New crisis of securities linked to mortgages: 400 billion at stake, and the banks are in the middle

There is a bomb, more or less always the same as 15 years ago, that hovers around the US financial markets and, above all, the US banking system: securities linked to commercial properties (Commercial Real Estate Bonds, CRE). This type of securities is divided into different classes according to the quality of the credits behind them (AAA, BBB etc) and according to the investments made, whether mostly in commercial real estate or hotels or in homes.

We have one tranche in particular which, including debts of the BBB- type and linked above all to commercial-hotel activities, is riskier than the others. This is tranche 15 of the CMBX which, as we can see, is plummeting in prices, as noted by Zerohedge:

At the same time, however, the other tranches of securities linked to real estate are also in free fall

Why is this trend a problem for the banking system? Because, as Morgan Stanley notes, the ownership of these securities is largely owned by the banking system which, indeed, has increased its share of ownership of these securities in recent years

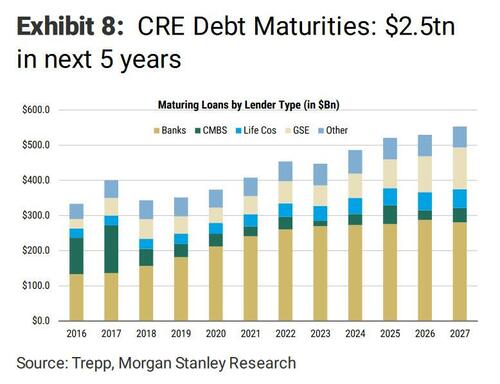

We are talking about 2.5 billion dollars in bonds that will expire between this year and 2027. An enormous figure that over 50% falls on the banking system. With share prices falling, banks have no other option than to hold the bonds until maturity, because selling them would be a real bloodbath. At the same time, with rising interest rates and the risk of not being repaid, especially for securities linked to variable rate mortgages, it is very high because many tranches are of low quality. So there is a nice bomb that weighs 400 billion for 2023, but 2500 if we include the next 4, which risks causing devastating damage to the financial and credit system.

Are we back to 20007-08?

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article New crisis of securities linked to mortgages: 400 billion at stake, and the banks are in the middle comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/nuova-crisi-dei-titoli-legati-ai-mutui-400-miliardi-in-ballo-e-le-banche-ci-sono-in-mezzo/ on Thu, 23 Mar 2023 10:00:05 +0000.