China also wants to control the supply of uranium

China is making an aggressive push to constrain global uranium supplies amid a global scramble for nuclear fuel supplies, warned the head of Yellow Cake, a London-listed investment vehicle for the radioactive asset.

André Liebenberg, CEO of the Aim-listed company, reported by the FT , said that the West was late in securing uranium after prices hit 15-year highs and that Chinese companies they buy supplies on the open market, sign long-term contracts and buy the mines.

“Any mineral they need, they will try to grab,” he said. “Chinese efforts to secure supplies will certainly create competition for resources and, given that resource opportunities are limited, will challenge the ability of Western utilities to source supplies.”

Uranium was one of the best-performing commodities of the year, rising 70% to $81 per pound, the highest since 2007.

The meteoric rally has been supported by governments backing nuclear energy – a steady, low-carbon energy source – extending the lifespans of plants and considering building new reactors in the wake of soaring gas prices skyrocketed last year. There are currently 60 nuclear power plants under construction and 110 more are planned.

At the recent UN COP28 climate conference in Dubai, 22 world leaders declared a commitment to tripling global nuclear capacity by 2050 compared to 2020 levels, adding further positive sentiment to an already buzzing market.

The rising price of the commodity has lifted Yellow Cake , founded in 2018 to offer investors a way to gain exposure to the expected uranium bull run. Liebenberg said there is a “fair chance” the price will top $100 per pound next year.

After a decade of little investment in new production and years of supply shortages following the global decline in atomic energy after the 2011 Fukushima nuclear disaster, uranium prices have started to rise again.

Yellow Cake has entered into a 10-year supply agreement with Kazatomprom, the world's largest uranium producer, to purchase $100 million of ore from the Kazakh company each year, which Yellow Cake then stores in storage facilities in Canada and France. Currently, Yellow Cake holds the equivalent of nearly 20% of global annual supply.

Following the surge in uranium prices, Yellow Cake shares have risen 54% this year, taking its market capitalization to £1.3 billion. The company said last week that its net asset value rose from $1 billion in March to $1.8 billion in early December.

To cash in, the company would have to sell its uranium supplies at higher prices than it bought them at or be taken over by a utility that needs supplies.

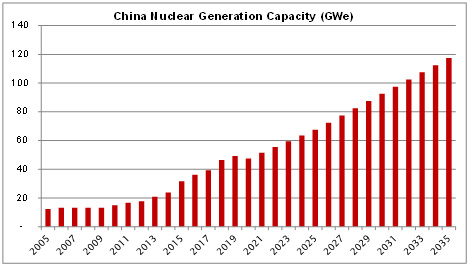

China, the world's second largest producer of nuclear energy, accounts for almost half of the reactors under construction globally, as well as having global ambitions to supply nuclear reactors, and therefore fuel.

“The Chinese are looking for new supplies,” Liebenberg said. “If they want to meet their nuclear plans by the end of the decade, they will need new kilos.”

Beijing has set itself the goal of self-sufficiency in nuclear fuel, producing a third of its uranium needs domestically, obtaining another third through investments in foreign mines and purchasing the rest on the market.

The China National Uranium Corporation and a subsidiary of CGN – China General Nuclear Power Group – have already acquired stakes in mines in Niger, Namibia and Kazakhstan, while CNUC is building a deposit in Xinjiang, near the border with Kazakhstan, which aims to become a major uranium trading center.Chinese intervention in Niger is particularly heavy, with the purchase of majority stakes in mines.

China's push to grab supplies adds to the problem the West faces in depending on Russia, which controls nearly 50% of global uranium enrichment capacity.

Liebenberg said that if Russia were to cut supplies of nuclear fuel to the West, utilities would face a disruption in the five years needed to build a supply chain independent of Moscow.

China, on the contrary, does not want to risk depending on anyone for its energy supplies, not even Russia.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article China also wants to control the supply of uranium comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-cina-vuole-controllare-anche-la-fornitura-di-uranio/ on Mon, 11 Dec 2023 20:13:44 +0000.