Federal Reserve: Three essential points from the FOMC meeting

Yesterday we finally moved from proclamations to operational decisions. With the declarations of the FOMC, the operative arm of the US Central Bank, the modalities of ending QE and returning to a “Normal” monetary policy are clarified. Here are the three key points:

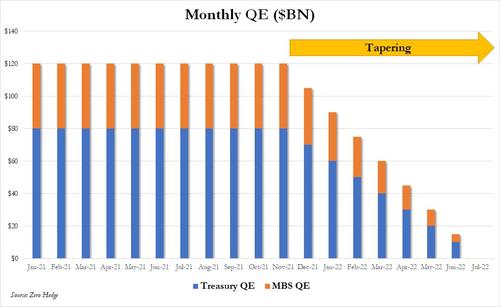

- The tapering will be announced in November and completed by the middle of the year. While the tapering signal in the statement was vague – "it may soon be guaranteed" – President Powell made it clear in the press conference that everything should be arranged at the next meeting (in November). Therefore, in the absence of negative employment data or financial market disruption, the “Tapering”, ie the end of QE, will begin in November and will run out in July 2022.

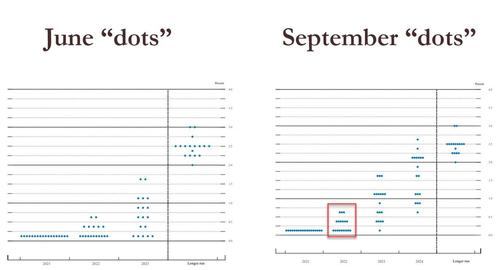

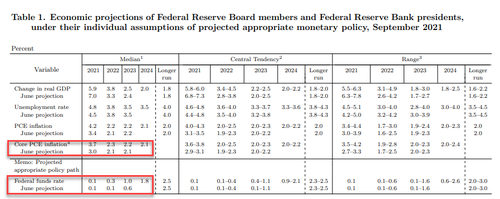

- Committee members are becoming convinced of the need for higher rates: As the Fed's updated dot plot showed, the committee is now evenly split between the first hike in 2022 or 2023, which brought the median to 0.25%. . The consensus is now for 3 hikes in both 2023 and 2024, leaving rates at the end of the forecast horizon at 1.75%. As President Powell noted, this is still decently below the long-term funds rate of 2.5%, which means that the policy is still accommodative; meanwhile, the OIS (overnight indexes swap) for 2024 is still fixed at 1%, which indicates that the market, for now, does not believe these increases are possible.

- We are facing higher-than-expected inflation due to increased supply-side constraints: the forecasts for core inflation have been raised slightly, and Powell noted that the problem is not monetary policy, but monetary policy. supply-side shock. As BofA notes, “The Fed has become more concerned about persistent price pressures, although the critical test will be long-term inflation expectations, which remain subdued. It will be essential to monitor developments on the supply side, both as a labor market and as a commodity market.

The bond market interpreted the Fed's announcements as aggressive, with the yield curve flattening, 5-year rates up 2bps and 30-year rates down 2bps. This makes us understand that the market believes that there will be a critical moment between two and four years from now, just when the assumptions about rate hikes have been made. Evidently it is considered that this decision will create problems . Meanwhile, the dollar has obviously strengthened on international markets

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The Federal Reserve article : three essential points from the FOMC meeting comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/federal-reserve-tre-punti-essenziali-dalla-riunione-della-fomc/ on Thu, 23 Sep 2021 08:42:33 +0000.