China: after Evergrande, what will happen to the Chinese super bubble, and to the world one?

Evergrande did not default: out of thin air, or rather from sales and, probably, from some indirect state aid, the money to pay interest on the dollar bonds came out. However, the problem is far from being solved. Evergrande cannot continue to sell off its assets to pay interest, and today (November 1st) developer Yango offered a swap of its securities in dollars, offering a cash reward to be able to defer them to a future maturity.

That China faces structural problems is well known, and the list is long. From a political point of view, there are only problems related to the consolidation of Xi Jinping on the Party and of the Party on the country, a process that appears increasingly uncertain, under a solid superficial aspect, put into play on the one hand by widespread disinterest, on the other. from corruption. But there are even deeper general problems that have already defeated the West: the demographic crisis, inequality, an environment increasingly compromised by the fact of being the "Factory of the world"

Two essential points that bind politics and economics in China are often not understood:

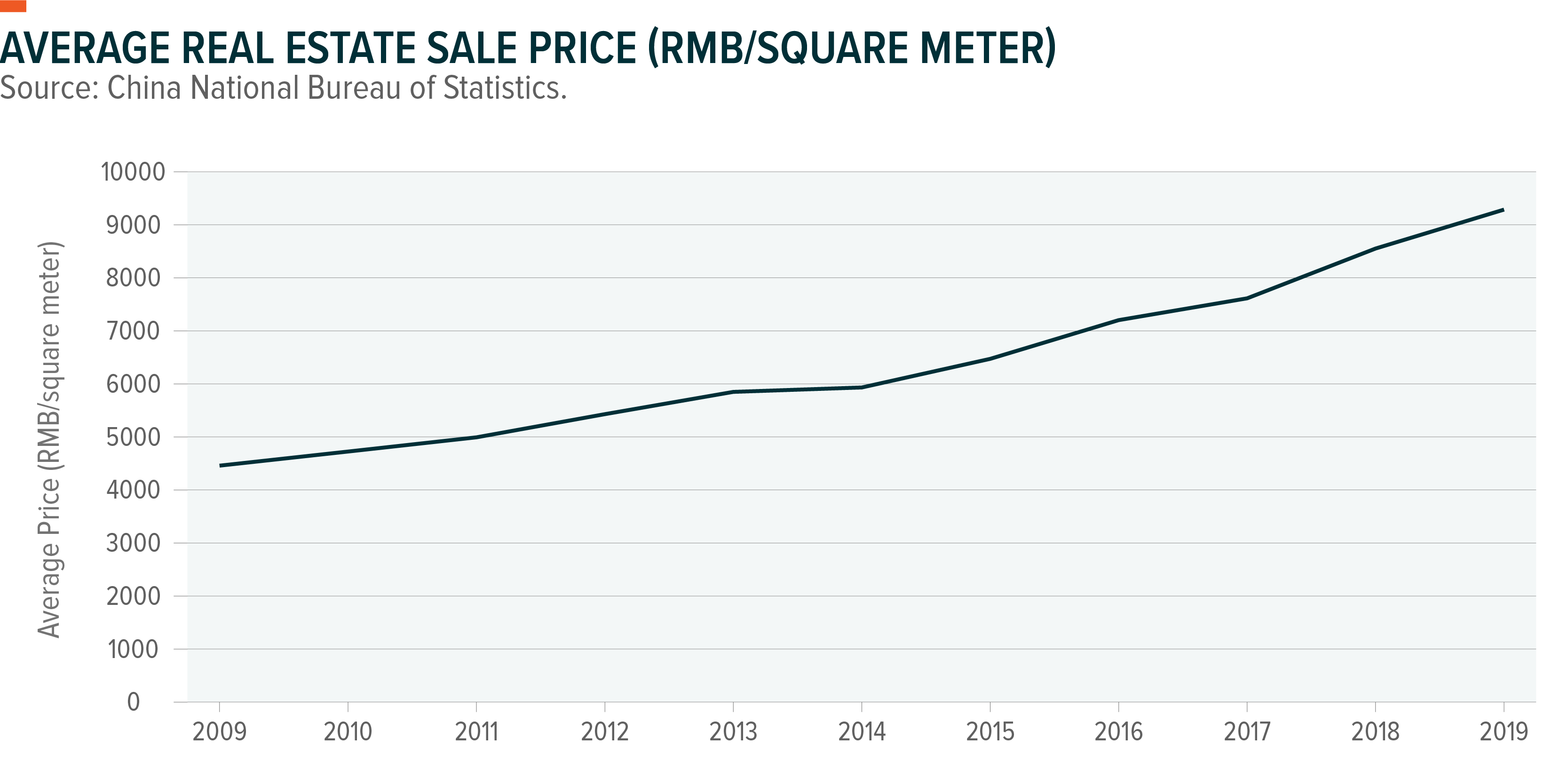

1) the existential threat to the CCP and the Chinese economy posed by its unprecedented real estate and investment bubble, increasingly based on widespread debt;

2) a serious and incipient energy crisis, without an easy and quick solution.

The presence of a Communist Party which, in order to avoid social upheavals, comes to cover the losses of almost any speculation is a very strong incentive for the so-called "Moral Hazard", that is, for the detachment between actions and consequences: even if entrepreneurs have the threat of very harsh sanctions, these do not fall on the investors, and even the former often manage to escape through ties with a not clear party. At the same time, the state has so far largely intervened in covering investment costs, both construction and industrial, because these expenses have in any case been considered as a “development cost” necessary to cancel the inefficiencies of growth.

The good-natured attitude of the CCP, however, has favored high-risk investments and high margins over industrial investment, perhaps dedicated to exports, which has much lower profit margins, but sure, average profit margins of Chinese exporting companies range from '1% to 3%.). So China's growth is strictly based on an increase in debt-related speculative investments, all concluded on the hope that eventually the state will pay the losses for all.

This institutionalization of moral hazard has spurred less productive and riskier gambling, not just for big conglomerates like EverGrande, but for middle-class households that have invested in shadow banking (unregulated private sector loan pools to risky borrowers at high interest rates) and bought the second, third and fourth "investment" apartments.

