The Volcker era is back: the FED increases rates by 0.75%. The last time he did it sent Mexico into crisis

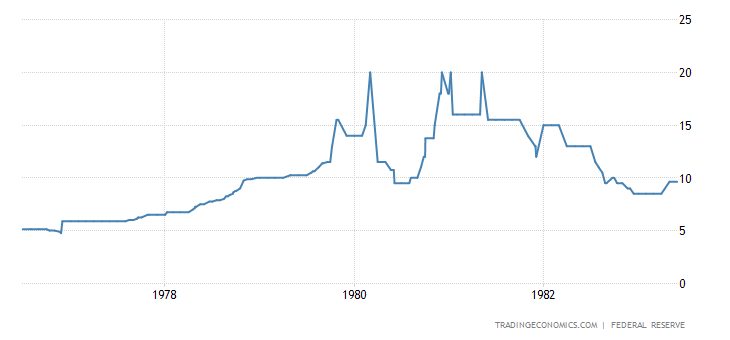

Eventually the FED intervened massively, with a return to the Volcker era, the governor of the FED who, in the late 1970s, cured US inflation with a sharp rise in interest rates, which stopped inflation. at the cost of sending the economy into recession,

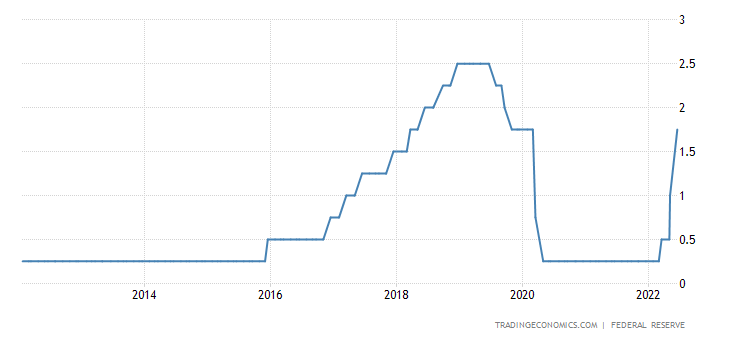

This is the current increase of + 0.75%

And to give you an idea of what happened in the Vocker era, here are the interests from 1976 to 1983

In this case it seems that the decision was not taken unanimously, but that some governors of the individual banks were opposed to such a sharp increase and in favor of a more

The effects of such a sharp and sudden increase will be felt not only in the US, with a vertical fall in the value of many financial assets, especially the most speculative ones. Or the fall in the value of cryptocurrencies. The real problem will be for many developing countries that still have dollar debt. The last time the US raised rates this way, 1994, started the "Tequila Crisis" in Mexico. Volcker brought about the debt crisis of South America, Argentina in the first place, and was indirectly a cause of the Falklands War.

In the next few days we will see some good ones.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Back to the Volcker era: the FED raises rates by 0.75%. The last time he did it sent Mexico into crisis comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/torna-lera-volcker-la-fed-aumenta-i-tassi-dello-075-lultima-volta-che-lo-fece-mando-in-crisi-il-messico/ on Wed, 15 Jun 2022 21:18:46 +0000.