The two faces of Schnabel (German in the ECB) on inflation, which in any case lead to poverty

Passing month, economic theory in fashion at the ECB. Yesterday in the Financial Times, Isabel Schnabel, the ECB executive responsible for market operations, said that the planned transition from fossil fuels to a greener, low-carbon economy "poses measurable upside risks to our baseline projection. 'medium-term inflation ”.

After the economy recovered from the impact of the coronavirus pandemic, a sharp rise in energy prices drove inflation to 5% in December, a record high for the eurozone. An effect which, however, should be destined to vanish when the supply situation has adapted to post covid demand. Too bad that Schnabel herself then goes back on this statement a bit, stating that the effect may not fade so quickly.

"There are cases where central banks will have to break with the prevailing consensus that monetary policy should look through rising energy prices in order to ensure price stability in the medium term," said Schnabel…. A banal question arises for me: what does it mean? That prices will not fall and inflation, from being temporary, will become stable.

Energy prices in the 19 euro-sharing countries rose 26% in December from the previous year, close to the record high set the previous month. Natural gas prices hit record highs in the region last year, bringing wholesale electricity prices to € 196 per megawatt-hour in November, nearly quadrupling average pre-pandemic levels, the ECB executive said.

"While in the past energy prices have often fallen as fast as they have risen, the need to step up the fight against climate change may mean that fossil fuel prices will now not only have to remain high, but also continue to rise. if we are to achieve the goals of the Paris climate agreement, ”said Schnabel.

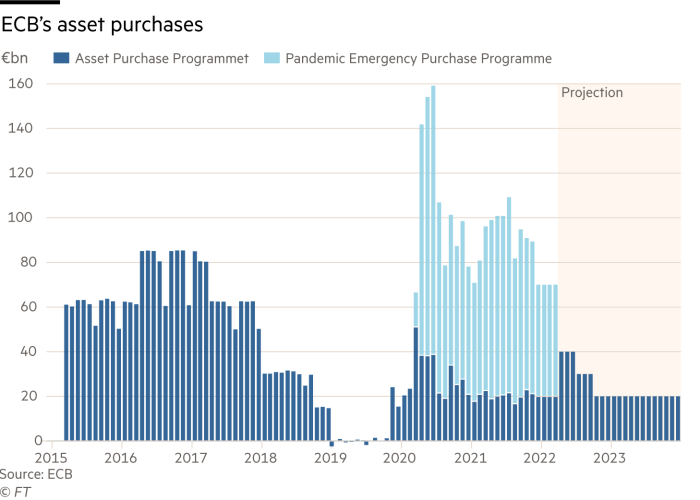

The German economics professor, who joined the ECB's board two years ago, has emerged as the staunchest critic among its top executives of its vast bond buying program, which has acquired a 4.7 trillion euros since it started seven years ago.

The beauty is that Schnabel, however, had expressed a very different idea, namely that inflation was due to the expansive monetary policy of the ECB, that is to the QE also carried out through the famous PEPP program, a pandemic purchase of a Eurozone government bond. , up to 17800 billion euros. A program which, being inflationary, according to Schnabel and the Germans and the Nordics in general, had to be reduced step by step, reducing it from 90 to 20 billion euros in October.

The FED and the BoE have begun, even in a much more decisive way, a reduction of the expansionary policy, but they are not facing the problem that the EU poses the ECB, that is a badly considered green energy policy that has led to an explosion energy costs and therefore inflation. Schnabel fears that elevated inflationary expectations could cause wages to rise in an exiting way either, fueling inflation, or that they would do the same to excessive aid to poor families (which, evidently, in her opinion, are better off suffering from the cold). However, he expects to have to intervene, in these two cases, to calm inflation. We will see how.

Philip Lane, chief economist of the ECB, appears to disagree. He told Irish broadcaster RTE on Friday that while rising energy prices are "a major concern", there has been "less upside" this year and he was confident that "supply will change, pressures should loosen up overall this year ".

The Schnabel, or rather LE Schnabel, do not give up: a restrictive policy must be, and so do the increases in interest rates. In the event that inflation is due to rising energy costs, to prevent wages from rising and this fueling the inflation already ignited by oil costs. In this way, the German economist puts the higher energy costs for green policies completely on the shoulders of the weaker classes, who will see their purchasing power drastically reduced. as it seemed in October, so why not invite countries to spend more, otherwise there would be the "Moral Hazzard", the "Moral Risk" (after all for the Germans we are all thieves and mandolin players in the Mediterranean area), keeping thus the differentials of growth and employment between the various countries remain unchanged. Indeed making them immovable. So the former Schnabel thinks that high interest rates, less growth and more poverty create green energy, the latter simply does not want countries to reduce their employment differentials, even if he will then tell you about "Reforms", which basically reform nothing.

In the end, the moral will always be this: the citizens of the Mediterranean area will pay for the austerity for the Germans, but if you tell them they get angry.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The two faces of Schnabel (German in the ECB) on inflation, which in any case lead to poverty comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/le-due-facce-della-schnabel-tedesca-nella-bce-sullinflazione-che-comunque-conducono-alla-poverta/ on Tue, 11 Jan 2022 08:00:47 +0000.