They crush the shorts, and they hurt. A bit of market democracy, opposed by the “greats”

The pressure continues on the short positions of speculators, that is, on short selling on stocks that are obviously mistakenly considered overvalued. The best selling short stocks literally exploded:

At the top of this ranking of growing stocks, despite the opinion and speculation of the big funds, always Gamestop (GME), which has grown practically 100 times from the minimum, and is stable on these values:

But also Entertainment Holding, (AMC) is having a similar trend to that of Gamestop:

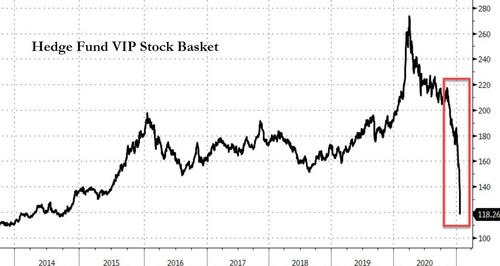

The large hedge funds were hit in their short positions and lost a lot of money so much that they were forced to sell the “Long” positions, ie those in which they had invested a lot.

This explains why certain tech positions hitherto adored, such as Alphabet (Google, -4.67%), have been heavily beaten.

Who hit these positions in the open? A mass of small, or very small, investors and speculators, operating from mobile applications such as Robinhood, but not only, and who, like voracious piranhas, have stripped the positions of large funds. They wanted mass speculation, they reduced people to live by pressing buttons on a cell phone, and now welcome to the new world, where the best advisor is an 18-year-old man who runs his app.

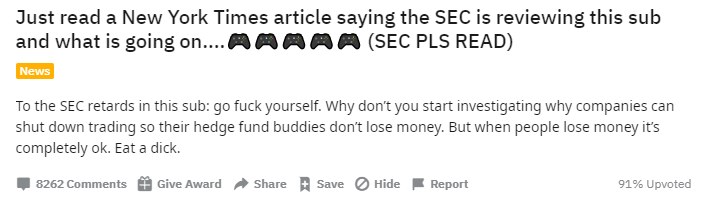

Of course, the fact that a few young people, often kids, starting from scratch can undermine the large hedge funds managed by multimillionaires cannot go unpunished, and the SEC has stepped in to observe and crack down on what the business banks and the great unscrupulous managers do it every day. The response of the small traders, who coordinate through miniblogs such as Wallstreetbet on Reddit, has been burning and disrespectful.

A couple of funds would have already jumped, without contributions for a few billion from friendly banks and lenders. There is talk of losses of 15% -30% for many managers who, without external help, would have already gone bankrupt.

The oligopolists have also asked the SEC to Stop the market to allow "Rebalancing Positions"; read to cover themselves, but they have not succeeded. The open short positions are still huge. We will have some good ones these days.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article They crush the shorts, and they hurt. A bit of market democracy, opposed by the "Big" comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/schiacciano-gli-short-e-fanno-male-un-po-di-democrazia-del-mercato-e/ on Thu, 28 Jan 2021 07:00:07 +0000.