Manufacturing: China, India and Japan, who wins and who loses in the forecast indices

Today the manufacturing PMI forecast indicators of three industrial giants were made public: India, China and Japan. Although these are only forecast indices to be taken with a pinch of salt, especially the Chinese ones, they tell us something about what is happening in the world.

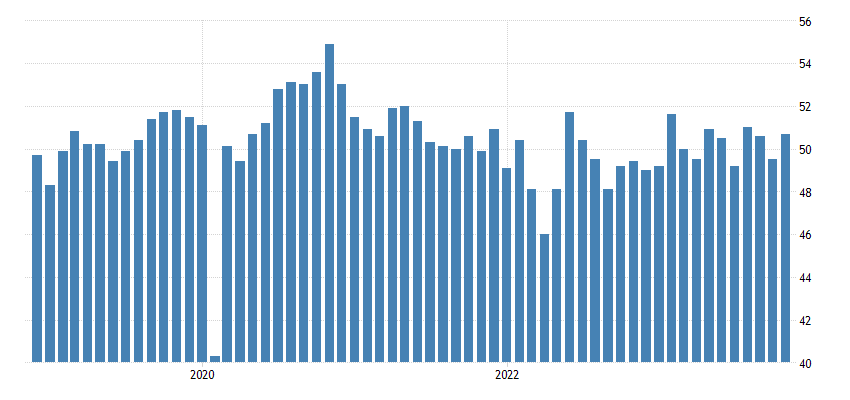

Let's start with the biggie, China : Caixin's Chinese overall manufacturing PMI rose to 50.7 in November 2023 from 49.5 in October, beating market forecasts of 49.8 and marking the highest reading since August. Both production and purchasing levels have started to grow again, despite Beijing's recent efforts to revive a stagnant economy. Additionally, new orders increased the most in four months, while the rate of job losses declined. Meanwhile, supply chain performance improved slightly for the second consecutive month.

Price data indicated that cost pressures remained subdued, with production costs rising modestly, slower than in October. At the same time, efforts to attract and secure sales reduced pricing power and sales costs remained essentially unchanged. Ultimately, sentiment improved to a 4-month high . Here is the relevant graph:

So China manages to seize a moment of macroeconomic change and its manufacturing begins to expand again, unexpectedly, even if only slightly. The domestic market is evidently starting to pick up again, even if the data should be taken with caution.

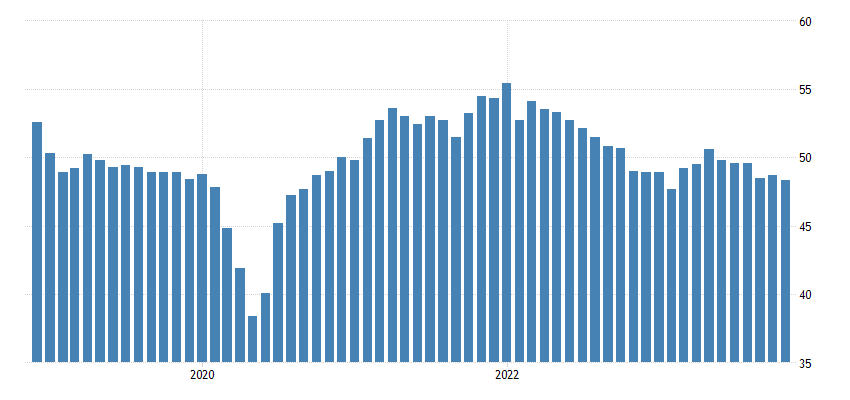

Let's look at Japan : Bank Jibun's Japanese manufacturing PMI was revised upward to 48.3 in November 2023 from 48.1 in preliminary estimates and after 48.7 in the previous month , indicating the sixth consecutive month of contraction of industrial activity. However, the latest reading recorded the sharpest contraction in the manufacturing sector since February, as output and new orders fell faster, with new export orders falling at the fastest rate since June. L

employment fell for the 2nd consecutive month, while backlog fell the most in eight months, indicating they had enough capacity to complete outstanding tasks. Purchasing activity fell the most in nine months, while delivery times lengthened. On prices, production costs fell to their lowest in three months, while production cost inflation slowed for the first time in three months, reaching its lowest level since July 2021. Finally, sentiment of businesses improved on hopes of a sustained improvement in demand following new product launches and a global economic recovery. Here is the relevant graph:

In this case, Japan, with one exception, has shown a contraction since the end of 2022. Japan is mainly the factory of Western countries and its internal market is smaller than that of China, making the economy more dependent on not brilliant.

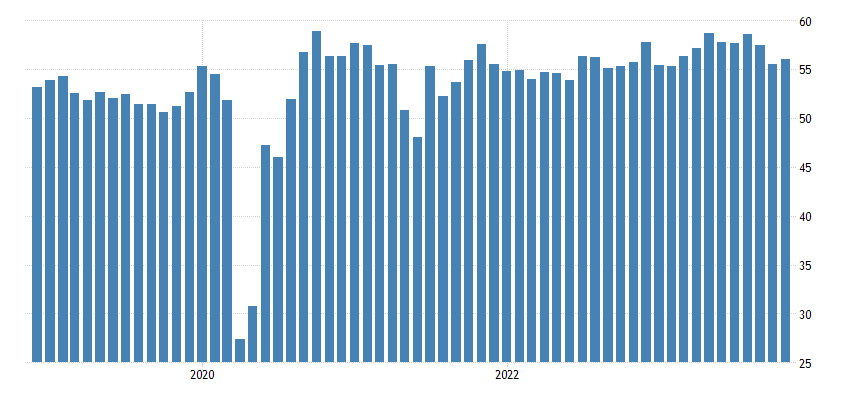

Finally India : The S&P Global India Manufacturing PMI rose to 56.0 in November 2023 from October's 8-month low of 55.5, in line with market consensus. It was the 29th consecutive month of increased industrial activity, as production grew at an above-trend pace.

Additionally, new order growth improved from the yearly low in October and exceeded the series average; while foreign sales increased for a 20th month, albeit at the slowest pace since June. Additionally, employment increased for the eighth month, amid a slight increase in pending business.

Purchasing activity and inventories of inputs increased, in many cases due to buoyant demand conditions. The vast majority of panellists reported no change in delivery times since October, amid modest deterioration in supplier performance. As for prices, purchasing costs have increased the least in 40 months . Here is the relevant graph:

Meanwhile, rates increased modestly as most companies decided to leave rates unchanged since October. Finally, confidence fell to a 7-month low, due to rising inflation expectations.

India is the country with the greatest expansionary expectations, but it experiences internal tensions linked to very rapid growth, even too much, which, obviously, creates problems, precisely because of this acceleration in development. The tension is reflected in prices and this creates anxiety, but it is also a sign of strong growth in manufacturing. India, barring unexpected shocks, is the world's next economic locomotive.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Manufacturing: China, India and Japan, who wins and who loses in the forecast indices comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/manifattura-cina-india-e-giappone-chi-vince-e-chi-perde-negli-indici-previsionali/ on Fri, 01 Dec 2023 09:00:48 +0000.