Government bonds: yields fall after the FED says “Stop”

Today something changed in the government bond market, and something quite important.

Treasury yields fell below multi-year highs as dovish comments from Fed officials lowered expectations for another interest rate hike this year, while demand for safe-haven assets rose due to the war in the Middle East.

Traders now await the release of the FOMC minutes and new price data later in the day for further clues on the Fed's next steps.

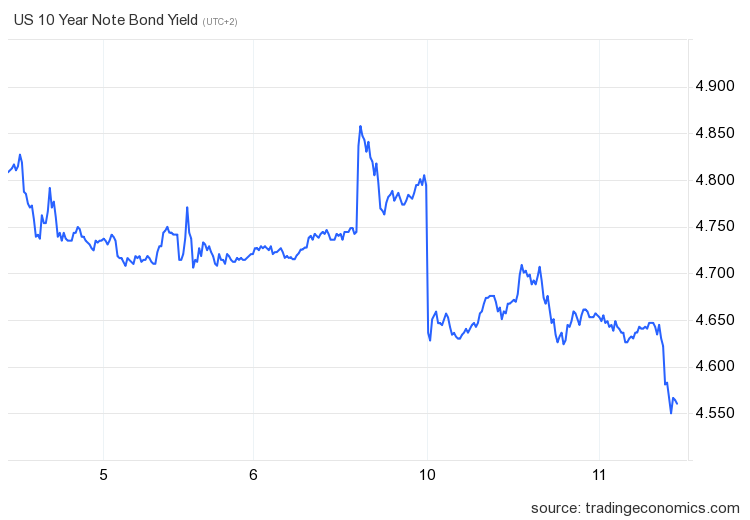

Let's see how the various titles behave. Let's start with the decades of the USA:

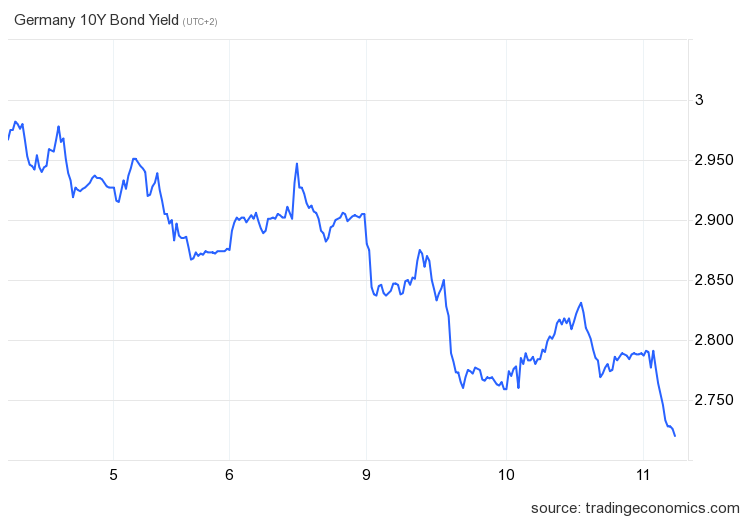

The drop was very strong, but let's look at the German stocks

The Italian 10-year BTP

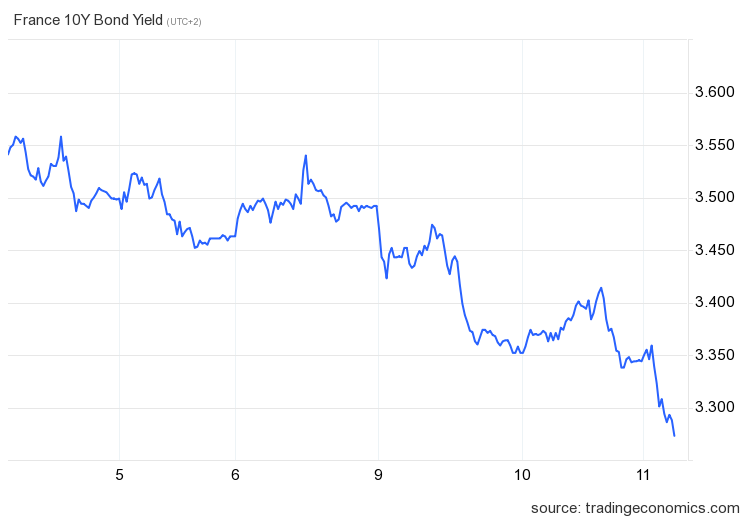

And the French state title…

The trend was practically parallel and almost simultaneous. It seems unlikely that there wasn't an intervention, also coordinated, between various financial institutions to contain a situation which, with too many wars underway, risked getting out of control.

Do you remember last week when they said that the spread had risen because of the Italian government, that we had to "Converse with investors" (Word of Visco), when the Economist accused us of being spendthrifts and therefore causing the explosion of interest? In the end, the central banks' decision that, given the political situation, it was better not to push too hard was enough to lead to a normalization of rates.

By now the games of certain newspapers and certain sources are boring.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Government bonds: yields fall after the FED says “Stop” comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/titoli-di-stato-rendimenti-al-ribasso-dopo-che-la-fed-ha-detto-stop/ on Wed, 11 Oct 2023 10:18:45 +0000.