US inflation continues to ride, so the Fed will continue to tighten

300 dpi Rick Nease illustration of man burning $ 100 bill; can be used with stories about self-destructive financial behavior. Detroit Free Press 2012

300 dpi Rick Nease illustration of man burning $ 100 bill; can be used with stories about self-destructive financial behavior. Detroit Free Press 2012

krtnational national; krt; krtcampus campus; mctillustration; 04000000; 04006018; FIN; krtbusiness business; krtfinancialservice financial services; krtnamer north america; krtpersonalfinance personal finance; krtusbusiness; us us united states; USA; $ 100 bill; de contributed nease; fire; lighter; money to burn; 2012; krt2012

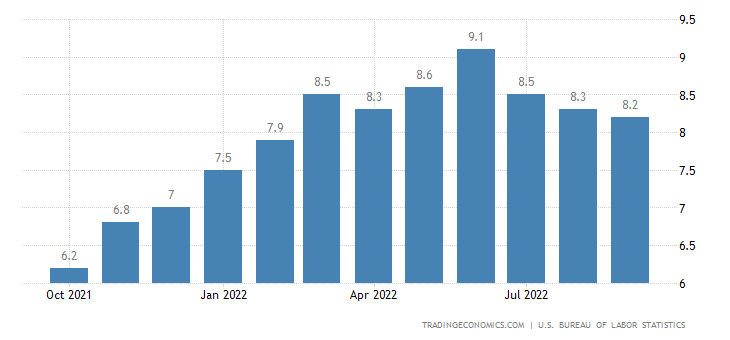

The US inflation data saw a minimal reduction in this indicator, which suggests a continuation of the restrictive policy by the Central Bank with stars and stripes. The annual inflation rate in the United States slowed for the third consecutive month, reaching 8.2% in September 2022, the lowest in the past seven months, compared to 8.3% in August but below. above market forecasts by 8.1%. The energy index increased by 19.8%, compared to 23.8% in August, due to gasoline (18.2% against 25.6%), fuel oil (58.1% against 68.8 %) and electricity (15.5% versus 15.8%, the highest value since 1981). A small slowdown was also recorded in the cost of foodstuffs (11.2% vs 11.4%, the highest since 1979) and used cars and trucks (7.2% vs 7.8%). On the other hand, housing prices increased more rapidly (6.6% versus 6.2%). Meanwhile, the core rate, which excludes food and energy volatility, rose to 6.6%, the highest since August 1982, and above market expectations of 6.5%, a sign that inflationary pressures remain high.

Here is the CPI inflation

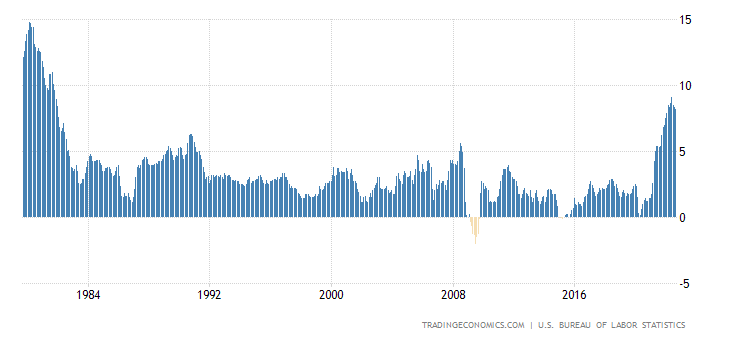

and here is the vision in a longer term perspective

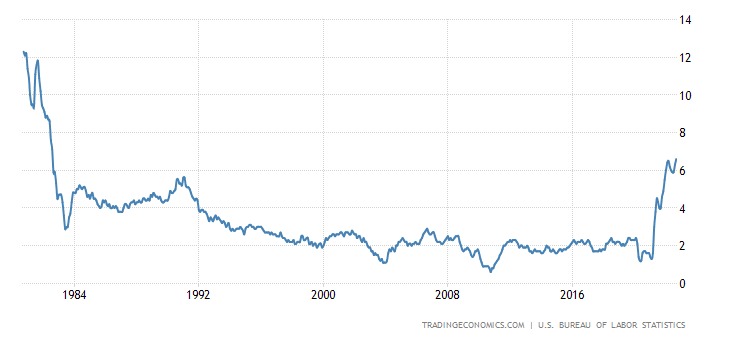

Let's go back to the eighties to see this level of inflation, but even more serious is the "Core" inflation, the one purified from agricultural and energy seasonal fluctuations, which reached the levels of the early eighties

This inflation, linked to wage dynamics and economic overheating, has grown to record levels, and justifies the intervention of the FED through the increase in rates, to cool the economy itself. This is an almost obligatory choice for the US, and a huge problem for other countries in the world. The increase in interest rates will divide the globe into two parts: the countries that choose to follow the US, such as those in the Euro Zone, which will increase rates by going into recession, and those that will not, such as Japan, who will see the own depreciated currencies. All while waiting for some big problem at the level of state debts.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article US inflation continues to ride, so the FED will continue to tighten comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/linflazione-usa-continua-a-cavalcare-quindi-la-fed-continuera-a-stringere/ on Thu, 13 Oct 2022 15:57:35 +0000.