USA: real estate prices start to grow again. Will the FED cut rates at this point?

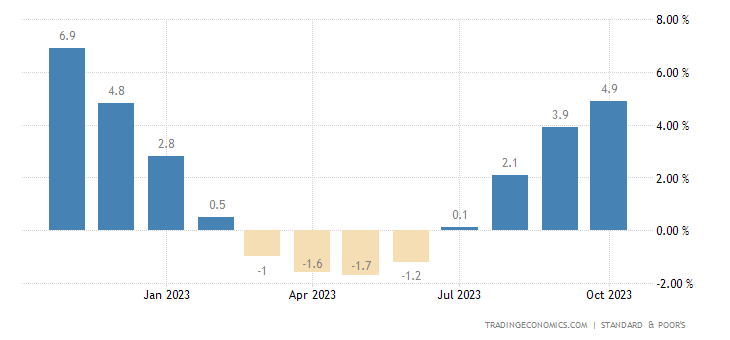

Data on US real estate values has been published and this shows an unexpected trend. The S&P CoreLogic Case-Shiller index of home prices in 20 U.S. cities surged 4.9% year-over-year in October 2023, marking the largest increase since November 2022 and falling in line with market expectations. market, as the shortage of available homes for sale has pushed home prices higher.

Additionally, easing mortgage rates and the Federal Reserve signaling a slightly more accommodative stance can potentially fuel further appreciation in the coming months. Detroit maintained its position as the fastest-growing market for the second consecutive month, boasting an 8.1% annual increase, followed by San Diego (7.2%) and New York (7.1%). On a monthly basis, the 20-city composite index recorded an increase of 0.1%.

Here is the short term chart

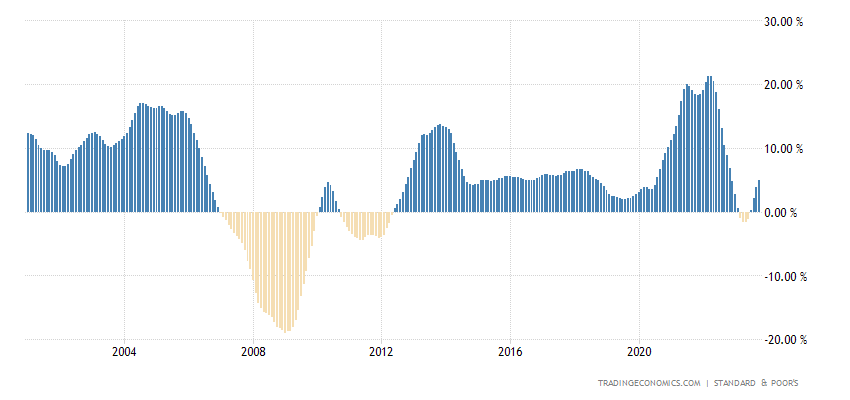

And a vision with a 25-year time horizon:,,

The Case Shiller index indicates the indications of real estate prices in individual American cities rather precisely, as it detects the prices of the same house in subsequent resales. Therefore, since the detection basis is the same, the evaluation is extremely precise. Obviously it is an optimal system only on the US market where real estate sales are frequent, especially in urban areas.

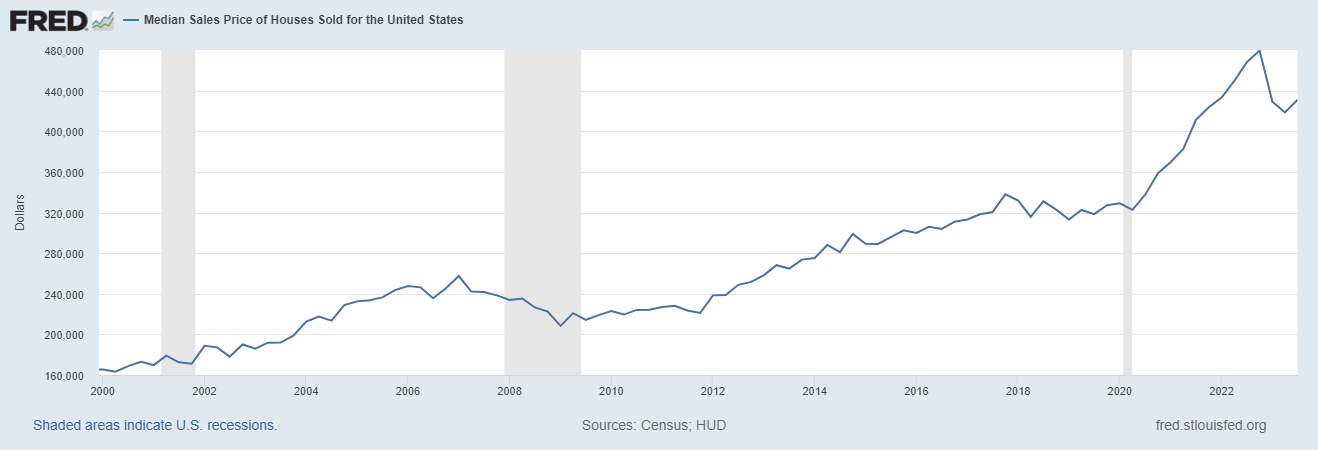

If we instead want to show the median value of properties, the St Louis Fed helps us:

The average value of a US house is just under three times that of 2000, and even if we are below the values of 2022, after a sharp fall, this has stopped.

In reality, prices have not moved homogeneously in the USA and there are cities that have seen a very significant drop in real estate prices:

- San Francisco Bay Area: -11.7% (from May 2022)

- Seattle: -10.9% (from May 2022)

- Portland: -5.8% (from May 2022)

- Las Vegas: -5.3% (on July 2022)

- Denver: -5.2% (from May 2022)

- Phoenix: -5.1% on June 2022)

- Dallas: -4.4% (on June 2022)

- San Diego: -2.1% (on May 2022)

- Los Angeles: -0.8% (from May 2022)

These are cities whose values had grown significantly in the 2020-22 bubble.

Now the big question is: given that real estate markets are holding up and unemployment isn't growing for now, why should the FED lower rates? There's no reason for it. The USA is not Europe…

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article USA: real estate prices start to grow again. Will the FED cut rates at this point? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/usa-riprendono-a-crescere-i-prezzi-immobiliari-a-questo-punto-la-fed-tagliera-i-tassi/ on Wed, 27 Dec 2023 09:05:47 +0000.