China: Manufacturing Forward-Looking Indicators Point to Storm

In China something is not yet moving in the right direction. Maybe it won't be exactly the fault of the Chinese government, maybe it will be due to the international economic trend, but, in any case, the forecast indicators of the Chinese commercial and manufacturing sector are not positive.

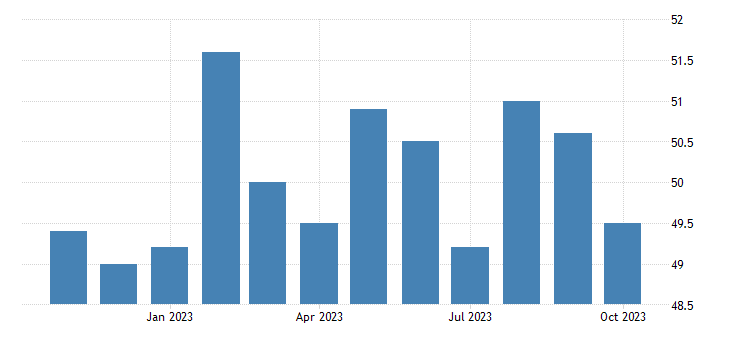

Yesterday, the official NBS PMI for economic activities in China unexpectedly fell to 49.5 in October 2023 from 50.2 in September, missing the market forecast of 50.2 which highlighted that the country's economic recovery remained fragile, with the need for further support measures from the government.

New orders began to contract again (49.5 versus 50.5 in September), with foreign sales falling at a faster pace (46.8 versus 47.8), in a context of softer increases of production (50.9 against 52.7), while employment continued to fall (48.0 against 48.1).

Meanwhile, purchasing levels reduced for the first time in three months (49.8 vs 50.7). Delivery times shortened, but the pace was the lowest since February (50.2 vs 50.8). On the cost front, input price inflation fell to a three-month low (52.6 vs 59.4), while producer prices fell for the first time in three months (47.7 vs 53, 5). Finally, business confidence improved slightly (55.6 vs 55.5).

Below 50 there is an expected decrease in the manufacturing sector. Here is the relevant graph

However, this is not the only negative manufacturing index: the C aixin China General Manufacturing PMI fell to 49.5 in October 2023 from 50.6 in September, missing the market forecast of 50.8. It was the first contraction in industrial activity since July, against a backdrop of a renewed decline in production due to the fragility of the economic recovery.

Additionally, overseas sales fell for a fourth month, while purchasing levels fell for the first time since July. Furthermore, employment suffered its largest contraction in five months as backlogs continued to expand, with some companies linking this to pressure on production capacity.

Meanwhile, growth in new orders has slowed for two consecutive months. On the price side, input cost inflation reached a 9-month high, driven by rising commodity and oil prices, while selling prices increased moderately.

Finally, sentiment hit its lowest since September 2022, amid concerns over the global outlook. “Manufacturers were not in a good mood,” said Wang Zhe, senior economist at Caixin Insight Group. “The economy has shown signs of recovery, but the foundations of the recovery are not solid.”

Here is the index graph:

A contraction is also expected in this case.

So something still needs to be restarted in the Chinese economy, and this may be due either to internal factors, i.e. the problems of the Chinese real estate and financial sector and its poor demographic growth, or to external factors, with Europe not grows and presumably will not grow in 2024, with large-scale war events underway, and with widespread unrest . Growing up in this environment is truly a difficult undertaking, especially when the problems of an elephantine and disproportionate real estate sector are unresolved.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article China: manufacturing forecast indicators indicate storm comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-gli-indicatori-previsionali-della-manifattura-indicano-tempesta/ on Wed, 01 Nov 2023 08:01:37 +0000.