IRPEF advance: an injustice of a communist state

In a week, millions of Italians will be forced to pay taxes on a profit that they probably have not and will not achieve. Italy is one of the few cases in which it is not paid on the income earned, but those of the following year are paid on a hypothesis of income to be verified. Other than taxation on income provided for by the Constitution!

The barbarism of the "100% deposit" on taxes could only be the creation of a historical period in which the Communist Party guaranteed external support with the "Historical Compromise". The first version was introduced by the Andreotti government in 1977, just when the PCI had a direct influence on politics and saw autonomous income earners as enemies of the people. The art. of Law 97/197 stated: " Starting from 1977, taxpayers subject to IRPEF or IRPEG must pay in November of each year, as an advance on the tax due for the current tax period , an amount equal to 75 per cent of the tax relating to the previous period, as indicated, net of deductions and tax credits and withholding taxes, in the tax return presented for the same period. If the return was omitted for the previous period, the advance payment is commensurate with 75 per cent of the tax corresponding to the total income that should have been declared, net of tax deductions and credits and withholding taxes ".

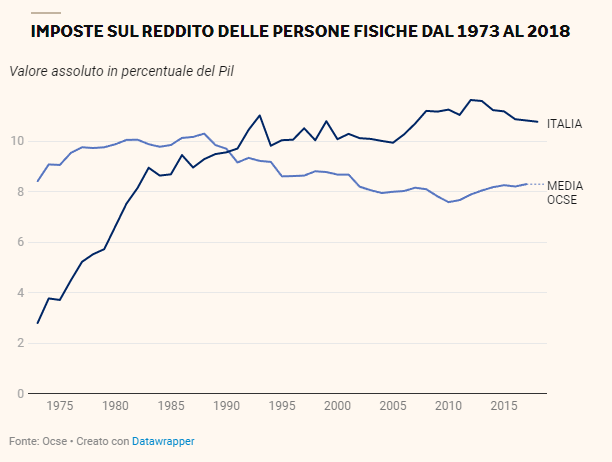

It must be said that taxation was very different then compared to now:

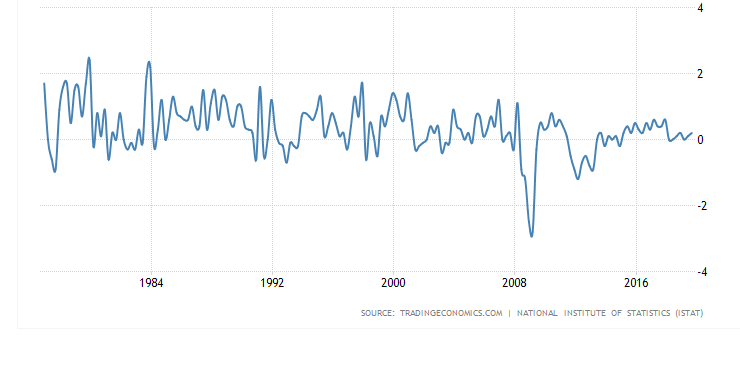

Direct taxation accounted for around 4% of GDP in those years and the down payment was around 75%. So it passed, all in all, almost unnoticed especially at a time when on the one hand it was the last oil crisis, on the other, however, the growth rates were very different from the current ones.

Now the direct tax burden is more than double, compared to GDP, compared to what it was in 1977, growth is very different and the advance payment has gone from 75% to 100% in the 1980s. The basic hypothesis of 1977, that incomes would always grow, so that it was still possible to always have large advances on taxes that, in any case, would have grown is over. Self-employed workers are often the new poor, unsecured, and forced to periodically unrelated income withdrawals. Even the safeguard that excludes the payment of the down payment in the face of a decline in income of at least 40% is complex and in any case does not repair any significant drop in income: if a company or a private individual expects a decrease of 30%, however, it will be to pay disproportionate advances. All this in the face of an increasingly stingy banking system, especially in preparation for the application of the Basel 4 criteria.

It would be right, for general social correctness, to abandon this remnant of a distant past, possibly replacing it with voluntary, incentivized payments, or with a presumptive monthly payment scheme in the year of perception of the income itself. Instead, in a week, many companies and individuals will go into liquidity crisis, all to help a state that often forgets about them.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Inconto IRPEF: an injustice from a communist state comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/acconto-irpef-uningiustizia-da-stato-comunista/ on Sat, 20 Nov 2021 10:00:13 +0000.