China, however, has particular contradictions that make all this even more dangerous than a Western country:

1) in China an apartment once rented loses value because it is “used”, which doesn't make much sense in Europe;

2) the vast majority of the market for "investment" apartments does not generate profits, because those who invest want a "New" apartment, which does not generate profits. “Used” apartments have a different market, much less profitable.

This massive investment in illiquid empty apartments has generated enormous, absurd, social distortions: there are areas where an apartment is 30 years of average salary, there are tons of apartments, but these are empty, and young people cannot marry by accentuating a demographic problem already present. In turn, this intervenes on the wealth gap between rich and poor, all however based on a tide of waste paper.

All this may not yet have been fully grasped by the Chinese rulers because at the base there is an extremely opaque shadow banking system, which does not send signs of crisis, except in extreme situations, when it is too late.

This distorted and speculative financial and investment system comes to bring a threat to the political supremacy of the CCP on two levels:

1) Every exploding bubble threatens the party government on the economy;

2) the explosion of bubbles, even in the shadow banking system, generates the search for scapegoats, many of whom can only be characters linked to the Party, as happened with Evergrande.

The CCP's implicit promises of bail out have in turn created a monster that is now in danger of swallowing everything and everyone.

Now the CCP is faced with two alternatives:

a) to burst the bubble, or allow it to burst, and let it deflate now, even at the cost of an extremely painful moment for Chinese politics and economy;

b) continue inflating the bubble, with the risk that it will then burst, overwhelming everything and everyone.

The story of Xi Jinping, his active role in the Party and in the new cultural revolution, points towards the first solution: the CCP will burst the bubble as soon as possible, hoping not to be overwhelmed and preparing for a period of transition. A gamble for China and the world:

- if Xi and the party have neglected the synergies between different economic sectors and the contemporary industrial and energy crisis from exports, in any case it could lead to the economic implosion that we would like to avoid;

- as Evergrande revealed, Chinese speculation has now spread globally, and the explosion of the eastern bubble could lead to an enormous destruction of world wealth, which in turn would have repercussions on China itself.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article China: after Evergrande, what will happen to the Chinese super bubble, and to the world one? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-dopo-evergrande-che-succedera-alla-superbolla-cinese-e-a-quella-mondiale/ on Mon, 01 Nov 2021 10:02:01 +0000.