Steel: prices declining or stable in the US, and production on the rise

We present an analysis of steel prices carried out by MetalMiner on the US market. The aim is to make you notice how the prices of certain very important raw materials are declining even in markets that are still very active and how these declining prices will have a severe impact even on less convenient European productions, in crisis due to the price of energy and who will not get relief from higher global remuneration.

Raw Steels Monthly Metals Index (MMI) fell 5.08% from October to November. The decline in US steel prices is due to several factors.

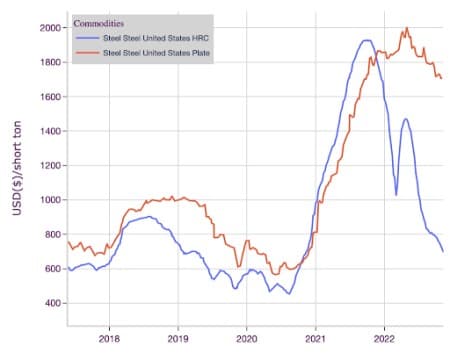

After US steel prices appeared to have stabilised, the decline in hot rolled coil, cold rolled coil and hot dip galvanized prices accelerated during the month of October. Hot rolled coil prices are now at their lowest level since covid November 2020. Sheet metal prices, on the other hand, remained more stable, registering only modest declines during the month of October.

Nucor maintains flat sheet metal prices in December

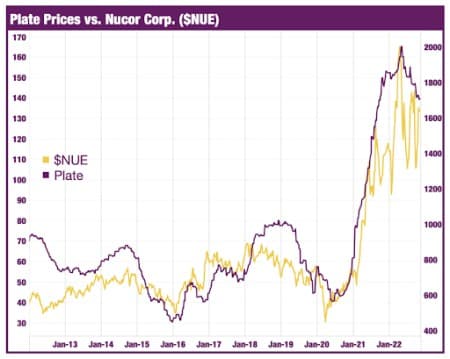

US steel giant Nucor announced that it made no changes to its December discrete plate prices, holding them at $1,620/st. This is the second month in a row that Nucor has kept prices unchanged, after lowering them by $120/st in mid-September.

While flat rolled prices remain in free fall, plate prices continue to diverge from the overall trend. Since their peak nearly seven months ago, sheet metal prices are down just 14.76%. By way of comparison, HRC prices fell by as much as 52.69% over the same period.

For months, buyers have complained about the widening gap between the two commodities. Up until the peak of HRC prices in October 2021, plate prices averaged around $107/st to HRC. Since then, however, this average has risen to nearly $600/st, with the current spread reaching an all-time high of $1,014/st.

The market situation will face the next big threat as new production capacities come on stream. In fact, Nucor's Brandenburg, Kentucky, laminate factory officially began operations on October 20. At full capacity, the plant can produce up to 1.2 million short tons annually. However, operations are still in an early stage and it is not yet clear when the plant will reach peak production.

According to the company, the steel mill will mainly supply the renewable energy sector, supplying plates for solar and wind energy projects. However, as the mill starts supplying the sheet metal market, the sideways price action will come under increasing downward pressure. Steel prices have so far resisted any significant decline. However, this new steel mill could be the tipping point.

Steel mill delivery times have experienced a substantial retracement from last year, eventually returning to levels well below their historical range. to mark that there is NOT an offer problem. For this reason, the supply/demand equation is unlikely to be the sole driver of the current high prices. Overall, the slab market remains a small market, with few large domestic producers. In addition to the continued demand for infrastructure investment, this has given these producers more control over prices than other forms of steel.

Steelmakers are always keen to keep plate prices as high as possible, because they reference the industry as a whole. Indeed, high input costs and demand destruction amid a worsening economic outlook put severe pressure on steel companies' earnings in the third quarter. For example, in its latest earnings report, Nucor noted that the decline in earnings between the second and third quarters "was primarily caused by shrinking metal trading margins and lower sales volumes."

Nucor Corp.'s stock has been strongly correlated (92%) with sheet metal prices since 2012. This suggests that sheet metal prices are likely to have a material impact on the company's earnings. They also likely helped offset the impact of falling prices of other forms of steel. However, diverging price trends have in part led to higher volatility for Nucor Corp. They also continue to be a significant drag on equities.

In the same report, Nucor warned of further declines in earnings expected between the third and fourth quarters. The company noted "increasingly difficult market conditions in a context of economic uncertainty", as well as declines due to seasonality. These bleak prospects seem to predict continued weakness in steel prices, which could start to spill over into plate prices. It could also prompt Nucor and other producers to focus on maintaining plate prices amid expectations of lower steel prices in other

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Steel: falling or stable prices in the USA, and rising production comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/acciaio-prezzi-in-calo-o-stabili-negli-usa-e-produzione-in-aumento/ on Fri, 18 Nov 2022 09:00:57 +0000.