China: the “Cabbage Houses” at a bargain price. Imminent real estate crisis

In China, the small town of Hegang, in Heilongjiang province, is making headlines for its cabbage houses . These are houses of average size by Chinese standards, about 55sqm, which are sold “Secondhand” at bargain prices. A Chinese middle-class family can buy such an apartment for three months' salary, 30,000 yuan, just over 4,100 euros. A really bargain price for the "Cabbage Houses" even for the Chinese meters.

This phenomenon of falling house prices is repeating itself in other medium-sized cities of the Yang-Tse Delta and the Pearl River, that is, the heavily populated areas upstream of Hong Kong and Shanghai. Areas that had been at the center of the real estate boom of past years. The "Cabbage houses" are "Used" houses, a concept that for us, used to selling prestigious properties with hundreds of years of history, makes little sense, but which shows the illogical dichotomy of the Chinese market: in the East, real estate value is in the “New” houses, never inhabited, while collapsing for the “Used” houses, which have already been inhabited. This means that the real estate value is placed in houses that are essentially useless, because they are not intended to be inhabited. When they were, they would see their value drop.

The phenomenon seems to be not limited to Hegang, but is spreading to all the medium-sized cities of the south. The CCP has invested heavily in economic development in the Northwest, and it has been paying the price above all for the South, starting with small and medium-sized cities. The big ones, in fact, manage to enjoy the advantage of a more benevolent credit system. Third row cities, on the other hand, feel the impact of the real estate crisis directly.

this phenomenon is accompanied by the failure of the monetary policy of the PBOC to relaunch the values of the real estate market. The People's Bank of China recently reduced RRRs and interest rates several times and eased monetary policy, but the v i effect was only on the stock market . A new research report on the real estate market shows that in January this year, the overall volume of residential building transactions in 29 key cities in China fell by almost 50% compared to the equivalent period last year.

According to a report released by the Crane Real Estate Research Center on the first day of the first lunar month (February 1), the combined transaction volume of 29 key cities in China was 14.29 million square meters, a year-over-year decrease of 46%. The total volume of transactions in the four cities of Beijing, Shanghai, Guangzhou and Shenzhen was 2.85 million square meters, down 38% and 21% respectively. Shanghai alone is a special case, with 1.3 million square meters of transactions in a single month, up 43% on a monthly basis, hitting a new high since February last year. As for the second and third tier cities, the total transaction volume was 11.43 million square meters, down 41% on a monthly basis and 47% on an annual basis, and the transaction volume was halved. This only confirms what we wrote above: the crisis in the Chinese real estate market has started, but for now it is creeping and almost invisible, because it mainly affects small towns.

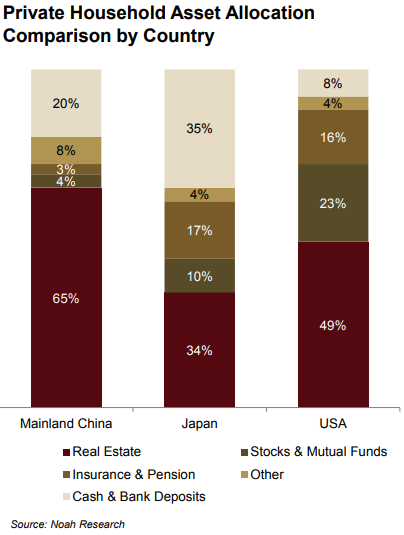

Considering how Chinese families have invested their wealth in the past, especially in real estate, this is a significant element for Beijing's economy.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article China: the “Cabbage Houses” at a bargain price. Imminent real estate crisis comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cina-le-case-dei-cavoli-a-prezzo-stracciato-crisi-immobiliare-imminente/ on Tue, 15 Feb 2022 10:00:53 +0000.