Milton Friedman: monetary theory and extreme liberalism. Is he the winner in today’s economy and politics?

Milton Friedman, for better or for worse, is one of the economic figures of the 20th century who shaped politics and finance in the last century in a radical way. Thus he deserves a place in our list of influential economists of the 19th and 20th centuries, even if his figure, and that of the Chicago school of which he was a part, is, to say the least, highly controversial. But we'll talk about it later.

Now let's begin.

Who was Milton Friedman

Milton Friedman was an American economist, born in Brooklyn on July 31, 1912 into a family of Jewish immigrants. He graduated from Rutgers University with a degree in economics in 1932 and obtained his master's degree from the University of Chicago in 1933, where he met his future wife Rose Director. After teaching at various universities, he returned to Chicago in 1946, where he remained until his retirement in 1977.

He was one of the founders and main exponents of the Chicago school, a liberal and liberal thought movement that influenced the economic policy of many countries. He won the Nobel Prize in Economics in 1976 for his contributions to the analysis of consumption, monetary theory and history, and the intricacies of stabilization policies. He was also a prolific author and popularizer, writing numerous books and articles on various economic and social topics. He died in San Francisco on November 16, 2006.

Friedman's economic theories

The permanent income theory. According to this theory, consumption depends not only on current income, but also on past and future income, as individuals tend to standardize their consumption over time, resorting to savings or debt to compensate for transitory variations in income 1 .

Friedman defined permanent income as that level of long-run income whose present value is equal to the household's wealth and its expected future income. Permanent income therefore represents the weighted average of current and future incomes, discounted at the interest rate. Transitional income, on the other hand, is the portion of income that is considered contingent, such as a lottery win or job loss. Friedman hypothesized that individuals consume nearly all of their permanent income and save nearly all of their transitional income.

The permanent income hypothesis has several implications for economic policy. First, it implies that temporary changes in income, such as those caused by fiscal or expansionary monetary policies, have little effect on consumption, as individuals expect their income to return to its previous level in the future. Conversely, permanent changes in income, such as those caused by structural reforms or technological innovations, have a greater effect on consumption, as individuals expect their income to rise or fall over the long run. this disarms much of the fiscal policies which, for example, were supported by Keynes.

Furthermore, the permanent income hypothesis explains some empirical phenomena that are not compatible with the Keynesian consumption function, based only on current income. For example, it explains why the average propensity to consume tends to decrease with the increase in current income: in fact, individuals with a high current income also have a high transitory income, which saves more. It also explains why the average propensity to consume tends to be constant in the long run: in fact, in the long run the changes in income are mainly in the permanent component, which has a stable propensity to consume 3 .

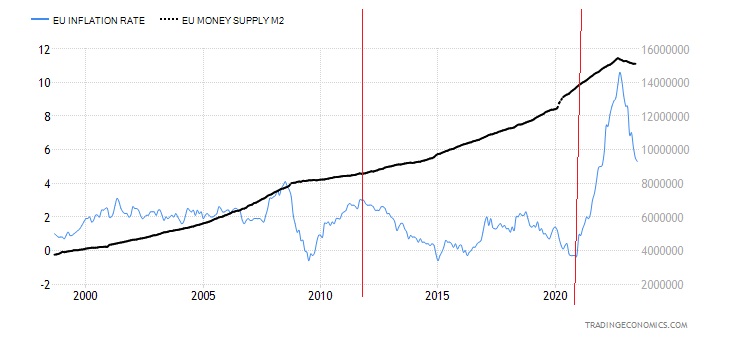

Friedman's monetary theories are based on the principle that the quantity of money in circulation determines the level of prices and economic activity. According to Friedman, inflation is always and everywhere a monetary phenomenon and cannot be used in the long run to reduce unemployment. Conversely, an expansionary monetary policy can only cause temporary and distorting effects on the real economy, while in the long run it only leads to an increase in inflation.

Friedman therefore proposed a monetary policy rule based on the control of the growth of the money supply, in order to guarantee price stability and the neutrality of the currency. Furthermore, Friedman argued that the demand for money depends on people's permanent income, that is, on their expected lifetime income, and not on their current income. This theory implies that transitory changes in income have little effect on consumption and the demand for money.

Paradoxically, Friedman, wanting to limit the weight of monetary expansion, has pushed people to believe that this is the essential element of growth and inflation, much more than fiscal policy. So Friedman disempowered political power and gave celebrity and enormous influence to central bank governors. From this point of view he was a true enemy of democracy and the herald of technocratic rule. In this purely negative sense, he is perhaps the most influential figure of the second half of the 20th century and the first twenty years of the 21st.

Friedman and helicopter money

Helicopter money is an idea originally formulated by Friedman in a 1969 parable in which he imagined a helicopter dropping a quantity of bills at the population, causing increased spending and inflation. This idea has been picked up by some economists as a possible solution to stimulate the economy in a liquidity trap situation, when interest rates are close to zero and conventional monetary policy is ineffective.

Helicopter money would consist of a direct distribution of money by the central bank to citizens or businesses, financed by the creation of money. This intervention would aim to increase aggregate demand, inflationary expectations and economic growth.

The "Chicago School"

The Chicago School is a movement of economic thought that developed at the University of Chicago between the 1930s and 1970s. It is characterized by its liberal and liberal approach to economics, based on microeconomic analysis, empiricism, price theory, monetary theory and criticism of state interventions in the market.

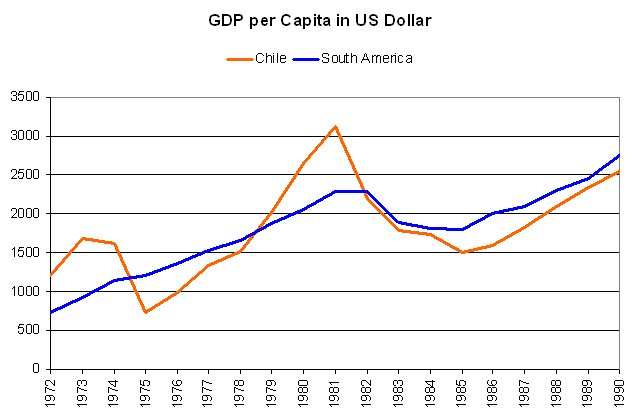

Among the main exponents of the Chicago school we can mention Frank Knight, Jacob Viner, Henry Simons, Milton Friedman, George Stigler, Gary Becker, Robert Lucas and Ronald Coase. The Chicago school has had a great influence on the economic policy of many countries, especially in the United States, where it inspired the liberal reforms of the 1980s under the presidencies of Ronald Reagan and Margaret Thatcher. It must be said that Raegan was much more practical in his economics and also influenced by more immediate political motivations, while Thatcher followed his ideas more decisively. The social conflicts in the United Kingdom and the disposal of a large part of British industry in the eighties were the children of his ideas.

Economic criticisms of Friedman's theories

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Milton Friedman: monetary theory and extreme liberalism. Is he the winner in the current economy and politics? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/milton-friedman-teoria-monetaria-e-liberismo-estremo-e-lui-il-vincitore-delleconomia-attuale/ on Mon, 28 Aug 2023 09:04:12 +0000.