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cattivi-dati-sulloccupazione-privata-usa-riducono-i-tassi-sui-titoli-decennali-usa/ on Thu, 05 Oct 2023 06:00:14 +0000.