FTX: story of the madness that can happen to centralized exchanges

It thundered so much that it rained. Centralized exchanges, those where cryptocurrencies are deposited for exchanges leaving the possession to a third party, are similar to the banks of the eighteenth and nineteenth centuries, before the minimum control necessary to avoid waking up in the morning with no more money in the account arose. current. In the first half of the nineteenth century US banks simulated gold stocks by covering crates of nails with a layer of coins, today some centralized exchanges use the deposited funds for their own development, with the risk of not being able to return them.

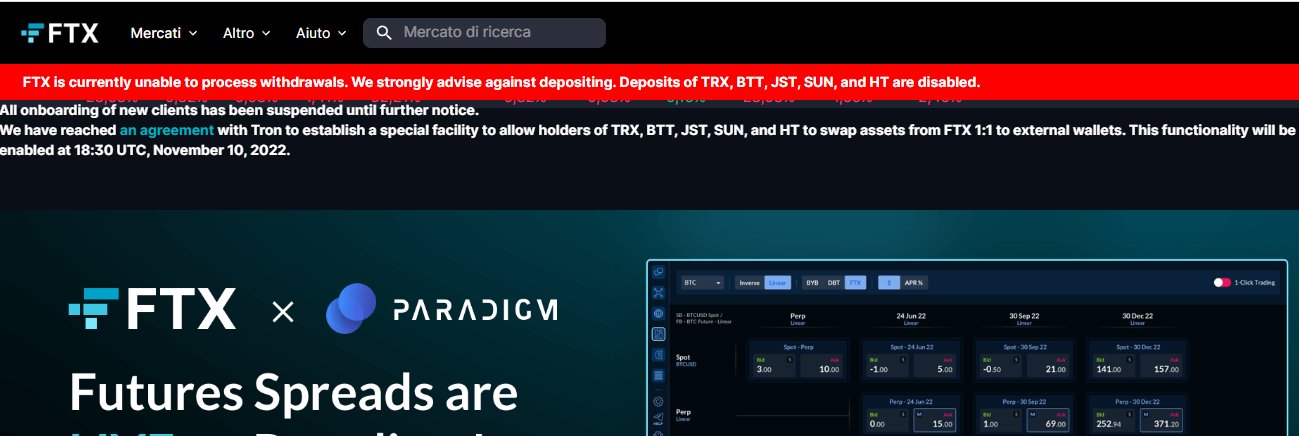

Here we come to the FTX case: On Friday FTX Trading filed for bankruptcy under Chapter 11, signing a sudden and surprising fall for one of the largest cryptocurrency exchanges in the world.

Founder and CEO Sam Bankman-Fried also stepped down from the company, which appointed John J. Ray III as the new CEO. Bankman-Fried intends to remain with FTX throughout the bankruptcy proceedings.

" The immediate discharge with Chapter 11 (bankruptcy) is appropriate to give the FTX Group the opportunity to assess its situation and develop a process to maximize recoveries for stakeholders ," Ray said in the statement.

Press Release pic.twitter.com/rgxq3QSBqm

– FTX (@FTX_Official) November 11, 2022

To understand the level that FTX had reached in its hubrys, since 2019, FTX also holds the naming rights to the arena where the Miami Heat play their home games. The FTX Arena is owned by Miami-Dade County.

On Friday night, however, in response to the bankruptcy, Miami-Dade County and the Heat issued a joint statement saying they "take immediate action to terminate our business relationship with FTX" and are looking for a "new partner for naming rights ".

There are potentially millions of cryptocurrency investors who held their tokens on FTX, so the worldwide fallout is colossal and will be felt for a long, long time. The most biting comment is that of Elon Musk …

– Elon Musk (@elonmusk) November 12, 2022

The latest rescue attempt was made by Binance, but evidently the hole was too big to fill. At the same time, as happens with the failure of a single bank, all other exchanges will also be heavily affected by the failure of FTX from a reputational point of view.

Not all tokens are lost and the company has already put in place a tool to return some of these, such as Tron

The causes? The investigation focuses on subsidiary, also bankrupt, Alameda Research, which allegedly placed a series of extremely risky bets using depositor funds to be able to see a profit to be distributed to shareholders and investors that then did not materialize. A bit like the banks that invested the money of the account holders in real estate and industrial speculations did in the nineteenth century, which sometimes were good many other times not.

Obviously BTC has fallen, but the fault is also of those who did not respect the creation of Satoshi: BTC was born to not have to entrust the money in a fiduciary way to third parties. If these are then entrusted anyway, it is obvious that there is a risk of losing them …

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The FTX article: story of the madness that can happen to centralized exchanges comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/ftx-storia-della-follia-che-puo-accadere-agli-exchange-centralizzati/ on Sat, 12 Nov 2022 08:09:29 +0000.