The ECB finally worries about the spread. Too little

Today finally Mrs. Lagarde and the Board of the ECB have found the time to meet, in an emergency, and at least talk about the problem of the "Splitting of the Euro", that is, the progressive gap in the yields of the government bonds of the various EU countries, which it is a prelude to the breakdown of the Euro Area. Also because, let's face it, none of the possible “Reforms” proposed for the EU is even remotely capable of bringing any relief to the budgets of the weaker countries, Italy in the lead. What did the ECB say? Here is the translation of the press release at the end of the meeting:

Today the Governing Council met to exchange views on the current market situation. Following the start of the gradual process of monetary policy normalization in December 2021, the Governing Council has pledged to take action against the recurring risks of fragmentation. The pandemic has left lasting vulnerabilities in the euro area economy which are effectively contributing to an uneven transmission of the normalization of our monetary policy across jurisdictions.

Based on this assessment, the Governing Council has decided that it will apply flexibility in the reinvestment of maturing redemptions in the PEPP portfolio, in order to preserve the functioning of the monetary policy transmission mechanism, which is essential for the ECB to be able to fulfill its mandate to price stability. In addition, the Governing Council has decided to mandate the relevant Eurosystem committees, together with the ECB services, to accelerate the completion of the design of a new anti-fragmentation tool for consideration by the Governing Council.

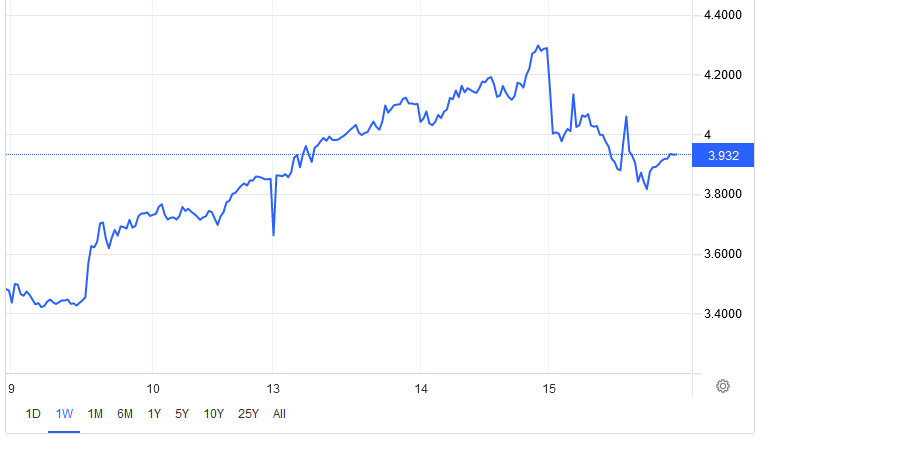

A statement that is a mix of nice wishful thinking, benevolent visions and ambitions, among other things dangerous. The market is believing the ECB with admirable restraint. In fact, the yield of BTPs has dropped, but only just enough to drop below 4%, and appears to be growing.

So the market is a bit skeptical. Should we blame him? We see two weaknesses in the ECB's response:

- first of all, for now, the committee is responsible for studying the instrument for… practically we have remained in an extremely vague and imprecise position on how the ECB will possibly intervene;

- secondly, a dangerous limit is provided to the intervention of the ECB, which corresponds to the reinvestment of the yield on the securities purchased with the PEPP, whose capital amounts to 1,700 billion. The figure is not significant, and above all it is still LIMITED and setting a limit to the size of monetary instruments is extremely dangerous, indeed it is almost an invitation to speculators.

We will see the real effectiveness of the tool in the coming days. Allow me to be skeptical: if they think they can stop speculation with a few tens of billions of Euros of purchases? Deluded.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

Article LThe ECB finally worries about the spread. Too little comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/lla-bce-finalmente-si-preoccupa-dello-spread-troppo-poco/ on Wed, 15 Jun 2022 17:17:28 +0000.