The Marginal Debt shows us the enormity of the bubble that must explode

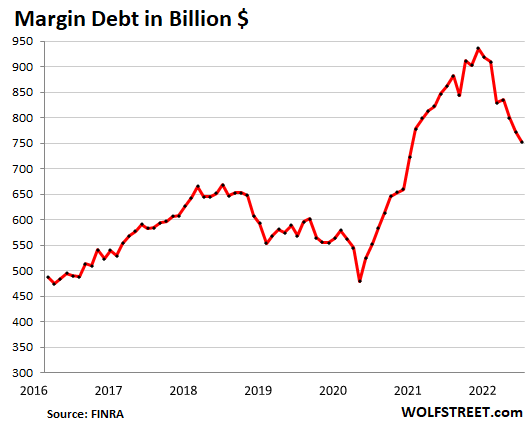

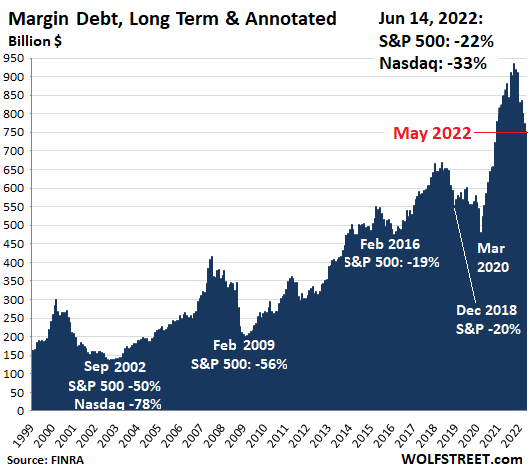

As Worlfstreet notes, US margin debt, so-called "Margin debt" – the visible tip of the iceberg of the direction of the overall leverage of the stock market – fell by $ 20 billion in May compared to April, to stand at $ 753 billion. dollars, according to Finra, based on reports from its member brokers. Margin debt peaked in October 2021, at $ 936 billion, and began to decline in November 2021.

The Nasdaq peaked in mid-November when debt on the margin began to decline, and has since plummeted 33%. The S&P 500 peaked on the first trading day of January as margin debt began to plummet. Since then, the S&P 500 has dropped 22%.

In the seven months since the peak in October, margin debt has fallen by $ 183 billion, or 20%, from last year's gigantic levels – an indicator of market turmoil, but also that leverage it is still extremely high and still has a long way to go:

Strong increases in the leverage margin are associated with rising stock prices, because leverage creates buying pressure with borrowed money; but then things are reversed and, in a vicious mechanism that includes margin calls, major stock market events are associated with sharp drops in leverage. Borrowing on margin can serve as an effective warning of stock market woes.

The absolute amount of leverage in the stock market, in all its forms, is unknown and no one is in control. Margin debt reported by brokers is the only form of stock market leverage that is tracked and reported on a monthly basis.

Another form of stock market leverage, Securities Based Lending (SBL), is reported sporadically and partially by banks in their annual or quarterly reports. Some banks indicate the amounts, while others share them with other forms of loans. There is no overall metric for the SBL amounts of all banks.

Marginal debt is an indicator of which securities are about to jump, or rather which were first blown up by bubbles and then left to fend for themselves. Here is a short list of the stocks most affected by the speculative wave:

Carvana: -94.5%

Vroom: -99%

Rivian: -84%

Nikola: -93%

Lordstown: -98

Zillow: -85%

Redfin: -92%

Opendoor: -87%

Peloton: -94%

DocuSign: -81%

Snap: -86%

Virgin Galactic: -86%

Palantir: -83%

AMC: -84%

Modern: -76%

DoorDash: -77%

Chegg: -85%

Roku: -85

These stocks plummeted from ridiculous highs that many people had speculated would lead to even more ridiculous highs, which is why they bought them in the first place. With the stock crash, leveraged investors had to reduce their debt on margin as collateral values evaporated and they became forced sellers.

Leveraged investors with a concentration in these stocks could be completely wiped out, with their brokerage account balance reduced to almost zero, if they did not download these instruments in time.

Some of the biggest stocks also plummeted to such an extent that a forced sale by margin investors was triggered (percentages from highs to mid-day on June 14):

Netflix: -76%

Amazon: -45%

Tesla: -46%

Meta: -57%

Nvidia: -54%

Salesforce: -47%

Intel: -44%.

If you look at the trend in margin debt since 2020, you see very intense growth, indicating how strong the speculation caused by excess liquidity was then.

This gives you an idea of how much room there is for the stock market decline, for which we are only just starting. It remains to be seen whether the real economy will survive this bubble burst, or whether we will see a colossal depression.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The Marginal Debt shows us the enormity of the bubble that must explode comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-debito-marginale-ci-indica-lenormita-della-bolla-che-deve-esplodere/ on Wed, 15 Jun 2022 06:00:18 +0000.