South East Asia: the solution to energy problems is not there

The Covid-19 pandemic marked the end of an era for Southeast Asia's combined oil and gas production, pushing the region's 2021 production below 5 million barrels of oil equivalent per day (boepd ) for the first time since 1998, a threshold that is not likely to be exceeded again in the future, despite the launch of new projects in the coming years, shows an analysis by Rystad Energy .

Average daily hydrocarbon production plummeted to 4.86 million boepd in 2021, down from 5.06 million boepd in 2020, and a massive 12% drop from pre-pandemic volumes of 5.5. million boepd in 2019.

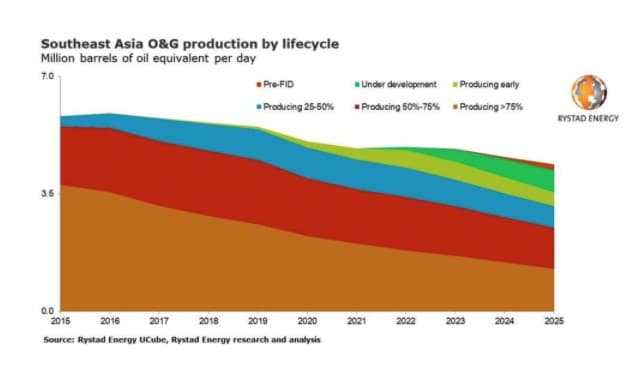

Operators struggled to recover production losses triggered by the pandemic as operators slowed investment due to the 2020 crisis and uncertainties triggered by botched ESG, i.e. green, policies. The decline is expected to continue until the middle of the decade. Although volumes will remain stable in 2022, production will decline by a further 10% by 2025 to around 4.3 million boepd from current levels.

Liquid production in Southeast Asia has been in decline for nearly 20 years due to a lack of discovery and project sanctioning activities in the region. While the new government incentives can help, the region looks set to experience declining production levels in the future as well, ”says Rystad vice president Prateek Pandey.

In contrast, natural gas production in the region remained stable between 2009 and 2019, at around 20.8 billion cubic feet per day (Bcfd). Despite expectations of an increase in gas sales volume that would counteract the 8% drop in production in 2020, volumes are expected to drop by around 2% this year compared to 2020, to around 19 Bcfd (billion cubic feet). per day, i.e. 538 million cubic meters per day). the decline is linked to the maturity of various projects, in the absence of new investments, exactly as is happening for oil.

The volume share resulting from projects under development and existing commercial discoveries is substantial and reflects the region's timely execution of the projects. Several projects were successfully launched in 2021, including the long-awaited Rotan field, using PFLNG Dua, which started in March, making Petronas the only operator globally to produce liquefied natural gas from two floating plants. They are present and active in Indonesia and ENI and Marekas.

However, despite these successes, Southeast Asia is still plagued with delays and blocked projects. In Indonesia, the resumption of gas production was further delayed after two major developments – Tangguh LNG T3 and Jambaran Tiung-Biru Unitization (JTB) – were postponed to 2022.

Oil production forecast for South East Asia

What the future holds

For most of Southeast Asia, over 60% of production comes from fields, which produce over 50% of its resources. Volumes of such blocks are likely to see a substantial decline in the coming years, with an estimated 60% of production by 2030 likely coming from projects currently in the pre-FID (final investment decision) stage . Consequently, the driving force behind the region's upstream prospects will be the approval of new developments.

2020 saw a very strong decline in investment decisions, but 2022 does not necessarily mean a real strong reversal. New investments are expected for 800 million barrels of daily production, up from 754 in 2020, but it will not be a simple increase. If 2020 was 85% focused on Malaysia, 2020 will be 60% Indonesia and 35% Malaysia. In total, there will be $ 15 to $ 20 billion in investment, but it is unlikely to lead to production increases, all while Asia is hungry for enormous energy. Recall that gas, coal and oil are among the main exports of Indonesia, constituting over 20% of its exports, and Malaysia also sees its exports dependent on black gold for 7%. Therefore:

- the solution to world energy problems will NOT come from South East Asia in the coming years;

- this area will not see a growth in its wealth from this sector, but will rely on industrial sectors to develop.

All bad news for us.

However, FID projects planned in 2022 may still face difficulties in obtaining final approval. Indonesia's domestic gas price regulation remains a concern for most of the major gas developments in the pipeline. Although incentives for blockades such as Kasuri are being discussed, it is still one of the factors that could further delay progress. Developments under production sharing agreements (PSCs) due to expire the current contract in the short term are also at risk, unless host country governments engage in advance discussions on potential extensions.

Southeast Asia is unlikely to see a substantial increase in spending in 2022, with investments expected to be between $ 15 and $ 20 billion over the year. Investments will likely be driven by more mature block drilling activity in Indonesia and Thailand as NOCs take the reins and focus on the most productive blocks.

About 360 million boe of resources were discovered in eight fields in November 2021, exceeding 2020 volumes by 40%. About 78% of the total resources discovered this year in Southeast Asia are gas or gas condensate, with the rest being oil. About 84% come from shallow water, with about 86% in blocks managed by NOCs. In line with the trend, over 90% of the volume in the region in 2021 was discovered in the Miocene-clastic formation.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article South East Asia: the solution to energy problems is not them comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/sud-est-asiatico-la-soluzione-ai-problemi-energetici-non-e-li/ on Sun, 26 Dec 2021 17:00:40 +0000.