Evergrande on the verge of default. Is it safe or not?

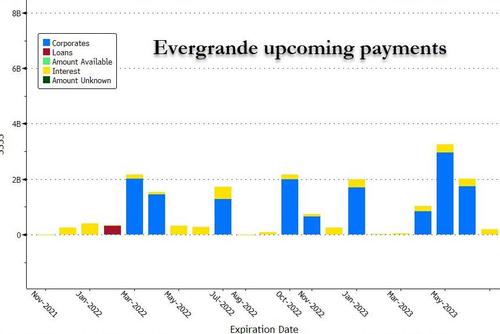

We are now there, despite the desperate attempts to postpone the non-postponable Some bondholders of the China Evergrande Group, long short of cash, received a payment at the last minute, in the literal sense of the word, yesterday, through the clearing house Clearstram , for 148.1 million dollars. It involved interest on past due securities, already outside the grace period. We are on the second bailout at the last second, but in the coming months the commitments will be much higher.

Evergrande, the world's most indebted real estate developer, is racing from side to side to plug holes in its $ 300 billion debt, of which $ 19 billion is international market bonds. The company was not in default on any of its offshore debt obligations, at least until yesterday.

Failure to pay would have resulted in a formal default by the company and trigger cross-default provisions for other Evergrande dollar bonds, exacerbating a debt crisis looming over the world's second largest economy.

It is not clear, however, whether this time he did it or not: the German consultancy firm DMSA has decided to initiate the bankruptcy procedure against Evergrande, in its own name, for the bonds it has purchased and in the name of the clients for which he managed the funds. The company has not received any interest payments, hence the legal move. The default will be requested on two securities maturing in September whose grace period ended just yesterday. It is unclear at this time whether DMSA subsequently received a payment at the last second.

However, the company is selling off everything. he sold the company's shares to produce electric cars at a quarter of book value, he sold two corporate jets, and the manager even pledged several of his properties, including a prestigious mansion in Hong Kong, as collateral on loans. You can't go on selling out forever.

As always, in these cases the position of the first one who moved will then correspond to those of many other operators. Currently, the 8.25% EVERRE stock in default, issued by the financial parent company based in Hong Kong, listed internationally, has a value of 28 out of 100. In short, it is cooked. To be affected in the first instance by the default will be the giants Vanguard and BlackRock, each of which has several hundred million dollars in portfolio securities.

Apparently Beijing will not intervene, as expected, to safeguard international investors, but only internal ones.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

Evergrande article on the verge of default. Is it safe or not? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/evergrande-sullorlo-del-default-anzi-ha-fatto-un-passo-avanti/ on Thu, 11 Nov 2021 07:00:32 +0000.