China cuts mandatory reserves. He gives water to the horse, but he doesn’t want to drink …

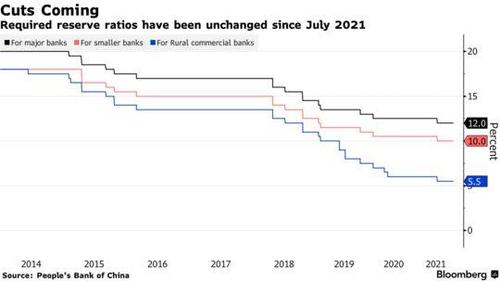

Beijing tries to move to support the internal banking and financial system with the monetary instrument, threatened by the collapse of Evergrande. The PBOC has cut the required bank reserve ratio for the second time this year, while Beijing has announced that it is preparing an ad hoc policy for the real estate sector. Neither move has changed the general impression that China is doing the bare minimum to support the economy.

RRR is nothing more than the “Reserve requirement ratio”, the percentage of compulsory reserves that banks must hold for loans. Cutting this percentage means giving the banks the opportunity to make more loans, and in fact will free up around 188 billion dollars of resources.

Three days after Premier Li Keqiang suggested a cut to the RRR, the PBOC duly followed up. The central bank quickly argued that the RRR cut is a routine move, in part to replace the maturing MLF (i.e. to cities, Municila Liquidity Facility) loans that banks have borrowed from the central bank. The PBOC said its stable monetary policy has not changed, downplaying the idea that this is the beginning of a round of easing.

The crisis of the real estate giants is now knocking on the doors and the impression is that there is still no clear policy to resolve it, even if the government, however, is moving. The Politburo on Monday promised to provide cheaper housing next year. He indicated that Beijing will take more of a supply-side approach, increasing the supply of land and housing in the private sector, to address high house prices, which will still employ the construction sector by throwing it a lifesaver, but it is not certain that this change will be sufficient.

It is worth noting that the previous RRR cut in July did not lower overall corporate loan costs much, as China Bull Research pointed out. Indeed, the weighted average rate on business loans increased 10 bps to 5.3% in the third quarter. In other words, the RRR cut was not passed on to the real economy except in part.

Where did the money go? At least some of the liquidity was channeled into the bond market as investors borrowed short-term funds in the interbank market to buy government bonds.

Practically China has given water, but, despite the Communist regime, it cannot force the horse to drink. The money did not go into loans, but simply remained liquid in the short term in order to fuel the next possible speculative push. Banks and investors do not want to invest in the property now, but wait for some high-yield bargain. The opposite of what the politburo would like

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

Article China cuts required reserves. He gives water to the horse, but he doesn't want to drink… it comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-cina-taglia-le-riserve-obbligatorie-da-acqua-al-cavallo-ma-questo-non-vuole-bere/ on Tue, 07 Dec 2021 10:00:51 +0000.