Just announce a rate hike and the US government bond market goes crazy. In the EU it will blow up the Euro

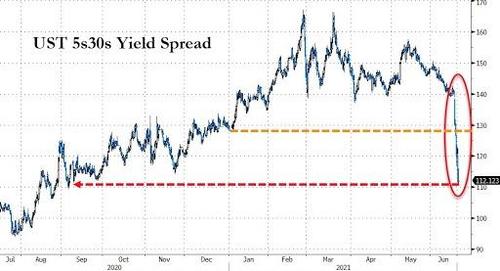

Since Jerome Powell announced last week that two interest rate hikes are to be expected in 2023, the US rate curve has begun to give the numbers, and not superficially. Here's how the differential between 5-year and 30-year bonds fell vertically on Friday:

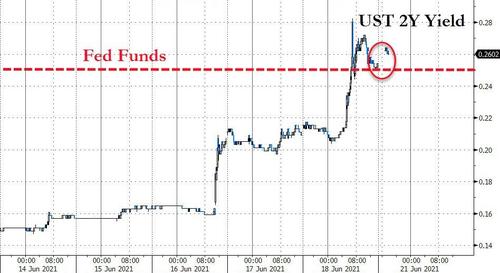

Not only this morning the 2-year US government bond yield and the 30-year yield on Asian markets.

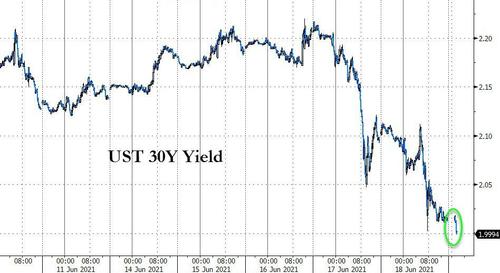

and now 30 years old

If long-term securities see their yields collapse, while short-term ones see it explode, it means that the market is looking for an economic crisis, with an increase in risk, over the next 2-5 years. In the end, Powell's announcement, albeit projected into the medium-term future, of a rate hike was enough to unleash the markets. Why ? The answer is quite simple: everyone knows that current growth cannot hold up higher interest rates.

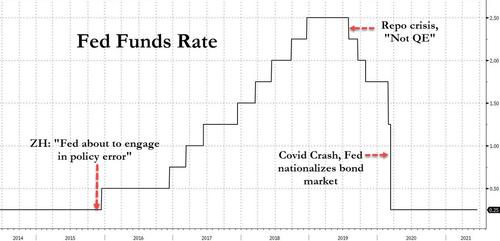

We are retracing Yellen's “Tapering” after the QE due to the great financial crisis, when rates were gradually raised to counteract inflation that was not there. All this led to a sharp slowdown in growth, to the crisis in the interbank market ("Repo") which in turn led to the drop in rates, all well before the epidemic economic crisis.

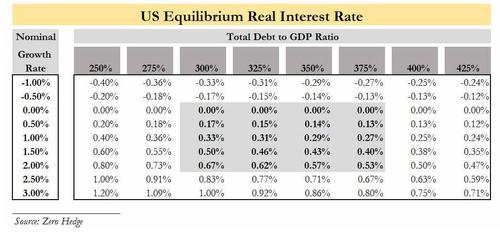

The problem was, and is, that high debt means that growth is only possible in the presence of low interest rates. we see the following graph on US equilibrium rates versus growth, the so-called r * (r star):

How do you read this graph? Simply that, in the presence of a growth of 2% and a TOTAL public and private debt of 325% of GDP, the maximum applicable interest rate is 0.62%, while if the public debt is 350% then the the maximum interest rate that the FED may apply will be 0.57%. Higher rates, with a growth of 2%, would lead to depressive effects.

So the market could think:

- that 2023 the debt may not be below 300%, but did not believe it;

- that growth in 2023 could be well over 2%, but did not believe it;

- that the increase in rates will be such as to create some disruptive economic phenomenon, and so he replied.

The Jerome Powell market signal was not to mess with an early end of QE. Growth is still too fragile, structural debt problems are far from being overcome and “Tapering” would risk triggering another economic crisis.

What will happen when the PEPP, the European pandemic QE, ends and the hawks finally have a chance to control the monetary and fiscal policy of the EU? We recall that the Austrians last week called for a return to the rules of budgetary discipline. The effect of the end of the PEPP combined with the return to budgetary control policies, in a situation where the overall debt situation is very differentiated between country and country, will have the effect of accentuating the economic and financial differences between the different countries. , currently softened by the intervention of the ECB. Without its blanket these differences will explode, putting pressure on the budgets and economies of individual states. We will return to a 2011-style situation, demonstrating, this time objectively, that the EU is not reformable and so is the euro area. If the budget rules are not changed in the next 12 months, this phenomenon will be evident and easily predictable and the path of the Euro will be marked.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Just announce a rate hike and the US government bond market goes crazy. In the EU it will blow up the Euro comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/basta-annunciare-un-aumento-dei-tassi-ed-il-mercato-dei-titoli-di-stato-usa-impazzisce-nella-ue-fara-saltare-leuro/ on Mon, 21 Jun 2021 07:00:58 +0000.