EMERGING MARKETS: DEBT CRISIS COMING? Capital mobility can do more harm than good

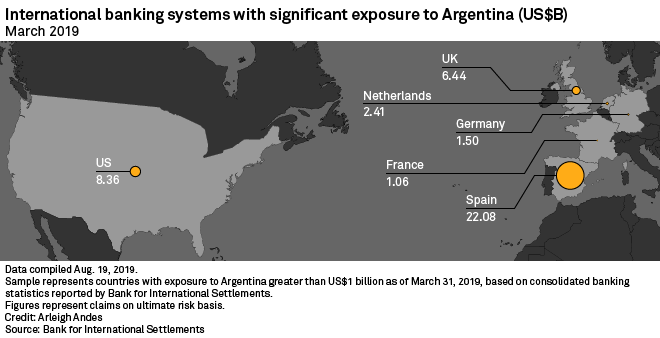

What if the next European crisis were the debt of emerging countries, such as to blow up some banking system? In the Hispanic world, the fear of a default of the Soran debt of emerging countries that could overwhelm Iberian credit institutions is spreading: if we take Argentina or Turkey as an example we can see a dangerous exposure of Spanish institutions.

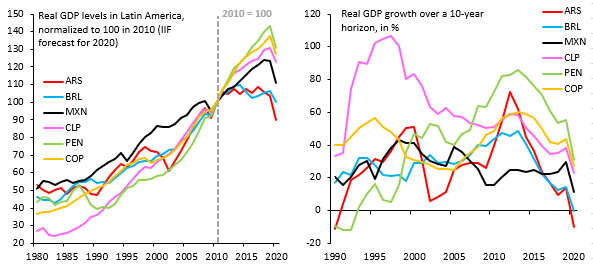

Covid-19 only worsens an already not rosy situation for emerging countries, especially those of Latin America: Covid-19 comes to place the tombstone on a Latin growth that marks a real "lost decade" in the growth. when the 2008 crisis broke out, emerging countries, especially Latin Americans, saw a veritable boom in investments in public and private debt, but this falling in love proved short-lived and resulted in crisis, adjustments and interventions by the IMF. Now it closes.

The problem the always excellent Robin Brooks shows very clearly is that the excessive inflow of foreign capital into emerging markets has not guaranteed growth.

The COVID crisis is evident in all South American countries, but among the giants only Mexico has managed to continue in growth, albeit slowed down. Brazil and Argentina have had a decade of stagnation that ends with a significant decline that threatens to bring the countries back to non-growth social conditions …) of the nineties. We point out that these are debts in currency, therefore dollars, for the most part, or euros, for a small percentage, so they cannot be resolved and overcome with an expansionary monetary policy. The only escape is default. Excessive capital injection not only failed to ensure growth, it set the stage for failure.

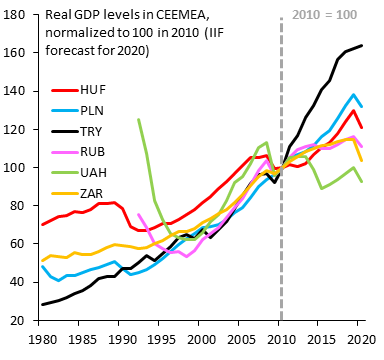

A less dramatic situation arises for the countries of Eastern Europe.

Let's see how Turkey has had the most significant real GDP growth despite all the financial problems. but also the economies of the East of the Union, Hungary and Poland, have had excellent growth also for the flow of resources of the Union. Russia is still very tied to the commodity market while Ukraine has paid for the internal and international political uncertainties.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article EMERGING MARKETS: DEBT CRISIS COMING? Capital mobility can do more harm than good comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/mercati-emergenti-crisi-del-debito-in-arrivo-la-mobilita-dei-capitali-puo-fare-piu-male-che-bene/ on Mon, 02 Nov 2020 08:52:40 +0000.