Monetary trends would advise the ECB to change monetary policy, but it won’t

Monetary growth in Europe continues to decelerate, suggesting that the ECB should review its restrictive policy and correct it before the damage to the economy becomes excessive.

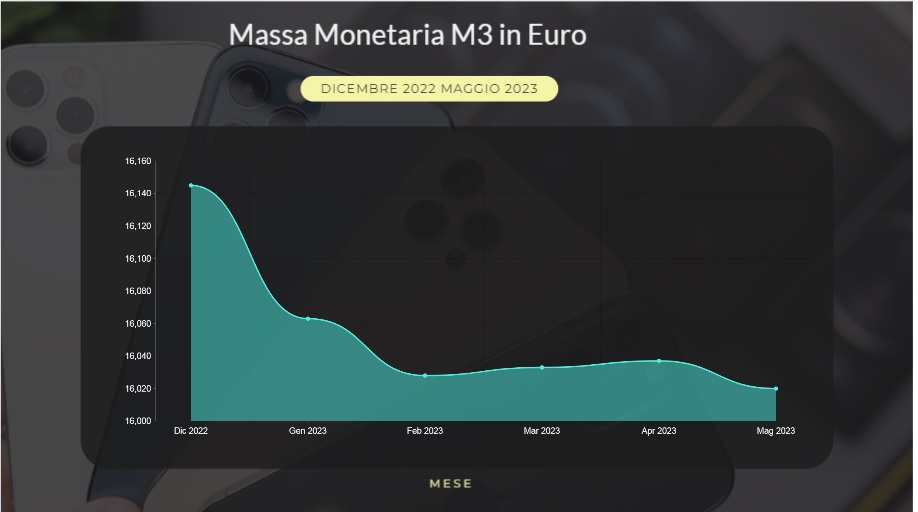

Europe's M3 currency decelerated to 1.4% year-on-year in May, from 1.9% the previous month, according to previously released data. The M3 money supply includes securities with maturities of up to two years, then commercial papers and other liquidity financing instruments which appear to be declining

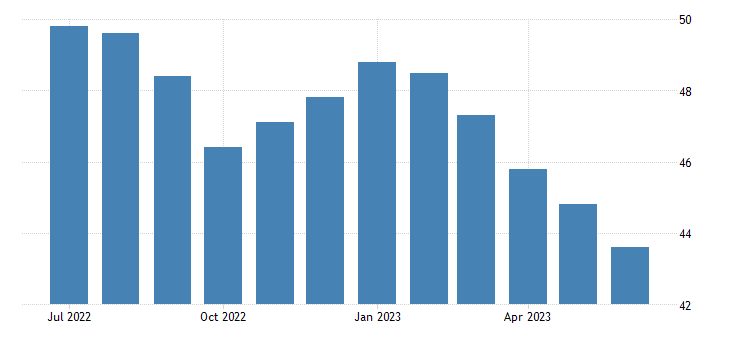

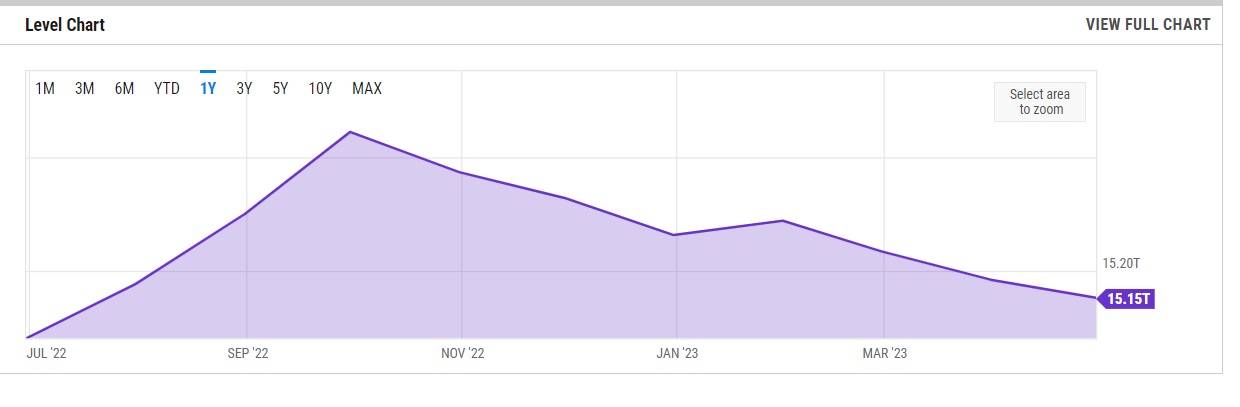

More important for economic activity is the decline in forms of money, especially M1. The latter consists mainly of sight deposits, i.e. deposits created when new loans and deposits are disbursed that are ready to be used in the real economy

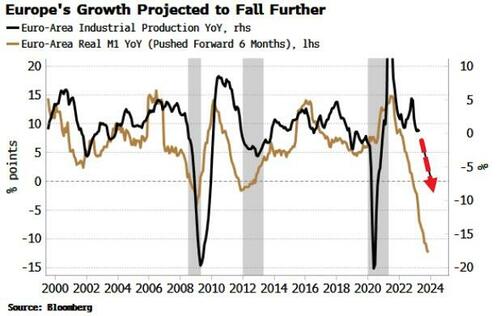

The real growth, adjusted for inflation, of the M1 money supply is declining sharply. Even the "Soft" indicators, such as the forecast PMI for manufacturing, are now showing a very sharp contraction.

The higher forms of money tend to be counter-cyclical. For example, M2 minus M1 is rising sharply due to growth in savings deposits. Savings accounts offer a higher interest rate and this attracts deposits. But money locked up for savings cannot boost economic activity. in the case of the Euro, however, even M2 is in cao, indicating that liquidity is reduced at every level, and we are talking about nominal values. If we evaluated the real ones, the fall would be even more vertical

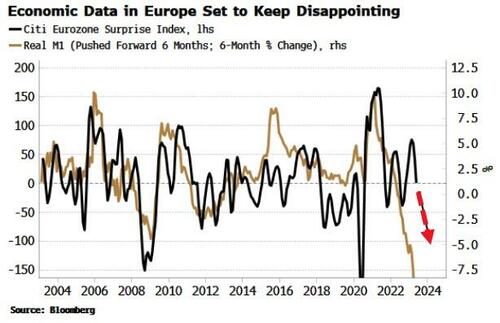

Curiously, economists in general do not appear to be following M1 as a leading indicator. If they did, we should not see the forward relationship between real M1 growth and economic surprises in the chart below.

As the chart shows, we should expect growing disappointment in European economic data over the coming months.

The ECB is continuing to raise interest rates and decrease the money supply to bring down inflation, which however has above all external, monetary causes. This is confirmed by Spain, where overall inflation falls, core inflation much less, precisely because overall inflation has a strong energy component.

The market could convince itself that the Central Banks, the Fed and the ECB, will end the restrictive policy early, precisely because of the effects on growth. This may apply to the Fed, which is still expected to raise interest rates twice more. The ECB does not work with economic-scientific motivations, but political-ideological ones, for which it will follow the German-Dutch diktats until the complete collapse of the economy. Let's just hope that the first to break is the Teutonic economy.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Monetary trends would advise the ECB to change monetary policy, but it won't, comes from Scenari Economics .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/i-trend-monetari-consiglierebbero-la-bce-di-cambiare-politica-monetaria-ma-non-lo-fara/ on Thu, 29 Jun 2023 17:02:30 +0000.