Goldman Sachs lowers its forecasts on Omicron

Goldman overnight became the first Wall Street bank to admit that its forecasts for the next few years need to be reviewed at the covid point, even though, again, no one has a clue yet what the real impact of the new covid variant.

Goldman analyst Hatzius writes that "the emergence of the Omicron variant increases the risks and uncertainty surrounding the US economic outlook" and while even the chief economist admits that "many questions remain unanswered, we now think that a scenario moderate downside where the virus spreads more rapidly but immunity against serious diseases is only slightly weakened is very likely ”. This opens on the one hand to the revision of the forecast GDP, but, on the other hand, also to the possibility of not reaching the Taper immediately by the Fed and the other central banks, but to continue for a while with the expansionary policy and with the economic stimuli.

Why Omicron could slow the economy:

- First, Omicron could slow the economic reopening, but with only a modest brake on spending on services because virus control policy and economic activity have become significantly less sensitive to the spread of the virus.

- Second, Omicron could exacerbate the supply shortage of goods if the spread of the virus to other countries required severe restrictions. This was a major problem during the Delta wave, but increases in vaccination rates in foreign trading partners since then should limit the chances of major supply disruptions.

- Third, Omicron may delay the timing for some people who feel comfortable returning to work and cause the shortage of workers to continue a little longer.

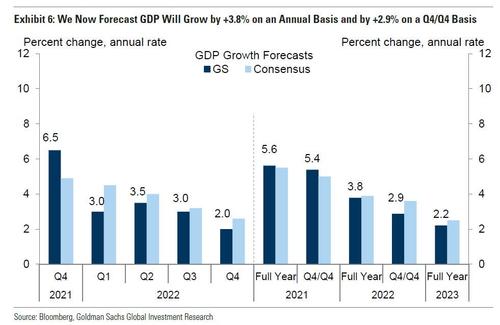

This translates into a growth review by Goldman “We have updated our GDP forecast to incorporate our updated virus forecast and the latest GDP monitoring data. These changes translate into a +0.5% quarterly for Q4 2021 based primarily on stronger inventory data and a -1.5 percentage point cut in Q1 growth and a -0.5 cut. percentage points in the second quarter due to the obstacles linked to the virus on the reopening and supply of goods ".

This, as we have warned earlier, is only the first of many upcoming GDP cuts and banks will use every possible excuse to "slide" their 2022 GDP forecast to drop to around 1% if not lower by the end of the year. end of year. This is the number the Fed will need to quietly forget all of its hiking plans.

What about inflation? In this case, Goldman Sachs has its prediction, which is that the slowdown will reduce energy costs and therefore cause general inflation to drop. So now Omicron would give the excuse for a new expansive round, or not to leave the previous one. Stimuli from here to eternity, up to where no economy has ever gone before.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The Goldman Sachs article lowers its forecasts on Omicron comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/goldman-sachs-abbassa-le-proprie-previsioni-su-omicron/ on Sat, 04 Dec 2021 20:38:47 +0000.