Chinese investment in gold does not benefit the countries that receive it. The case of Tajikistan

Many of the Chinese investments linked to the "Belt and road" program, or even private programs, always Chinese, however connected to that system, are in reality poisoned pills: in fact they carry investments, but offset by debts and in any case that only benefit the Chinese industry. This is also true when the investments are in gold. On April 14, the president of Tajikistan traveled to the northern Sughd region to oversee the opening of a new gold processing plant built by a Chinese investor with an investment of approximately $ 136 million.

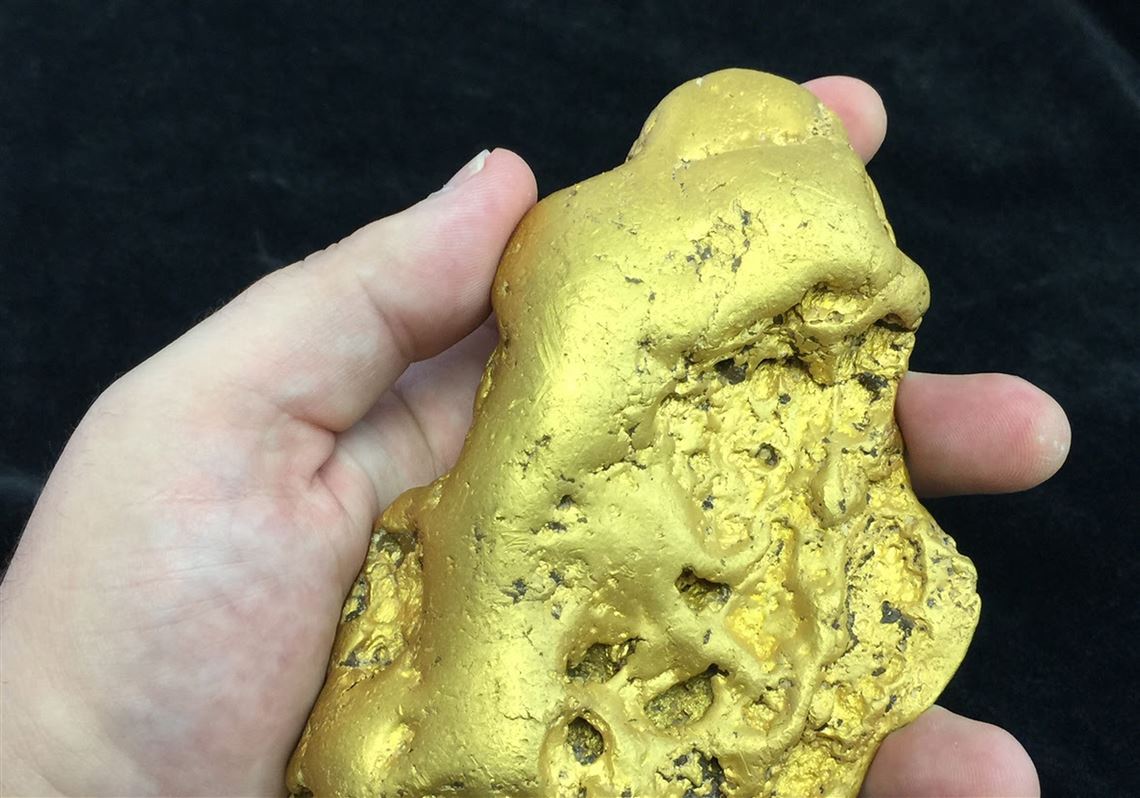

The firm, Talco Gold, will produce up to 2.2 tons of gold and 21,000 tons of antimony annually, according to government officials.

China is by far the main source of Tajikistan 's direct foreign investment. In 2021, Chinese companies invested more than $ 211 million in Tajikistan, an amount that represents nearly 62% of the global FDI figure. Those funds went mainly to the mining and processing of lead, zinc and tin ores and the extraction of precious and semi-precious gems and metals.

Talco Gold is a joint venture between the Talco Aluminum Company, a Tursunzoda-based company that is said to be owned by Hasan Asadullozoda, brother-in-law of President Emomali Rahmon, and China's Tibet Huayu Mining.

The company has promised it will employ 1,500 people, most of them Tajik nationals. This prospect comes at a fortuitous time, just as Tajikistan faces the prospect of a new economic crisis accelerated by international sanctions on Russia, where hundreds of thousands of Tajiks travel each year for seasonal work.

Work on the construction of the processing plant in the Sughd region, which will work with material extracted from the nearby Chulboi, Konchoch and Shakhkon fields, began four years ago but has been delayed since the start of the COVID-19 pandemic. .

Talco is apparently a company that engaged in the extraction and processing of aluminum-related minerals, but began expanding in 2015 following a program designed by the state to support the company. As part of that program, the government granted the company a 25-year concession to Konchoch's gold and silver deposits.

However, Chinese investments invariably come with many constraints, not least because Tajikistan is deeply indebted to Beijing. According to the Ministry of Finance, the Tajik debt to China as of January 1 amounted to 1.1 billion dollars, which is almost exactly one third of the country's total external debt.

Some economic experts question whether China's debt strategy for Tajikistan will bring the country a sufficient economic return.

"China lends money to Tajikistan for specific projects, and parliament often approves tax exemptions during the construction period," an analyst told Eurasianet on condition of anonymity, as criticism of the government can run into reprisals. “Construction equipment is brought in from China, Chinese workers are engaged in construction. As a result, all the money goes back to China and Tajikistan remains burdened with debt ”. In the end, those who receive these investments offset by debt, in reality, have no advantage …

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article China's investment in gold does not benefit the receiving countries. The Tajikistan case comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/linvestimento-cinese-nelloro-non-da-vantaggi-ai-paesi-che-li-ricevono-il-caso-tagikistan/ on Sun, 17 Apr 2022 06:00:53 +0000.